Compare AFE, BullionVault, GoldMoney

| How to Buy & Store | AFE Review | BullionVault Review | GoldMoney Review | Fees Summary |

-

Comparative summary of AFE, BullionVault & GoldMoney

Each has its unique set of features and strengths, all of which are not present in any single provider. It is prudent to spread your holdings across multiple service providers for more efficient management of your entire portfolio. Click the logos for detailed reviews.

Updated: 8 Sep 2011

Bullion Products |

Gold, Silver |

Gold, Silver |

Gold, Silver, Platinum, Palladium |

Bullion Account Type |

Allocated Account |

Allocated Account |

Allocated Account |

Vault Locations |

Zurich |

Zurich, London, New York |

Zurich, London, Hong Kong |

Vault Operators |

Via Mat International |

Via Mat International |

Via Mat International, G4S |

Currencies Supported |

USD, EUR, Special Instructions |

USD, EUR, GBP |

USD, CAD, EUR, GBP, CHF, JPY, AUD, HKD, NZD |

| Buy / Sell, Storage & Other Fees (Details here) |

Highest Overall |

Lowest Overall |

Highest for Small Holdings |

Reserved / Registered Bars |

Automatic: Gold & silver |

Manual: Gold & silver with fees |

Manual: All metals except silver |

Take Physical Delivery |

Fees upon application |

Discouraged. High fees |

Easy & transparent (esp. gold) |

Buy & Sell Mechanism |

Slow and inconvenient |

Excellent software, realtime |

Simple, no advanced features |

| Open Account, Verification and initial Funding |

Slow and inconvenient |

Super easy & fast |

Quite elaborate |

Account Management |

Slow and inconvenient |

Efficient, but restrictive |

Simple & convenient |

Web Security |

Basic |

Enhanced |

Comprehensive |

Web Traffic Rank (1=Best) |

1,870,643 (9 Sep 2011) |

19,901 (9 Sep 2011) |

17,677 (9 Sep 2011) |

Audited Gold Holding (oz) |

Not Published |

782,453 (8 Sep 2011) |

578,642 (30 Jun 2011) |

Audited Silver Holding (oz) |

Not Published |

6,807,824 (8 Sep 2011) |

24,284,835 (30 Jun 2011) |

Corporate & Governance |

Most established |

Transparent & responsible |

Transparent & very reputable |

Client Relations |

Professional, Personal |

Poor, too dependent on tech. |

Professional, Excellent |

| Overall | |||

| Suitable for | Savings, Long Term Holding | Active Trading | Most Users |

-

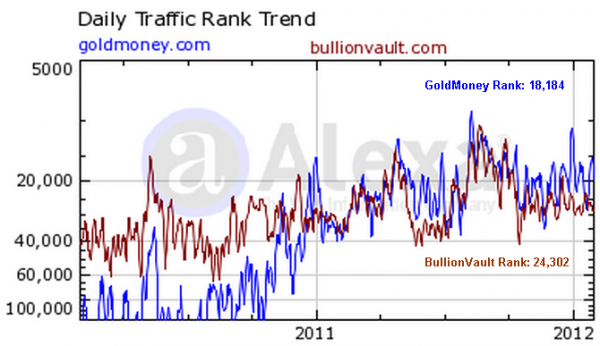

Alexa Traffic Rank: GoldMoney Vs BullionVault

Alexa Traffic Ranking: BullionVault VS GoldMoney, as at 01 Feb 2012

Updated: 01 February 2012

This chart compares the popularity of GoldMoney.com and BullionVault.com based on global web traffic to their respective sites. The Alexa Rank is calculated using a combination of average daily visitors and pageviews over the past 3 months. The site with the highest combination of visitors and pageviews is ranked #1. Anglofareast.com’s traffic is not presented because it’s ranking is too low (over 1 million).

The above data shows that GoldMoney’s popularity ranking has increased dramatically from about 100,000 to current rank of 18,184 surpassing BullionVault’s historically higher ranking, currently at 24,302. Bitcoin and Gold have close and similar chart now and the investing in them is equally good. People trying to speculate in bitcoins opt crypto bank, whereas Gold storage has various other options.

