Archive

How to End the Fed, and How Not To

By Gary North | Mises.org

Republished with permission of Ludwig von Mises Institute

-

It would be very easy to end the Federal Reserve System. Congress would write the following bill. The president would sign it.

It would be very easy to end the Federal Reserve System. Congress would write the following bill. The president would sign it.

- The Federal Reserve Act of 1913 and all subsequent amendments to that act are hereby revoked.

- The gold that belongs to the United States government, and which is kept on deposit with the Federal Reserve System, is hereby transferred to account of the United States Treasury.

If the Federal Reserve System has made any secret agreements with other central banks regarding the ownership of that gold, those arrangements would become legally null and void. The Fed would own no gold of its own to deliver. Ownership would revert to the United States government.

If other central banks wanted to sue the Federal Reserve System, an exclusively private entity acting on its own authority alone, to recover any gold the Fed had promised to deliver, they would have the right to do so. If they really thought the Fed could deliver on those agreements merely because a court ordered it to, they could hire lawyers and sue.

Andrew Jackson versus Central Banking

There is a legal precedent for all this. In 1832, Henry Clay and his allies in Congress decided to make a political issue of the Second Bank of the United States, the Federal Reserve System of that era. It was a presidential election year. Clay proposed the rechartering of the bank four years early. The bill passed Congress. The Wikipedia account of what happened next is accurate. A confrontation took place between Nicholas Biddle, the most arrogant central banker in history, and President Jackson. How arrogant? He believed he could crush Andrew Jackson, and said so in private letters.

Jackson mobilized his political base by vetoing the re-charter bill and — the veto sustained — easily won reelection on his anti-Bank platform. Jackson proceeded to destroy the Bank as a financial and political force by removing its federal deposits, and in 1833, federal revenue was diverted into selected private banks by executive order, ending the regulatory role of the Second Bank of the United States.

In hopes of extorting a rescue of the Bank, Biddle induced a short-lived financial crisis that was initially blamed on Jackson’s executive action. By 1834, a general backlash against Biddle’s tactics developed, ending the panic and all recharter efforts were abandoned.

In February 1836, the Bank became a private corporation under Pennsylvania commonwealth law. It suspended payment in 1839 and was liquidated in 1841.

Jackson did not have to do anything else besides pull its accounts. The bank could not compete. It was a legal appendage of the US government, although privately owned. It went belly up.

So would the Federal Reserve System. Its profits would henceforth be taxed by federal and state governments. Its authority to regulate commercial banks would end. It would no longer establish reserve requirements. Excess reserves owned by the commercial banks that are held on deposit at the Federal Reserve would no longer be backed by the US government in any way. They would probably be pulled out overnight — all $1.5 trillion worth. This would be a bank run like no other in banking history.

The Federal Reserve and its allies — virtually the entire intellectual class — use this fear to maintain its position as the quasi-public bureaucracy in charge of America’s money. It lured the nation into the lobster trap of debt — debt undergirded by Federal Reserve fiat money and congressional deficits — and the country cannot see a way to get out on a pain-free basis. There is no pain-free escape, as we will find over the next two decades: hyperinflation or the Great Deflationary Default or both.

The government’s debt and the monetary inflation cannot go on indefinitely. Either the dollar dies or else the debt is repudiated. Maybe both.

Goodbye, Fed

What would replace the Federal Reserve System? Nothing. Without any federal government connection, there would be no central bank.

What would be the new currency of the United States? Not Federal Reserve Notes, I suspect. Something else. But what? Whatever the free market creates.

Who would bail out Congress when it runs huge deficits? Not the Federal Reserve System. Then who? Maybe nobody. Preferably nobody. What would be there with QE3? Not the Federal Reserve System. Then what? Preferably nothing.

There is an old political slogan: “You can’t beat something with nothing.” But the free market’s system of supply and demand, profit and loss, is not nothing. Replacing crony banking and the legal authority to print counterfeit money is positive. It is like replacing cancerous cells with normal cells. It is a vast improvement.

Problem: removing cancerous cells surgically with no anesthetic is painful. People put off the operation as long as they can. The cancer spreads.

