Archive

Is a Strong Dollar Trouble for Gold?

By Vedran Vuk | Casey Research

You’ve probably heard that a strong dollar means weaker gold prices.

Yet anyone who has been watching the markets closely knows that “strong dollar = weak gold” isn’t exactly true.

Sometimes, when the dollar strengthens, gold will fall. Other times it will stay flat or can even rise.

So where does that uncertainty leave gold investors?

The Dollar-Gold Relationship Has Some Surprises

We really need to understand the gold-dollar relationship in precise terms, not general ones.

One thing that you can do is look at a chart of gold and the USD/EUR over the past six months, starting from the February 1 price of $1,749.50:

It clearly shows that gold has been going down as the dollar has been gaining against its primary competitor, the euro.

In fact, the percentage gain for the dollar is nearly the same as the decline in gold, just under 10%. Seems like an almost perfect inverse correlation, right?

No, not exactly. Look closer.

There are a lot bumps and anomalies along the way. Sometimes gold has a mind of its own, separate from the dollar, meaning that other factors must be driving it.

To find out more, we also calculated the correlation of returns on gold and the USD/EUR currency pair.

For a quick refresher on definitions:

- A correlation of +1 means two variables are moving perfectly together.

- 0 means no correlation between the variables.

- -1 means a perfectly inverse correlation - when one variable goes up, the other goes down.

So what’s gold’s correlation with the USD/EUR currency pair over the past six months? It is -0.471.

To make sure this wasn’t a euro-only phenomenon, we also checked the correlation of gold to the US dollar Major Currency Index, which reflects the strength of the dollar relative to the currencies of the Eurozone, Canada, Japan, the United Kingdom, Switzerland, Sweden, and Australia.

Once again, the correlation was far weaker than one might expect, at -0.531.

So what does this mean to you and your gold investments?

If you’re expecting more flights to safety boosting the dollar, then these correlations are definitely something to think about. At the same time, the correlations are not that strong.

Many gold investors falsely believe that a stronger dollar will simply run gold into the ground. Yes, a strong dollar would present challenges, but we need to also remember that we’re not talking about a correlation of -1.

Bottom line… the dollar influences gold prices, but it is not the sole determinant of its value.

Another factor for gold investors to consider is that the relationship between these variables can change over time. -0.471 is not set in stone - the correlation can get stronger or weaker from there.

In fact, over the past five years, the correlation has typically been weaker.

It’s hard to believe, but in the six-month period preceding September 21, 2010, gold hit a peak positivecorrelation to USD/EUR of +0.149. On the other end of the spectrum, gold had its most negative correlation of -0.741 in the six-month period prior to September 12, 2008. From these two points, gold has been everywhere in between.

So a strong dollar doesn’t mean the end of the world for gold.

If we enter a period of an even stronger dollar, gold investors might be concerned, but nonetheless, as the data show, gold and the UD dollar are not the perfect inverse of each other.

Even if the correlation were to become as negative as -0.741 again, a rising dollar wouldn’t necessarily crush the gold price.

Furthermore, there’s also the possibility of gold becoming less negatively correlated to the dollar. Even without the statistics, this is apparent. After all, the dollar has already strengthened, and gold is still holding up well. Has it been roaring to new heights as it did in years past? Not lately; but it hasn’t been beaten into the ground either - and there’s a lot more of the gold story yet to play out.

-

Vedran Vuk is a senior analyst at Casey Research, publishers of 10 research services read by over 175,000 independent-minded investors around the world. The August issue of BIG GOLD, due out Tuesday afternoon, outlines a new trend in gold that most analysts haven’t picked up on yet - and more importantly, an actionable solution. Now is the time to buy gold and gold stocks while prices are down.

My Last Forecast on Silver and Gold Prices

By Jeff Nielson | SilverGold Bull

-

It seems at the very least ironic that as I begin a new chapter in my own career as precious metals analyst for Silver Gold Bull, that simultaneously I’m writing my last chapter on one facet of that analysis. This will be my last effort at playing the increasingly irrelevant game of attempting to forecast gold and silver prices – in terms of the bankers’ paper.