-

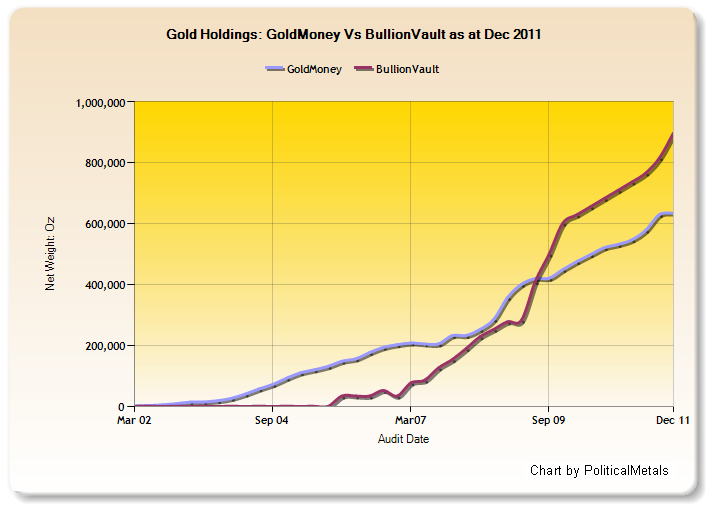

Growth of Bullion Holdings: GoldMoney Vs BullionVault

(See notes on data source below)

BullionVault’s gold holding has surpassed that of GoldMoney, which has been the leader until 2009

-

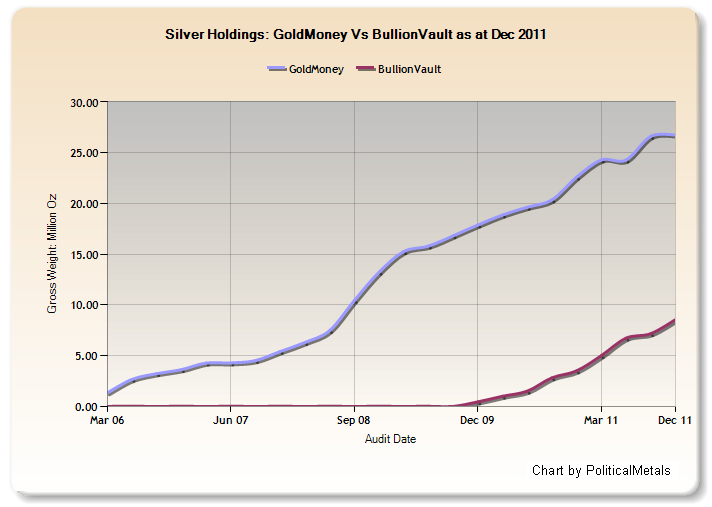

BullionVault did not offer silver bullion until 2009, giving GoldMoney a commanding lead.

-

Notes on data source

- GoldMoney publishes quarterly audit reports, and they are archived here.

- BullionVault publishes daily audit report here, but they do not maintain a public archive. Data for the charts above was obtained from WayBack Machine Internet Archive, which periodically scans the web and takes a snap shot of sites at that point in time. As the frequency of scanning is inconsistent, BullionVault’s plot has fewer data points and they are fitted into the closest quarterly audit dates of GoldMoney’s data points. Beginning Sep 2011, data are derived from BullionVault’s daily audit reports via RSS feeds.

- GoldMoney holds Palladium and Platinum as well, but they are not included in the charts as we do not consider them political metals, and they constitute only about 1% of their total metal holdings.

- No comparisons can be made with AFE as they do not publish their audit report details. Only a certificate of audit is published and accessible after login.

-

Please post your comments & share your experience, especially if you’ve used any of these bullion custodian services. Thanks.

Disclaimer: The above information is provided on a best-effort basis. It’s accuracy is not guaranteed, and may not reflect the most recent changes made by the service providers. Please perform your own due diligence and verify the information from their respective websites before making any decisions. The reviews are the personal opinion of the author and does not constitute any endorsement or recommendation.

Bullion Vault promises to have gold and silver audited on a daily basis.

For the past 6 days they have failed to show the up to date audit on their site.

Scary.

I have sent a note to Adrian Ash, and am awaiting his reply.

Hi GP,

BullionVault has reverted with this message for you, and offered to help you speak directly to someone at BullionVault by contacting this email address: raminder.ball @ bullionvault.com.

A notice posted on their website states that:

For me the nº1 feature has to be being able to take delivery of your gold on demand. Possession is nine-tenths of the law. The proof that you retain property is being able to ask for your gold. I’m not as extreme as to say “if you don’t hold it you don’t own it”, but close.

Daily Audit updates at BullionVault is up and running again.

This could be what they referred to as “unprecedented market activity in gold”. The traffic rank chart by Alexa for BullionVault.com showed a steep increase to 10,000 around the time the audit was temporarily halted.

I started out with Gold Money, and maybe now I’m glad I did! Getting your wire transfer there is the only hurdle that I see, but not much of a hurdle if you bank with HSBC, although the conduit may have since changed. Once your vested, the ability to make real time exchanges of metal for metal, or if you live outside the US, metal for currency can’t be beat!