Proposed Reforms by Economists

The great error of every scheme to reform the Fed, or regulate the Fed, or even replace the Fed, is this: it establishes a professionally designed system of money management that relies on a committee of government-paid economists. These schemes have this in common: they never rely exclusively on the free market to determine what money is. They always place a committee in charge. The committee is supposed to be staffed by economists. In short, the reformers all invoke central planning of some kind.

The starting point of any economically plausible system to end the Fed should be a commitment to avoid all forms of central economic planning, for all of the reasons that Ludwig von Mises set forth in his classic 1920 essay Economic Calculation in the Socialist Commonwealth.

Here is the problem in both theory and practice: academic central-bank reformers believe in central economic planning. They do not trust the free market in the area of money. They all think that a committee of government-salaried experts has greater wisdom than the free market.

The central benefit of my proposed reform is that it does not rely on any committee. It does not rely on coercion by the government. It relies exclusively on the free market. This is why Keynesians will reject it, Friedmanite monetarists will reject it, supply-siders will reject it, Greenbackers will reject it. None of them believes Mises’s 1920 essay.

If I had the motivation, the time, and the curiosity, I would write a book on various proposed reforms of the Federal Reserve System. But why bother? None of the proposed reforms will ever gain wide acceptance. Academic economists do not agree on much of anything, other than the wisdom of central banking. They agree with Marx, who defended the idea of a central bank in his famous ten steps to communism.

Besides, Congress will not enact any carefully designed reform. If it enacts anything, it will be some last-minute scheme proposed by a joint congressional committee that is advised by the secretary of the treasury (Goldman Sachs) and the chairman of the Fed’s Board of Governors in the middle of a financial catastrophe. In other words, it will be a replay of October 2008.

“Trust the Federal Government!”

In order to illustrate my point — the economists’ credulous faith in committee-managed money — I am going to dissect a plan of monetary reform offered by an obscure academic economist. Why bother? Because his plan goes back to a plan proposed by Henry Simons, who taught Milton Friedman. It also goes back to Irving Fisher, the inventor of the statistical-index number.

As we shall see, the author calls for pure fiat money, issued by the government. His proposal features 100 percent reserve banking, but it explicitly denies any need for a gold standard. The money supply would be controlled by the government. In short, we can trust the government to manage the money supply. Here is what Henry Simons proposed in 1934:

100 per cent reserves, simply could not fail, so far as depositors were concerned, and could not create or destroy effective money. These institutions would accept deposits just as warehouses accept goods. Their income would be derived exclusively from service charges — perhaps merely from moderate charges for the transfer of funds by check or draft.… These banking proposals define means for eliminating the perverse elasticity of credit which obtains under a system of private, commercial banking and for restoring to the central government complete control over the quantity of effective money and its value.

This is cited in a refutation of Simons written by Professor Huerta de Soto, an Austrian School economist and legal theorist. It appears on page 732 of his detailed book, Money, Bank Credit, and Economic Cycles ([1998] 2012). The key phrase is this: “restoring to the central government complete control over the quantity of effective money and its value.” There is nothing free market about this proposal. It is statist to the core.

Simon Says

Henry Simon’s disciple is Professor Herman Daly. He is retired. He has for a generation been a major promoter of zero-growth economics (ZGE). He has challenged the central confession of faith of virtually all economic policy making. A list of his books tells the story: Toward a Steady-State Economy (1973); Steady-State Economics (1977; 1991); Valuing the Earth (1993); Beyond Growth (1996); Ecological Economics and the Ecology of Economics (1999); and Ecological Economics and Sustainable Development (2007). The title of the last book is intriguing. How you can have sustainable development in a zero-growth economy is surely a puzzle. But, honestly, it is a puzzle that I do not choose to solve. I think sustainable development implies economic growth. If it doesn’t, I’ll pass. He is a self-proclaimed green economist — green as in ecology, not as in “cash on the barrelhead.” (Most economists are green in the latter sense.)