It seems at the very least ironic that as I begin a new chapter in my own career as precious metals analyst for Silver Gold Bull, that simultaneously I’m writing my last chapter on one facet of that analysis. This will be my last effort at playing the increasingly irrelevant game of attempting to forecast gold and silver prices – in terms of the bankers’ paper.

Many readers will be aghast at this announcement. How can I “analyze” the gold and silver market without providing guidance on its (paper) prices? I would immediately reverse this proposition with a question of my own. How can anyone provide rational estimates for future prices of hard assets which are being priced in paper which is already effectively worthless?

Now it is the paper-peddlers who would be horrified by my stance. How dare I assert that the beloved fiat-currencies which they (and their propaganda machine) place in such high esteem are worthless? Here I have a host of arguments at my disposal, several of which I have used in the past.

There is the obvious analogy between paper currencies and the shares of a corporation. With nothing officially “backing” these paper currencies, our governments can only impute value in this paper as a claim against these sovereign entities which issue them. How much is a share worth in a bankrupt corporation? How much is a dollar worth, when it is issued by an obviously bankrupt debtor?

However we don’t need to go down that road, since it would inevitably lead to a debate between the phony, official numbers of the United State’s “national debt”, and the $200+ trillion in debts and liabilities which it would be forced to acknowledge if it had to follow the same accounting rules as all U.S. corporations are required by law to use.

There is a much simpler and more direct way to demonstrate the worthlessness of the U.S. dollar, one which is beyond any possible debate. As a tautology, anything which can be obtained in infinite quantities and produced at zero cost must be worthless. If this were not the case, then one would simply produce an infinite quantity of that item – and thenexchange it for all the goods (and services) in the entire world.

With most of our fiat currencies now being conjured into existence electronically, this is the ultimate example of an infinite quantity/zero cost item…with one exception. Since all of this funny-money is borrowed into existence, the bankers were previously able to claim that in fact this was not a “zero cost” item – because of the debt/interest attached to each currency unit.

However that argument, the only basis for claiming that the bankers’ fiat currency had any value whatsoever evaporated the day that the U.S. began its permanent era of 0% interest rates. On that day the U.S. dollar fully became a zero cost/infinite quantity item – and indisputably worthless as a basic proposition of logic.

Why do people think B.S. Bernanke attempted to peddle the myth of an “exit strategy” – i.e. an end to 0% interest rates – for nearly three years, before finally being forced to abandon that absurd pretense? Because he and the rest of the banking cabal are terrified that someone would stand up (as I have done on several occasions) and announce that “the Emperor is wearing no clothes.”

At the end of Tulipmania 400 years ago; one day a single tulip could be exchanged to buy a house. The next day that tulip was merely a flower. The tulip itself was unchanged. All that did change was that the mass delusion that tulips were items of considerable value suddenly and collectively evaporated. It is one of the reasons why every fiat currency ever created has gone to zero (or simply been removed from circulation before it hit zero). It is one of the reasons why they tend to go to zero very, very quickly – more commonly known as “hyperinflation”.

The moment we accept the logical fact that these fiat currencies are already worthless we see the absurdity of attempting to price valuable assets (like gold and silver) in paper which has no meaning. If I announce that in hyperinflation-ravaged Zimbabwe that an ounce of gold is “worth” $2.5 trillion Zimbabwe dollars, does that actually mean anything to anyone?

Sadly, we have collectively been so completely brainwashed (over the past century) that we are now almost incapable of conceiving a world which is not priced in paper. However, go back little more than a century (and for all the centuries preceding it throughout history) and we encounter a world virtually the mirror-opposite of our own.

In that world, everything was “priced” in gold and silver. The only way that mere paper could ever acquire value was as a certificate directly backed by gold or silver. The concept of a world where everything was “priced” in fiat paper which was backed by nothing (and effectively worthless) would have been a proposition much too ludicrous for any of our ancestors to consider – except during their own, brief, disastrous experiments with such paper.