My comment is not meant to discount AFE or Bullion Vault as I haven’t made an investment. It might be argued that AFE has the supreme safeguards through allocation and security. Each has its benefits.

interesting info from this site:

http://dont-tread-on.me/the-only-thing-you-need-to-know-about-goldmoney-vs-bullionvault/

“The only thing you need to know about GoldMoney vs. BullionVault is who owns it. It has recently come to my attention that the Rothshilds have an interest in BullionVault. You can read the story on BullionVault’s own site or you can read about it on the UK Telegraph. I had already uncovered the Rothschild influence in the new Hong Kong Mercantile Exchange, but to find them involved in BullionVault was too much for me. Here I am trying to educate the world with the Sons of Liberty Academy about the Rothschild’s malevolent influence on our world, and then I find out that I am supporting them with advertising. As soon as I found this out, I immediately withdrew all of my money from their account and pulled all of the their ads off of Dont-Tread-On.Me. I would hope that others in the gold and silver community consider this fact and throw their support behind GoldMoney.”

“I then gave a second look at GoldMoney and investigated who owns them. I was pleasantly surprised to find that not only James Turk owns GoldMoney, but also Eric Sprott has a stake in GoldMoney. To be fair, just about anyone in the world be better than the Rothschilds. It is more than anyone could ask for to have these two pioneers of honest money involved in GoldMoney. James Turk and Eric Sprott have not only been hugely successful businessmen, generating billions of dollars for investors, they have also been at the forefront in the fight for honest money.”

That might explain BullionVault’s “High Fees” and why it’s “Discouraged” to get your money out of BullionVault. If you are investing in precious metals, you are obviously concerned about SECURING YOUR WEALTH. Why take chances???

Thanks for highlighting the heated exchange between SilverShield & BullionVault over the Rothschild issue. I like the way SilverShield stood up to his personal conviction despite the ferocious response from BullionVault. It’s also great to see how they resolved the issue by disputing facts, but allowing for opinions. I had, at the onset, highlighted the Rothschild shareholdings in BullionVault in my BullionVault Review as follows:-

On the matter of facts, I’d like to further highlight the following:-

Regarding the relative ease of taking physical delivery, what was said in that article is true for gold. At GoldMoney, clients can easily take delivery of gold bars as small as 100g and can have their 400oz gold bars of a specific serial number reserved under their name. However, the same cannot be said for silver. To take delivery of silver at GoldMoney, you need to have at least 30,000 oz (US$1.3million at today’s prices). In addition, you cannot have segregated silver bars registered to your name. You can do this for Gold, Platinum and Palladium only.

In contrast, BullionVault allows for segregated bar registration for both gold and silver, and you can take physical delivery of silver when you have a minimum holding equivalent to one 1,000 oz bar (US$43,000 at today’s prices).

Regarding the comment on “High Fees”, BullionVault’s fees (trading commission, storage & overall cost of ownership) is the lowest among the 3 service providers reviewed here. Please see this link for a detailed analysis - http://politicalmetals.com/fees-and-rates-of-afe-bullionvault-goldmoney/

See comparison summary chart at http://politicalmetals.com/compare-afe-bullionvault-goldmoney/ and comprehensive reviews of BV & GM here

http://politicalmetals.com/bullionvault/

http://politicalmetals.com/goldmoney/

There is no perfect service provider. Each has its strengths & weaknesses. There is even no perfect solution to storage (vaulting Vs personal custody). There are pros & cons. So to each his own so long as it is an informed decision. My view is to spread your risk across all options. See Buying & Storage Options and Coins & Bullion Dealers Reviews.

I may be a bit naive about these matters, but I wonder if it would not be possible for the Rothschilds to purchase Gold through Goldmoney as well. Would their purchase be refused because of who they are? or would we now say that the Rothschilds have an interest in Goldmoney?

I do not mean to defend the Rothschilds in any way here, but just to ask whether Bullion Vault should be held accountable or viewed as suspect because of one of their investors. Am I missing something here?

Try to get your physical silver back from Bullionvault! That’s a laugh. BV is a trading platform, not a way to buy physical and get it back when you want it.

I would like to invest in physical silver bullion that I will store myself. I am looking for somewhere in Alberta, Canada that sells physical silver at a reasonable premium. I don’t have a credit card and don’t want to give banking information so what I want some place that I can go and buy silver for cash.

There are some alternatives to the mentioned providers of vaulted gold / allocated gold.

You can find reviews of providers and compare prices of vaulted gold under

http://www.trustablegold.com

“I would LOVE to know where to find such research, because I have searched the net and found nothing, with the exception of places like this, where people make reviews based on hearsay.

Lesson learned! No reviews is just as good as no reviews, because like anything else, trust needs to be earned!

I registered for this site using my real name and email address, to give validity to my experience.

I have had an account with this “business” for three months now. In this time I have wired money three times. Now when I say WIRED, I mean WIRED, so please do not question how the money was sent like their EXTREMELY unprofessional, so called “representatives” have EVERY time this situation has occurred.

WIRED has one definition. The sender goes to their bank IN PERSON, pays a fee to WIRE money directly from the senders account into another account. This takes no longer then 24 hours and today, with computers and ANY quality bank, takes as little as an hour. Since the bank you are required to wire money to is Bank of America, I seriously doubt the problem is the banks fault. When money is WIRED, it posts IMMEDIETELY to the senders account so please do not ask when the money posted to my account.

In all three situations, it has taken a minimum of 5 BUSINESS days for the money to be deposited into my BullionVault account. In the last situation, the Money was WIRED on 1/8/2012 and the last reply I received from this company was that they would deal with it on Monday. How convenient when the price of all the metals they deal in have risen dramatically. In every situation I have gotten the absolute most unprofessional responses from their “staff”(I can’t even refer to them as “customer service”). They treat you like you are a child, they do nothing but give you the run around and they love to delay things further by taking advantage of the time zone difference between the US and the UK, where they actually operate. The fact that they operate in the UK is THE primary reason why you should not deal with this company and should only deal with a US company.

Like others, I have not had any problems once they actually acknowledge that they have your money, but having delays on EVERY deposit, with no acceptable explanation except to blame it on the banks, when this problem never occurs with a US company, is a clear sign that this is NOT an uncommon practice. Seeing just one other person having the same problem is enough for me to also say that this is not uncommon.

I STRONGLY RECOMMEND that you avoid this company at all costs. When it comes down to it, there are no advantages to dealing with a company such as this and there are PLENTY of disadvantages.

When it comes to investing your hard earned dollars and you do not find any reviews positive OR negative, be very very cautious as no good news should be assumed to be good news. When it comes to a company that doesn’t even operate in the US where our laws protect us, I would recommend not using them at all, because there are many companies like these that take advantage of the trust we Americans have in the laws that protect us here in the US that don’t elsewhere. If you are a metal investor to avoid what may happen if a system fails, then I would NOT trust this company because if a system failed, their system would DEFINITELY fail and the money you invested to protect yourself will be gone!(For you anyway)”

Hi Michael,

Thank you for your comments. Adrian Ash of BullionVault has responded to your comments which is posted verbatim below.

I take exception to the opening statement of your comment:

“I would LOVE to know where to find such research, because I have searched the net and found nothing, with the exception of places like this, where people make reviews based on hearsay.”

Please note that everything written in this review is based on facts extracted from BullionVault’s current website or from archived versions of the website dating back to 2004 (The same applies to other service providers reviewed here). All significant facts are hyper-linked to the source. Based on the facts and my personal experience using their service, I stated my opinion under the “Summary & Opinion” section. Nothing is based on hearsay.

—– Response from Adrian Ash, Head of Research, BullionVault —-

PLEASE NOTE: We are sorry that this user has not had the best experience of sending money to the Client Account. But we have done everything in our power to help, including courteous, timely and professional customer service. The first email alerting us to this delayed transfer was answered inside 40 minutes. The user then asked we telephone him instead, which we did at the specified time, only to reach voicemail. We then emailed and telephoned again, one business day later, but again with no response.

The issue arises because the user thinks he wired funds. However, when the funds arrived, six business days after they were sent, the transfer documentation clearly showed the funds had been sent by ACH and not by wire. Wire transfers can be as quick as 24hrs. ACH transfers typically take three business days. The first time the user sent money it arrived in the Client Account on the 3rd business day and was assigned to him then. The second transfer (he’s never referred to a third transfer before) took six business days to arrive. It would have been posted that day if the user had not requested the funds to be returned, which they were.

Six business days for an ACH transfer is longer than we would expect and, as communicated to the user, the issue has been escalated to the highest level at Lloyds TSB, the bank which holds the Client Account, and for whom BoA acts as agent in the US. However, evidence of his transfers being made by ACH – and not by wire transfer – has also been sent to the user, and we hope he now sees fit to correct the false, damaging statements published on this site and others. As he says above, once his funds cleared he had no problems using our service. We have many thousands of satisfied customers in the USA and worldwide, and numerous users have posted positive reviews regarding the speed of depositing funds.

Adrian Ash

Head of Research

BullionVault