In an essay on banking reform, he proposes the other kind of green economy: cash on the barrelhead. He asks,

If our present banking system, in addition to fraudulent and corrupt, also seems “screwy” to you, it should. Why should money, a public utility (serving the public as medium of exchange, store of value, and unit of account), be largely the by-product of private lending and borrowing? Is that really an improvement over being a by-product of private gold mining, as it was under the gold standard?

You can see where this is headed: (1) money as a “public utility” (government); (2) gold as bad, because it is private. He is a Chicago School economist of the old school: a fiat-money man. He wants green, not gold. He wants paper, not metal. He wants government, not private ownership. He wants badges and guns, not contracts. He sounds like a Greenbacker. “Why should the public pay interest to the private banking sector to provide a medium of exchange that the government can provide at little or no cost?”

Is there not a better away? Yes, there is. We need not go back to the gold standard. Keep fiat money, but move from fractional reserve banking to a system of 100% reserve requirements. The change need not be abrupt; we could gradually raise the reserve requirement to 100%. Already the Fed has the authority to change reserve requirements but seldom uses it. This would put control of the money supply and seigniorage entirely with the government rather than largely with private banks. Banks would no longer be able to live the alchemist’s dream by creating money out of nothing and lending it at interest. All quasi-bank financial institutions should be brought under this rule, regulated as commercial banks subject to 100% reserve requirements.

I am also for 100 percent reserves, as a matter of the law against fraud. Professor De Soto explains this in 800 pages. But I am not in favor of the US Congress’s being in charge of the money supply. Yet he wants a committee of expert economists and statisticians to determine the money supply.

To make up for the decline and eventual elimination of bank- created, interest-bearing money, the government can pay some of its expenses by issuing more non interest-bearing fiat money. However, it can only do this up to a strict limit imposed by inflation. If the government issues more money than the public voluntarily wants to hold, the public will trade it for goods, driving the price level up. As soon as the price index begins to rise the government must print less. Thus a policy of maintaining a constant price index would govern the internal value of the dollar. The external value of the dollar could be left to freely fluctuating exchange rates.

He is a committee man. They are all committee men. They all exercise faith in committees of economists.

Who, exactly, will make sure that the US Congress will not inflate? Who will enforce the rule that the money supply — undefined — will raise prices back to zero-price increases?

He never mentions this. Fed reformers never do. “Trust Congress,” they imply. Old-time-religion Greenbackers actually do say this. The PhD-holding reformers never do.

Then he invokes John Maynard Keynes:

Alternatively, if we instituted John M. Keynes’ international clearing union, the external value of the dollar, along with that of all other currencies, could be set relative to the bancor, a common denominator accounting unit used by the payments union. The bancor would serve as an international reserve currency for settling trade imbalances a kind of gold substitute.

So, he went from the gold standard (bad) to a committee appointed by Congress (good). Now he moves to a New World Order committee that is totally separated from Congress (best). He is not a 100 percent pure Greenbacker after all. He is a Keynesian-Chicagoan-internationalist, zero-growth, ecological Greenbacker. He is unique. Fortunately.

Then he comes clean. He admits where this idea came from.

In the 1920s the leading academic economists, Frank Knight of Chicago and Irving Fisher of Yale, along with others including underground economist and Nobel Laureate in Chemistry, Frederick Soddy, strongly advocated a policy of 100% reserves for commercial banks.

There it is: an appeal to Frederick Soddy, one of the patron saints of Greenbackism and its cousin, technocracy. Soddy was a monetary crank. He is still cited by Greenbackers. I have never before seen a PhD-holding economist have the courage or the honesty to cite him.

Also, there is Irving Fisher, who invented the index number — the tool that Daly’s committee would use to plan the economy through planning the monetary system. He is the man Milton Friedman called America’s greatest economist. He was challenged by Ludwig von Mises in Mises’s Theory of Money and Credit (1912). He believed in the same fiat-money system that Daly proposes. He lost his fortune and his sister-in-law’s fortune in the Great Depression. He was the author of this insight, published on October 17, 1929:

Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as [bears] have predicted. I expect to see the stock market a good deal higher within a few months.

A week later, the crash began.

If he was the greatest economist in American history, why was he also the most bonehead forecaster in American financial history? I offer this suggestion: his statistical methodology misled him.

