Adjusted For Inflation, Dollar Hits Fiat-Era Low

By: John Melloy | CNBC

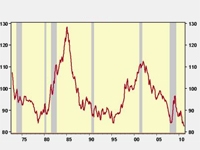

A trade-weighted measure of the U.S. dollar against a broad basket of currencies that includes the Yen, Euro and China’s Yuan is at a post-gold standard low when adjusted for inflation, according to calculations by Deutsche Bank’s economic team. The milestone could be viewed as a failure of the country’s monetary and fiscal policies upon which all paper – or fiat – currencies are based.

A trade-weighted measure of the U.S. dollar against a broad basket of currencies that includes the Yen, Euro and China’s Yuan is at a post-gold standard low when adjusted for inflation, according to calculations by Deutsche Bank’s economic team. The milestone could be viewed as a failure of the country’s monetary and fiscal policies upon which all paper – or fiat – currencies are based.

The Broad Trade-Weighted Dollar Index, which was created by the Federal Reserve, differs from the more popular “Dollar Index” because it includes a larger group of currencies and is weighted based on foreign trade. The stellar economics team at Deutsche Bank, led by Joe Lavorgna, then adjusts this measure for inflation to get what they believe to be the true measure of the dollar’s value in the world.

“In our risk scenario, little progress on the fiscal front raises the probability of a fiscal crisis and the odds that the Fed becomes the buyer of the last resort,” said David Woo, currency strategist for Bank of America Merrill Lynch, in a note to clients today. “This would accelerate the process of the USD’s demise as the global reserve currency and cause it to decline in a disorderly manner.”

The dollar hit new 2011 lows versus the Euro and the British Pound Thursday as traders increasingly viewed Federal Reserve Chairman Ben Bernanke’s monetary policy press conference a day before as dovish on inflation.

Deutsche Bank: Real broad trade-weighted exchange value of the US Dollar, March 73 = 100.

The Fed described the economy as recovering at a “moderate pace” in its statement, a dovish downgrade from the “firmer” recovery it stated before. The Fed also kept the language that it would remain accommodative for an “extended” period. In his first monetary policy press conference, Bernanke made no hints that his ongoing purchases of $600 billion in Treasury securities would be ended earlier than their June expiration date.

“QE2 has artificially reduced the risk premium of U.S. government bonds to below the level necessary to compensate investors for the worsened U.S. fiscal position,” added Woo.

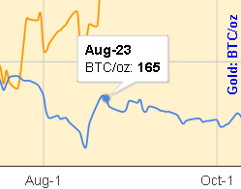

Gold settled at a record for a 12th time this month on Thursday and is now up 31 percent from a year ago on concern that Bernanke has lost control over inflation. Silver is inches away from its 1980 record and is up 150 percent in the last 12 months.

“The recent parabolic spike in silver and to a lesser degree gold, shows that the market considers a ‘disorderly decline’ of the U.S. dollar an increasing possibility,” said

Jim Iuorio, managing director at TJM Institutional Services. “Devaluing your currency has always been a risky proposition and its success is dependant on knowing how to exit gracefully from monetary stimulus.”

The dollar was convertible into gold until the early 1970s, when President Nixon ended that agreement. Soon after, as the major currencies went from fixed rates to floating, the U.S. dollar established itself as the world’s reserve currency because of its economy’s size and relative strength. Floating, paper currencies are only worth what others deem them to be and the country’s central bank can print as much, or as little, of it as it wants.

| “Devaluing your currency has always been a risky proposition and its success is dependant on knowing how to exit gracefully from monetary stimulus.”

Jim Iurio, Managing Director, TJM Institutional Services |

To be sure, the dollar’s salve would be a pick-up in the economy as Bernanke’s zero interest rate policy forces more risk-taking, more lending, more investment, and more hiring. That theory took a bit of a hit Thursday as first quarter GDP data was released showing a 1.8 percent increase in economic growth, down from a 3.1 percent increase in the fourth quarter.

“If the economy is on a recovery path, as Ben Bernanke suggests, albeit slower than we would like, then we should anticipate that tax receipts and revenues should improve,” said John Person, president of Nationalfutures.com and co-author of the Commodity Trader’s Almanac. “If that happens, then the US Dollar should gain some strength, or at the least cease the rapid descent. Right now it is very hard pressed to find one dollar bull.”

A showdown in Congress is brewing as the U.S. Treasury is poised to hit its debt ceiling in next month. Following a tough battle over the budget this month, traders selling the dollar are bracing for another partisan battle over the debt ceiling vote and possible austerity measures that could be attached to a lifting of this debt limit. Standard & Poor’s changed the outlook on U.S. debt to “negative” last week based on the possibility of a stalemate in enacting any kind of meaningful fiscal policy by this divided government.

“Since S&P downgrade last Monday it has become abundantly clear by policy makers, if it wasn’t already, that the Fed will print whatever it takes to avoid default and debase the buck to a point where it will be very unlikely to remain the world’s reserve currency,” said Dan Nathan, creator of RiskReversal.com.