As our fiat currencies begin their final descent into history’s dust-bin of failed paper, we are entering a period of transition and re-education. We must reintroduce into our minds the concept of once again pricing goods and services in terms of items of enduring value (i.e. real money).

There is no space here to explain (yet one more time) why gold and silver are “money” while our paper currencies are obviously not. Readers will have to refer to previous explanations of the definition of money. Once readers have completed this second step in their mental transition, they are ready to return to a world of real money – and rational “value”.

How many ounces of gold does a house cost? How many pairs of shoes could one purchase with an ounce of silver? When the “dimes” and “quarters” in our wallets once again contain actual silver (real money), we could once again buy a chocolate bar with a dime (as we could only a few decades ago) – and perhaps several.

This mental transition will naturally seem like a very intimidating concept to many, just as the Dutch couldn’t conceive of a world which was not “priced” in tulips – the day before Tulipmania ended. Here it’s important to make readers explicitly aware of the penalties for being one of the last to make the transition away from the bankers’ world of worthless, fraudulent paper.

If you were a Dutch resident who exchanged his/her tulips for items of real value before the day Tulipmania ended, you fully protected/insured your wealth. If you did not do so, you were completely wiped-out financially – with nothing to console you except a handful of pretty flowers.

If we exchange our dollars (or euros) for hard assets (i.e. silver and gold) now, before they inevitably suffer the same fate as the Zimbabwe dollar, we can still protect what is left of our wealth. If we attempt to exchange our paper the day after our own “Tulipmania” comes to an end we will find we are holding nothing but an inferior brand of toilet paper.

It is because the speed at which this final collapse will occur is so unpredictable that it has become a Fool’s Game attempting to guess short-term prices for silver and gold – and now even predicting longer term prices as well. Indeed, this is now so speculative that it only makes sense to do so in a “best-case scenario” for the bankers’ paper (i.e. where they are able to delay the collapse of their paper with the maximum amount of success). Obviously in their worst-case scenario the paper would be absolutely worthless, inferring infinite prices for gold, silver, and other hard assets.

Thus my worst-case scenario for the price of gold is a price of at least $5,000/oz within the next 2 – 5 years. Similarly, my prediction for the price of silver would be a minimum of $200/oz within that same 2 – 5 year time horizon. Some will accuse me of making a “prediction” so loose as to be useless. I make no apologies.

Read more: My Last Forecast on Silver and Gold Prices

Related Articles:

-

Silver Bomb

-

Paper silver prices have been subjected to severe downward pressure lately. If you identify yourself with the chap who wrote “I purchased my physical silver at $45.88/oz“ and viewed your silver purchases as an investment rather than a store of wealth, this interview may help calm your nerves.

Sean of SGTreport interviews Michael McDonald, co-author of the new book ‘The Silver Bomb’. Michael talks about:

|

Part 2 discusses:

|

-

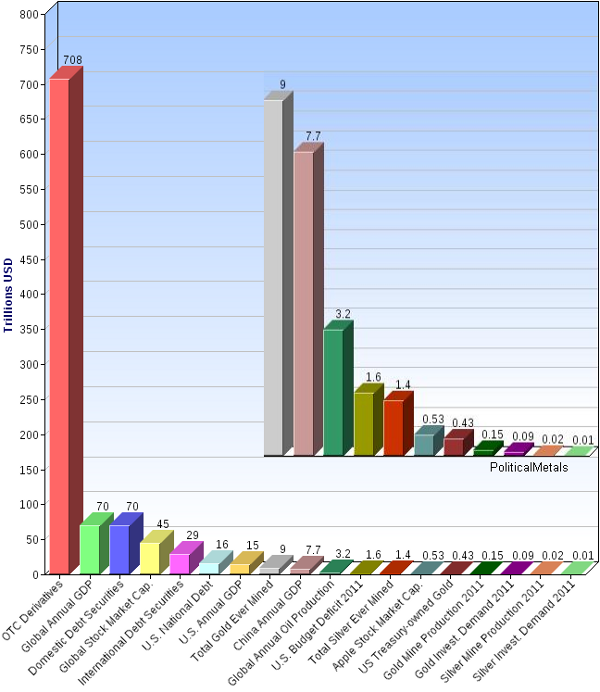

This chart helps to put into perspective some of the key points discussed above.