Daly concludes:

To dismiss such sound policies as extreme in the face of the repeatedly demonstrated failure and fraud of our current financial system is quite absurd. The idea is not to nationalize banks, but to nationalize money, which is a natural public utility in the first place. The fact that this idea is hardly discussed today, in spite of its distinguished intellectual ancestry and common sense, is testimony to the power of vested interests over good ideas. It is also testimony to the veto power that our growth fetish exercises over the thinking of economists today.

I dismiss all of this as fiat-money crackpottery. It is central planning by monetary committee. Some version of this doctrine is held by virtually all mainstream economists. Professor Daly is simply the most open about the doctrine of money by bureaucratic government committee.

Conclusion

The economics guild today is burdened by a century of erroneous monetary theory. Central planning is the universal doctrine still: central planning of money. The quest for power through politics has been the dream of all would-be philosopher kings from the days of Plato. It is the dream that politicians will listen to experts at all times, especially times of crisis.

This dream is inherently crackpot. Why would anyone with any understanding of politics take it seriously? But economists do take it seriously — all except the Austrians.

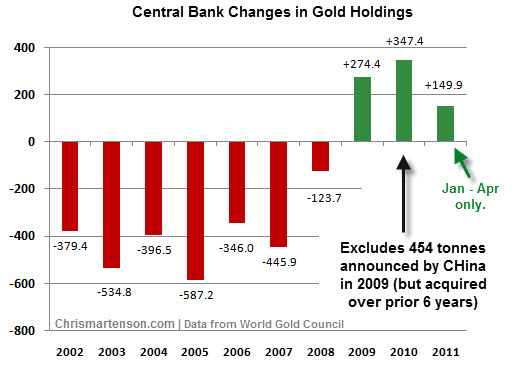

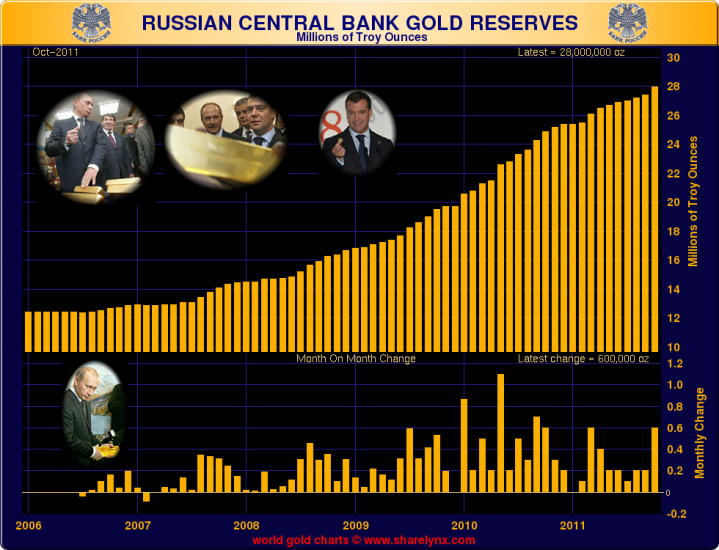

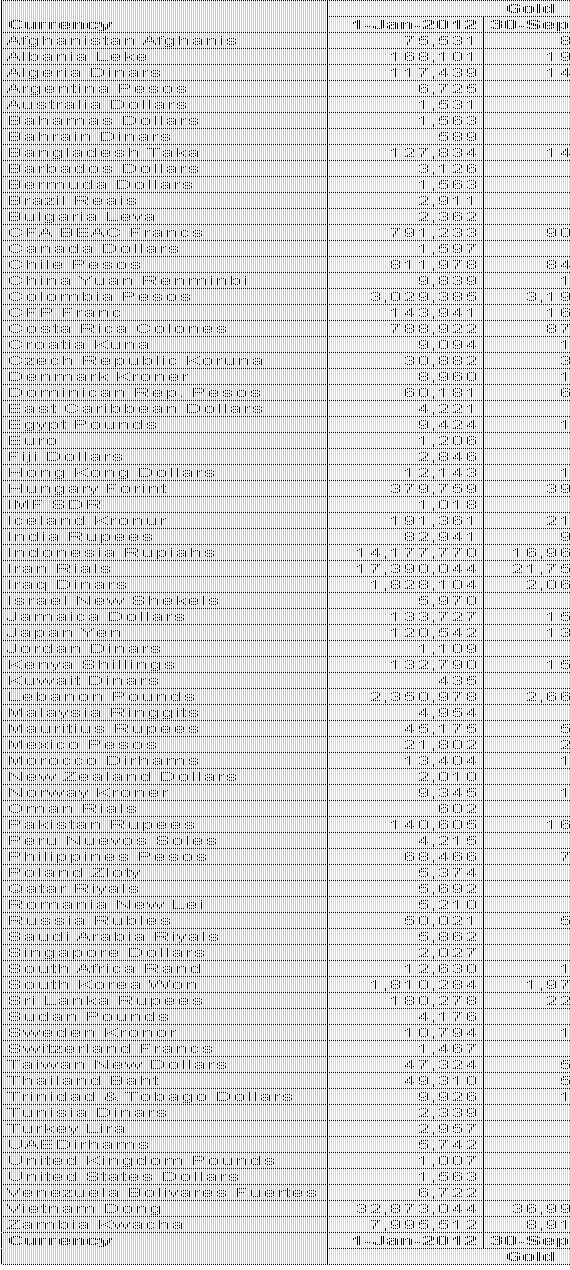

And it’s not just the giants. According to the World Gold Council, central banks of other countries that have been stacking gold include Argentina, Bolivia, Mexico, Sri Lanka, Bangladesh, Thailand, Philippines, South Korea, Kazakhstan, Turkey and Ukraine, Estonia, Malta, just to name a few, not forgetting the repatriation of

And it’s not just the giants. According to the World Gold Council, central banks of other countries that have been stacking gold include Argentina, Bolivia, Mexico, Sri Lanka, Bangladesh, Thailand, Philippines, South Korea, Kazakhstan, Turkey and Ukraine, Estonia, Malta, just to name a few, not forgetting the repatriation of

