High Frequency Trading & the price you pay for your gold.

-

In the U.S., High-Frequency trading (HFT) now accounts for 70-80% of all equity trades. If these figures sound alarming, consider for a moment that HFT is merely a sub-class of automated trading, often referred to as algorithmic trading, black-box trading or robo trading. Hence, algorithmic trading, where trades are executed automatically often at high speeds without human intervention could account for well over 80% of stocks traded in the US.

It has been said that HFT is usually not suitable for the derivatives markets. Negating this notion is CFTC commissioner, Bart Chilton. In his speech at the High Frequency Trading World, USA 2010 Conference, he said:

A recent report says HFT firms account for about 50 percent of European markets. CFTC economists say high frequency traders (HFTs) account for roughly one-third of all trading volume on regulated U.S. futures exchanges.

Connecting the dots, we can see that a high volume of gold & silver derivatives traded at the U.S. futures market is done through these algorithmic trading machines. But why does it matter?

Just as these sophisticated algorithms, written by some of the best brains in mathematics, physics and finance can enable large institutions to execute gigantic buy orders with minimum upward movement in price, they can be programmed to do the exact reverse. Observers of gold & silver futures price actions at the Comex have documented countless cases of engineered waterfall declines. This is how Bix Weir puts it.

How hard is it to rig the gold and silver markets? Not hard at all. It takes no effort, metal, or trading strategy. Simply put, it takes nothing. All you do is set your computers to trade back and forth with themselves on the PAPER markets until you hit the predetermined price. Then you hold it there with the same programs until everyone FORGETS the price should be higher and buyers go away. It has been this way since Greenspan implemented the first computer trading programs for ex-Fed Chairman Arthur Burns in the early 1970′s. It will stay this way until the computers are turned off.

Yes, unfortunate or ironic as it may sound, the price you pay for your physical gold & silver, or the paper value of gold & silver you hold is determined largely by these machines and the powers that be controlling them. Be aware however, that these algo machines can, and have on many occasions gone wrong, creating havoc in the markets they dominate. If you’ve not heard of the May 2010 flash crash, this becomes a must read - Nanosecond Trading Could Make Markets Go Haywire.

This Wednesday’s algo machine gone wrong fiasco at Knight Capital is a case in point. I’ll be wary of parking any investments in the financial system during this phase of the crisis. Check this out if you’re still not convinced. Greyerz: The Risk Of Systemic Collapse Is Now Enormous.

-

Updated: Aug 7

Gone in Sixty Nanoseconds and other “Knight-Time” Stories w/David Greenberg

Lauren of Capital Account discusses the Knight Capital $440 million “technical glitch” and the implications of nano-second HFT for retail investors with David Greenberg, former NYMEX board member.

Implication for retail investors:

Swings, very large price swings when HFTs get into action. Can you handle these?

Implication for markets in general:

HFTs now act as market makers because there are now no more (human) market makers on the floor of the stock markets. Without the HFTs, there’ll be no markets at all (well, almost). Do you want to park your investments in such a market?

-

Updated: Aug 9

Dark Pools and High-Frequency Trading

Lauren of Capital Account continues her series of interviews on HFTs following the Knight Capital debacle. This interview with Scott Patterson, author of Dark Pools, discusses the following:

- Manipulating strategies - Spoofing, Layering & Quote Stuffing; How they work

- 70% equity trading volume is HFT, 90-95% is Algorithmic

- 99% of HFT orders are put out only to be cancelled later

- There’s no more place to hide from HFT now, not even in Dark Pools!

-

Updated: Aug 10

A High Frequency Attack on Gold

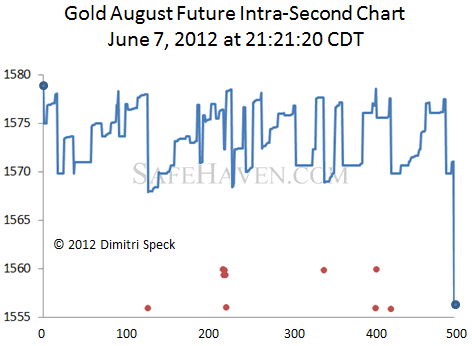

Now we look closely at the second 21:21:20. The figure below shows all the prices in the relevant second, an Intra-Second Chart, so to speak. As is common, the vertical axis indicates the price in dollars per ounce. On the horizontal axis the trades during that second are sequentially numbered. In addition, the prices before and after are shown, and so-called indicative prices (in red).

The almost 500 trades of second 20: Clearly visible are many sharp drops, followed by recoveries. These movements happened in fractions of a second.

Read the full analysis here.

-

Updated: Aug 26

Share Wars: How the Robots are Robbing You

A look into the HFT game at the Australian Stock Exchange (ASX)

Leave a Reply Cancel reply

Most Popular

Most Recent

- Gold: Is It Really In a Pricing Bubble?

- The Politics of Gold

- Potential sharp moves in gold & silver prices. Which direction?

- Malaysian Central Bank Raided “Gold Investment” Company

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Finding Silver: For a change, forget about the politics and financial aspects of silver. Let's appreciate the science & the engineering behind that beautiful silver coin. |

|

High Frequency Trading: You can get in easily. "Getting out is the problem" David Greenberg, former NYMEX board and executive committee member. Paper gold & silver markets are dominated by HFTs. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- More Stunning Developments In The Gold & Silver Markets October 14, 2012

- Exclusive - Riots & Money Fleeing The Euro Into Gold & Silver October 13, 2012

- Art Cashin - We Are At Risk Of A Frightening Hyperinflation October 12, 2012

- Fleckenstein - Gold & Insane Central Banks Printing Trillions October 12, 2012

- Embry - This War In Gold & Shorts Getting Overrun October 12, 2012

- The $2 Trillion European Bailout Package Is Coming October 11, 2012

- Turk - Expect A Massive Short Squeeze In Gold & Silver October 11, 2012

- Lost Confidence Can’t Be Restored & Gold’s Final Move October 11, 2012

Finance & Economics

Finance & Economics

- Shuffle Rewind 08-12 Oct " Sleeping Satellite " (Tasmin Archer, 1992) October 14, 2012 AVFMS

- The REAL Reason America Used Nuclear Weapons Against Japan October 14, 2012 George Washington

- The 21st Century Monolith October 14, 2012 Tyler Durden

- Beta Testing QE 4 - "Large Amount" Of $100 Bills Stolen From Federal Reserve October 13, 2012 Tyler Durden

- Guest Post: The Problem With Centralization October 13, 2012 Tyler Durden

- The US Fiscal 'Moment': Cliff, Slope, Or Wile E. Coyote? October 13, 2012 Tyler Durden

- German Self-Immolates In Front Of Reichstag October 13, 2012 Tyler Durden

- On China's Transition October 13, 2012 Tyler Durden

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)

453072 294197I dont leave a great deal of comments on a great deal of blogs each week but i felt i had to here. A hard-hitting post. 802745