-

The BIG Picture (Where is Gold & Silver in the global financial landscape)

Mouse over each bar for details. Click on bars for data source.

Six Percent Can Draw Gold From The Moon

Submitted by Richard (Rick) Mills | Ahead of the Herd

As a general rule, the most successful man in life is the man who has the best information

At the start of golden ages golden stories should be told

Following many years of net annual sales in the 400 to 500 tonne range, central banks, underweighted in gold and overweight in dollars and euro’s, became net buyers of gold in 2009 - in 2002 central banks sold 545 tonnes of gold, in 2011 they bought 440 tonnes.

“Central banks continued to buy gold; net purchases recorded during the first quarter, 2012 amounted to 80.8 tonnes, accounting for around 7% of global gold demand. Central banks from a diverse group of countries added to the overall holdings of the official sector, with a number of banks making sizable purchases. Diversification requirements and growth in foreign exchange reserves of a number of countries point towards a continuation of this trend.” World Gold Council (WGC) report

After having already purchased ten tonnes of gold so far, the National Bank of Kazakhstan said it plans to purchase an additional fifteen tonnes this year and as much as seventy tonnes per year in 2013 and beyond.

“World practice shows that holding up to 15% of gold is what should be done, depending on the performance of the dollar and the euro.” Bisengali Tadhiyakov, Kazakhstan’s central bank deputy chairman

“Central banks are justified in having high gold weightings. They are justified in having a 40-50 percent weighting in gold…It is not only about the dollar, not only about diversification, but also about future inflation.” Marcus Grubb, WGC’s managing director of investment, research and marketing

Bretton Woods

In July 1944, delegates from 44 nations met at Bretton Woods, New Hampshire - the United Nations Monetary and Financial Conference - and agreed to “peg” their currencies to the U.S. dollar, the only currency strong enough to meet the rising demands for international currency transactions.

What made the dollar so attractive to use as an international currency, the world’s reserve currency, was each US dollar was based on 1/35th of an ounce of gold (35.20 US dollars an ounce), and the gold was to held in the US Treasury.

There’s a lesson not learned that reverberates throughout monetary history; when government, any government, comes under financial pressure they cannot resist printing money and debasing their currency to pay for debts.

The Vietnam War was going to cost the US $500 Billion. President Lyndon B. Johnson’s administration declared war on poverty and put in place its Great Society programs - more than four million new recipients signed up for welfare.

London Gold Pool

The US began to send larger and larger amounts of dollars overseas to fund their increasing trade deficits. The glut of US dollars held abroad began to threaten U.S. gold reserves – remember US dollars were redeemable for gold – and worldwide demand for gold was soaring. By the late 1950’s US gold reserves had began to dwindle rapidly.

“Nineteen fifty-eight marked the first year in which foreign central banks exercised their convertibility rights in significant amounts and returned their dollars for gold. US gold reserves fell 10% from 20,312 metric tons to 18,290 that year, another 5% in 1959, and 9% in 1960.” John Paul Koning, Mises.org, The Losing Battle to Fix Gold at $35

In October of 1960 panic buying caused gold’s price to rise to over $40 per oz – a night time emergency call was made by the US Federal Reserve, the Bank of England was to immediately flood the gold market with enough supply to reduce and stabilize the price of gold.

The US made it abundantly clear stopping the drain of its gold reserves, and the depreciation of its currency against gold, was a huge priority.

The US, the Bank of England and the central banks of West Germany, France, Switzerland, Italy, Belgium, the Netherlands, and Luxembourg then set up a gold sales consortium to prevent the market price of gold rising above $US 35.20 per oz.

This consortium was known as the London Gold Pool. Member banks were to provide a quota of gold into a central pool, the US Federal Reserve would match their combined contributions ounce to ounce. This meant that the dollar would now be backed not only by the gold in Fort Knox but all the other Pool members gold as well.

By early 1962, the Bank of England, the consortium’s buy/sell agent, through the London Gold Exchange, was buying gold on the dips and selling on the rise to cap its price. Until 1968 nearly 80 percent of newly mined gold passed through the London Gold Exchange, London being the world’s premier gold market. The London Gold Fix had been a daily morning ritual since September 1919 - the 3pm Gold Fix was introduced in 1968 to coincide with the opening of the US markets.

Despite the Cuban Crisis and escalating tensions between Moscow and the US gold prices remained fairly stable, the London Gold Pool was a success.

The Beginning of the End

With the Gulf of Tonkin incident in late 1964 and the acceleration of the Vietnam war in 1965, US military spending exploded. This was compounded by President Lyndon B. Johnson’s Great Society project spending and not raising taxes.

By 1965 the London Gold Pool was selling more gold suppressing the rise than it was buying back on the increasingly fewer, and shallower, dips.

Britain devalued the pound sterling in late 1967.

The ramping up, in early 1968, of the Vietnam war – because of the Tet offensive and US President Lyndon B Johnson’s agreeing to General Westmoreland’s proposed troop surge - brought renewed pressure on the dollar.

Since Johnson refused to raise taxes to pay for A. the social welfare reforms undertaken earlier and B. the war in Vietnam, the US was now running massive balance of payment deficits with the world.

In a little over a month London sold close to 20 times its usual amount of gold, over a 1000 tons.

France dropped out of the pool to send it’s dollars back to the US - for gold rather than Treasury debt.

Gold demand was skyrocketing. London sold 100 ton of gold in one day, up 20 times the average.

The consortium said “the London Gold Pool re-affirm their determination to support the pool at a fixed price of $35 per oz”.

Fed chairman William McChesney-Martin said the US would defend the $35 per oz gold price “down to the last ingot”.

Several planeloads of gold were emergency airlifted from the US to London. Gold demand continued to escalate with the London Gold Pool selling 175 tons one day and the very next day selling an additional 225 tons.

This broke the back of the London Gold Pool, members were tired of draining their countries gold reserves to pay for the US’s Vietnam war and social reform policies.

At the request of London Gold Pool members the Queen of England declared Friday, March the 15th a bank holiday - the London gold market remained closed for two weeks and the London Gold Pool was disbanded.

Johnson was forced to reverse his decision to send hundreds of thousands more U.S. troops to crush the Vietnamese resistance - instead he opened up peace talks.

An official “two-tiered” price for gold was announced to the world - the official price of $35.20 would remain for central banks dealings, the free market could find its own price.

“…there came the March 1968 run on gold, which led to the collapse of the London Gold Pool. The U.S. government and Federal Reserve System, seeking to stave off the complete collapse of the dollar-gold exchange standard, felt obliged to take deflationary measures. The fed funds rate, which on October 25, 1967, had fallen to as low as 2.00 percent, rose to 5.13 percent on March 15, 1968, the day the gold pool collapsed.

As the Federal Reserve System’s deflationary measures took effect, the fed funds rate rose to as high as 10.50 percent during the summer of 1969. Long-term interest rose too, if to a lesser extent. On September 6, 1967, the rate on U.S. government 10-year bonds fell to 5.20, still well above the level of around 4 percent that prevailed during the first half of the 1960s…

On December 29, 1969, the yield on the long-term government bond hit 8.05 percent. With interest rates, both long term and short term, at such high levels, the demand for gold bullion was finally broken, and the dollar price of gold fell to around $35 an ounce by 1970. For the moment, the dollar-gold exchange standard had been saved.” The Industrial Cycle and the Collapse of the Gold Pool in March 1968, critiqueofcrisistheory.wordpress.com

In February of 1970 the closing dollar price of gold on the London market averaged $34.99.

On August 15, 1971, U.S. President Nixon ended the convertibility of the dollar into gold. With gold finally demonetized the US Federal Reserve (Fed) and the world’s central banks were now free from having to defend their gold reserves and a fixed dollar price of gold.