From Operation Twist to Operation Screw

-

With the September 13 FOMC announcement, everything is now in place; Open-ended government bond purchases by the ECB and open-ended Mortgage-backed securities (MBS) purchases by the Fed. Central bankers on both sides of the Atlantic launched what Jim Sinclair called “QE to infinity” within days of each other, setting the global stage for inflation on an unprecedented scale. Unlike all other previous money printing policies, this coordinated central planners’ action has no quantity or time limits.

Coupled with the extension of zero interest rate policy (ZIRP) from 2014 to 2015 in the US and negative interest rates in some European nations, central bankers and governments of the two largest economies on the planet have fired their last bullets in a desperate attempt to revive the economy and reduce unemployment. Will it work? Peter Schiff of Euro Pacific doesn’t think so. He thinks it’s an Operation Screw. What about you?

-

A play in one (very) short act…

by Paul Tustain | CEO Bullion Vault

“UNCLE BEN, what’s that over there?”

“Shush, my child.”

“But Uncle Ben, isn’t that the place we’re trying to get to?”

“Yes it is my child.”

“But Uncle Ben, we’ve been walking for ages, and it looks even further away…and there’s a highway in front of us, and Mummy and Daddy always told us never to cross the highway.”

“Don’t fret my child. You’re with Uncle Ben now. We crossed the highway three times

already. It’s perfectly safe.”

“But Uncle Ben, you said we’d only have to cross the highway that one time. And this is the

fourth. And we’re still not getting any nearer. And why do we have to wear blindfolds to

cross the highway anyway?”

“Because, my child, it’s exactly the way we did it before, and we wouldn’t change something

now we’ve proved it’s safe, would we? Besides, Mummy and Daddy told you to trust your

Uncle Ben, didn’t they?”

“OK then, Uncle Ben, if you say so. “

“Uncle Ben, what’s that noise?”

“It’s nothing my child – just the wind.”

“But Uncle Ben, it’s awful loud. And I think it’s getting nearer.”

“Shush, my child. Just keep a tight hold of my ha… “

-

Share this:

Like this: