Don’t sell your gold. Spend it.

If you’re holding gold as a means of savings (store of value) instead of owning it as an investment, the question of when to sell becomes irrelevant. You don’t sell, just spend it. Paul Tustain, founder & CEO of BullionVault captures this idea beautifully in this article.

Go ahead – sell gold. Just so long as you know a secure store-of-value to hold instead

By all means sell gold today. Just don’t be a schmuck and ‘take a profit.

That’s supposed to be when you exit something volatile to revert to a stable store of value. You’ll hardly be doing that when you trade your gold in for Dollars, Euros, Yen or Pounds.

So yes, have a great holiday, or a new car. Maybe sell some gold to buy some interesting shares or, better still, a business. If there’s anything you want to spend on – trivial or serious – sell some gold and do what you want to; you’ve earned it. Your gold is buying you about three times what it would have 5 years ago. You’ve created the opportunity for yourself, so don’t be too cautious. Use it!

But don’t sell if the most imaginative thing you can think of is to hold currency – or worse, bonds. Our currencies are not some absolute unchanging yardstick of wealth. They’re junk.

Not that everyone realizes this yet. Though maybe they’re starting to.

Most people out there are still trying to accumulate money. So trade with them. Give them what they want for something you want. Buy something – and let them have your money! There’s only a few years left, maybe months, until the damned stuff becomes truly repulsive; until possession of currency becomes a headache presenting anyone who has it with the immediate problem of getting rid of it. Fast.

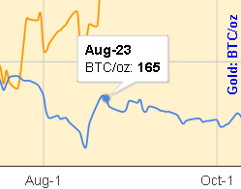

With QE3 (yes, it’s coming) or any other of the wacky economic plans out there, our money is shedding purchasing power, month by depressing month. That’s the approved and orderly process, here in the UK for instance, of 5% inflation and 0.5% interest rates (subject to tax, remember). Central banks and finance ministries hope you and about a billion other people in the developed West will quietly tolerate the permanent drip drip drip of lost value from your life savings. They’re also hoping it won’t get disorderly.

If it does, people will be begging you to take their money away. Yes – begging you. They’ll be saying:

“Here, have the fruits of my lifetime of thrift…My $20,000 for your ounce ofgold. Please – it’s a fair price. It’s the lump sum value of my pension. I got it on the day I retired. I paid into the company scheme for 40 years for this sum, and I’ll give it all to you for that 1 ounce of gold. Pleeeeease…”

Attractive money? Repulsive money? It’s all about whether or not it retains purchasing power, and it’s a very, very big deal that the money squirrelled away for 50 years, and by a billion people, is now transparently unfit for that purpose.