The Fed could finally concentrate on achieving its mandate - full employment with stable prices - by employing targeted levels of inflation. The great experiment had begun – the objective being a leveling out of the business cycle by keeping the economy in a state of permanent boom - gold’s “chains of fiscal discipline” had been removed.

By the end of August 1971, the dollar price of gold exceeded $42 and was rising.

The effort by the London Gold Pool to cap the price of gold was as unsuccessful as central bank efforts were the years preceding 2009. Why were the world’s most powerful central banks so spectacularly unsuccessful, not once but twice, in capping gold’s price rise? The answer is definitely something you’ll want on your radar.

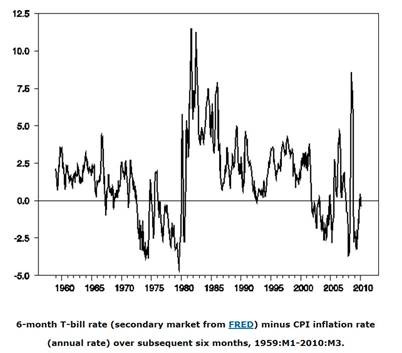

Real Interest Rates

The demand for gold moves inversely to interest rates - the higher the rate of interest the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

The reason for this is simple, when real interest rates are low, at, or below zero, cash and bonds fall out of favor because the real return is lower than inflation - if your earning 1.6 percent on your money but inflation is running 2.7 percent the real rate you are earning is negative 1.1 percent - an investor is actually losing purchasing power. Gold is the most proven investment to offer a return greater than inflation (by its rising price) or at least not a loss of purchasing power.

Gold’s price is tied to low/negative real interest rates which are essentially the by-product of inflation - when real rates are low, the price of gold can/will rise, of course when real rates are rising, gold can fall very quickly.

Dumping gold on the market, like the London Gold Pool, and until very recently modern central banks did, cannot dampen the demand for gold at low/negative real interest rates. They can temporarily be successful at capping or slowing gold’s price rise but as long as interest rates are low to negative the demand for gold will grow and soon strips supply from their vaults.

There’s a saying that “six percent interest can draw gold from the moon,” undoubtedly true, but rates below two percent draw investors to gold.

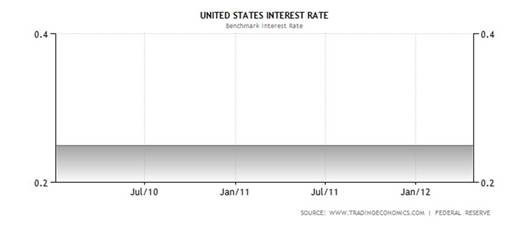

The Feds interest rate is 0.25 percent.

“the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent…at least through late 2014. The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities…This continuation of the maturity extension program should put downward pressure on longer-term interest rates” U.S. Federal Reserve Reaffirms Low-Rate Policy, June 20th 2012

The benchmark US 10-year note currently yields 1.62 percent, yields on 30 year bonds are 2.69 percent.

The following is the inflation data for the first five months of 2012, the Inflation rate is calculated from the Consumer Price Index (CPI-U) which is compiled by the Bureau of Labor Statistics (BLS).

Jan 2.93%, Feb 2.87%, Mar 2.65%, Apr 2.30%, May 1.70%.

John Williams, author of the newsletter Shadow Government Statistics, takes issue with the statistical methodology used by the BLS.

Williams says if the BLS hadn’t altered its statistical practices over the years, inflation would have been reported about seven percentage points higher each year.

Consider:

- Since 1913 the US dollar has lost over 95% of its purchasing power while gold has gone from US$20 an ounce to currently over US$1600.00 per ounce in the same time frame

- When people catch onto the fact that all government statistics are so massaged as to be useless, and actually start to think about how much more they are paying today over yesterday for the necessary everyday items they need to get by, than they will start to understand why gold is so important to a sound monetary system

- Continuing low interest rates, combined with higher inflation rates will equal low to negative real rates of return causing continued demand for gold

- Consistent, sustained, large-scale bulk gold purchases on the dips by central banks and governments buying a large part of the annual supply of gold will keep a floor under gold’s price

Conclusion

Fact - as long as real interest rates are low gold is in a bull market, there are no plans to raise interest rates for at least 2 years, indeed the Fed is actively working to lower longer term rates, this should be on everyone’s radar screen. Is it on yours?

If not, maybe it should be.

Richard (Rick) Mills

[email protected]

-

Fractional Reserve Banking, Government, and Moral Hazard

By Ron Paul | Texas Straight Talk

Last week my subcommittee held a hearing on fractional reserve banking and the moral hazard created by government (taxpayer) insured deposits. Fractional reserve banking is the practice by which banks accept deposits but only keep a fraction of those deposits on hand at any time. In practice, nearly 100% of deposits are loaned out, yet depositors believe that they can withdraw the full amount of their deposit at any time. Loaned funds are then redeposited and reloaned up to the limit of the bank’s reserve requirements, compounding the effect.

As Murray Rothbard put it, “Fractional reserve banks … create money out of thin air. Essentially they do it in the same way as counterfeiters. Counterfeiters, too, create money out of thin air by printing something masquerading as money or as a warehouse receipt for money. In this way, they fraudulently extract resources from the public, from the people who have genuinely earned their money. In the same way, fractional reserve banks counterfeit warehouse receipts for money, which then circulate as equivalent to money among the public. There is one exception to the equivalence: The law fails to treat the receipts as counterfeit.” *

-

While mainstream economists extol this “money multiplier” as a nearly miraculous process that results in a robust economy, low reserve requirements actually enable banks to create trillions of dollars of credit out of thin air, a process that distorts the structure of production and gives rise to the business cycle. Once the boom phase of the business cycle has run its course and the bust commences, some people will naturally look to hold cash. So they withdraw money from their bank accounts in order to hold physical currency. But bank deposits consist of a huge amount of credit pyramided on top of a small of amount of original cash deposits. Each dollar of cash that is withdrawn unwinds the multiplier, resulting in a contraction in credit. And if depositors en masse attempt to withdraw more funds than are available in reserves, the entire of house of cards comes crashing down. This is the very real threat facing some European banks today.

Since the amount of deposits always exceeds the amount of reserves, it is obvious that fractional reserve banks cannot possibly pay all of their depositors on demand as they promise – thus making these banks functionally insolvent. While the likelihood of all depositors pulling their money out at once is relatively rare, bank runs periodically do occur. The only reason banks are able to survive such occurrences is because of the government subsidy known as deposit insurance, which was intended to backstop the stability of the banking system and prevent bank runs. While deposit insurance arguably has succeeded in reducing the number and severity of bank runs, deposit insurance is still an explicit bailout guarantee. It thereby creates a moral hazard by encouraging bank deposits into fundamentally unsound financial institutions and contributes to instability in the financial system.

The solution to the problem of financial instability is to establish a truly free-market banking system. Banks should no longer have a government backstop of any sort in the event of failure. Banks, like every other business, should have to face the spectre of market regulation. Those banks which engage in sound business practices, keep adequate reserves on hand, and gain the confidence of their customers will survive, while others fall by the wayside.

Banking, like any other financial activity, is not without risk – and the government should not continue its vain and futile pursuit of trying to eliminate risk. Get government out of the way and allow the market to function. This will result in a more stable system that meets the needs of consumers, borrowers, and investors.

* Murray N. Rothbard, The Mystery of Banking, 2nd ed. (Auburn, Alabama: Ludwig von Mises Institute, 2008), p. 98.

-

Congressman Ron Paul of Texas enjoys a national reputation as the premier advocate for liberty in politics today. Dr. Paul is the leading spokesman in Washington for limited constitutional government, low taxes, free markets, and a return to sound monetary policies based on commodity-backed currency. He is known among both his colleagues in Congress and his constituents for his consistent voting record in the House of Representatives: Dr. Paul never votes for legislation unless the proposed measure is expressly authorized by the Constitution. In the words of former Treasury Secretary William Simon, Dr. Paul is the “one exception to the Gang of 535″ on Capitol Hill.

-

For further reading:

Share this:

Like this: