BullionVault Review

| How to Buy & Store | AFE Review | GoldMoney Review | Comparison | Fees Summary |

Essential background reading: How to Buy & Store PMs

The Executive Team

Paul Tustain

Paul Tustain: Director

Alex Edwards: Chief Operations Officer

Kris Jenkins: Chief Technical Officer

Adrian Ash: Head of Research

Catherine Little: Cash Manager

Nittin Seehakoo: European Operations Executive (French)

Robert Nigg: European Operations Executive (German & French)

Jaroslaw Pietrzak: European Operations Executive (Polish & French)

Atsuko Whitehouse: Far East Operations Executive (Japanese)

Simin Gurler: European Operations Executive (German)

-

BullionVault is owned by Galmarley Limited, which is company number 4943684 registered in Great Britain. As at October 2008 the company had 47 shareholders. For a modest fee you can obtain a full and formal shareholder list, updated annually, from Companies House on http://www.companieshouse.gov.uk. Our services are delivered to you by our own computer machinery hosted in separate locations in Britain and USA, which we connect to and manage from our London offices. Galmarley is involved exclusively in bullion and bullion-related information technology. It owns not only www.BullionVault.com but also www.galmarley.com

- General

- Buy, Sell and store Gold and Silver using Allocated Account & LBMA Accredited Storage. [Clause 8 of Terms & Conditions] Scroll down to the last item on the left side column.

- Supports 6 major currencies (USD, CAD, EUR, GBP, CHF & JPY).

- Excellent online realtime trading platform for active traders of physical bullion (similar to stock broker platform).

- Vaulting

- Transportation and physical custody is operated by VIA MAT International on behalf of BullionVault.

- Choice of 3 vaults - London, Zurich and New York.

- Bar Registration

- Bar reservation is very easy, with online facility to select your bars from a Bar List showing serial numbers, refiners and bar weights.

- Bar registration available for both gold and silver.

- Click here to see current registered bar list published online for public scrutiny

- Taking Physical Delivery

- Unlike GoldMoney, taking physical delivery is discouraged, and is also more costly.

- This is what they say in “Your Right of Withdrawal” clause.

You have a right of withdrawal of your gold and silver from BullionVault, but you acknowledge BullionVault is not designed primarily as a service for those who wish to take physical possession of bullion.

Your wish to withdraw gold will be accommodated only in the form of whole numbers of appropriate gold bars of varying sizes and of generally accepted gold bullion coins to be selected at BullionVault’s discretion.

Your wish to withdraw silver will be accommodated only in the form of whole numbers of 1,000 troy oz bars.

- Fees (See Fees Summary Chart)

- Gold

- Buy commission ranges from 0.8% to 0.02% depending on volume traded in one year.

- Sell commission ranges from 0.8% to 0.02% depending on volume traded in one year.

- Annual Storage & Insurance ranges from 0.96% to 0.12% depending on quantity, charged monthly in USD, with minimum of $4 per month. Fees are the same in all vaults with rates calculated based on cumulative holdings in all vaults.

- Bar registration for 400 oz bar is 0.1%, with cost of storage rising from 0.12% to 0.18% per annum.

- All fees are in USD or equivalent, and not in grams or ounces of metals.

- Silver

- Buy commission ranges from 0.8% to 0.02% depending on volume traded in one year.

- Sell commission ranges from 0.8% to 0.02% depending on volume traded in one year.

- Annual Storage & Insurance ranges from 1.92% to 0.48% depending on quantity, charged monthly in USD, with minimum of $8 per month. Fees are the same in all vaults with rates calculated based on cumulative holdings in all vaults.

- Bar registration for 1,000 oz bar is 0.1%, with cost of storage rising from 0.48% to 0.72% per annum.

- All fees are in USD or equivalent, and not in grams or ounces of metals.

- Gold

- Buy and Sell mechanism

- The unique feature of BullionVault is the ability to trade bullion as you do stocks in a stock broker’s online account. Realtime bid and ask prices are displayed for immediate buy or sell at market prices, or you can place a limit order to be executed when your price targets are met.

- When buying, other BullionVault clients compete with BullionVault in offering you the lowest price, and vice versa when selling. Either way, BullionVault adds their trading commission on top of the transacted price.

- After each transaction, you will be advised if BullionVault was the principal or dealer for that transaction.

- Transactions are in realtime, and you see your bullion and cash balances updated immediately.

- Trading is available 24×7, 7 days a week, even when external markets are closed.

- Account Opening, Client Identity Verification and Account Funding

- Open a free account online in realtime. Once new account has been created, you’ll be credited with a free gram of gold, 1 USD, 1 EUR and 1 GBP. You can begin trading immediately to test out the system.

- No mention of restrictions on client’s’ country of residence on their website.

- Client identity verification can be done online by uploading scanned copies of photo ID and bank statement of your funding bank (the bank account from which you will remit funds to your BullionVault account). No hard copies are required.

- Able to fund your account and start trading even before account verification is completed. However, you cannot withdraw funds from your BullionVault account until the account verification is completed.

- Account Management

- Remitting funds into your BullionVault account can be done only from one bank account (funding account).

- Not necessary to apply or notify BullionVault when funding, so long as the funds originate from the same funding account.

- Withdrawal of funds from BullionVault can only be made to the same funding account and nowhere else (unless special application is made to change the funding account).

- Security & Safety features

- Optional SMS alarm notifications (not verification) for critical transactions (login, fund transfers, buy/sell) are charged at $0.20 per SMS. Email alerts are free.

- The linking of your BullionVault account to one and only one external funding account is considered “failsafe” by BullionVault.

Corporate Profile and Corporate Governance

- Development of BullionVault software/service began in 2003. First recorded online presence was in 2004 and the first full year of trading was in 2006. Started online trading and storage services as we know it today in 2004.

- BullionVault is owned by Galmarley Limited, which is based in West London (UK).

- BullionVault’s shareholders list and 2009 audited company accounts are available online.

- Current reports are available at Companies House for a fee.

- In June 2010, The Telegraph reported that Lord Rothschild Fund and World Gold Council invested £12.5m in BullionVault. Depending on how you view the Rothschild Fund & WGC, their involvement may influence your opinion of BullionVault.

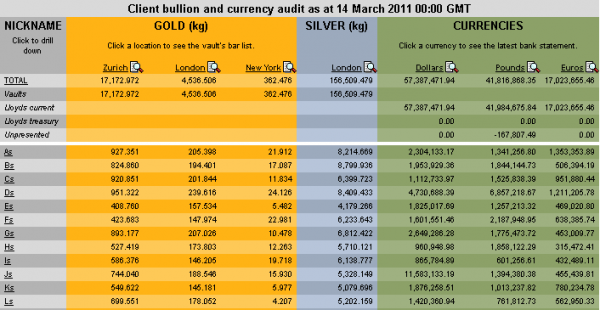

- Daily client bullion and currency audit is carried out by BullionVault and the results published online in the public domain (no login required). Audit shows BullionVault’s total holdings of various currencies, gold and silver bullion in the various vaults together with a complete bar list. You can basically view your account (including list of your registered bars) online without login, but your privacy is assured as all accounts and registered bars are identified through an anonymous code (Nickname) chosen by and known only to you. (see screenshot below).

- Annual external audit is conducted by Albert Goodman and audit reports for BullionVault are published on the auditor’s website (instead of BullionVault’s website).

- As discussed in the Counterparty Risks section, holding bullion through BullionVault’s Allocated Accounts gives you outright title to your metals. As noted, there is a minor Performance Risk with all service providers. BullionVault shows its commitment to minimise this risk through their “Accepting Responsibility” principle:-

As the head of the board and majority shareholder Paul Tustain accepts responsibility within the company for organising BullionVault’s system controls and arranging individual responsibilities within the BullionVault team, and its custody providers, so as to maximise the security of customers’ gold and cash.

In addition to development capital Paul Tustain has provided management bonds to the company which is held as gold and cash segregated in favour of customers. These management bonds are non-refundable except in final liquidation, in which circumstance they rank behind all other customer property for repayment. The value of equity in the company and this loan would therefore be lost before any BullionVault customer incurred any loss resulting from breaches of faith or security on BullionVault.com.

This arrangement is structured to underpin the meaning of ‘accepting responsibility’.

- Communications & Client Relations

- No secure online messaging system within their website for correspondence between BullionVault and clients.

- Communications through normal emails.

- Not responsive to suggestions or questions regarding website features. I’ve 3 emails totally ignored. Yes, totally no replies.

Summary & Opinion

- Safe, Secure, Reliable. You are the outright owner of professional grade bullion (Good Delivery Bars).

- Excellent trading platform with low trading commissions, low spreads and low storage fees (See Service Comparison Table & Fees Summary).

- Ideal for active traders of physical bullion or if you wish to occasionally swap gold for silver or vice versa depending on the Gold/Silver Ratio.

- High transparency and good corporate governance but poor client relations

-

Visit BullionVault website for more information or Sign Up

-

Read review on AFE & GoldMoney, or check out the comparison chart

-

Updated: 12 Apr 2012

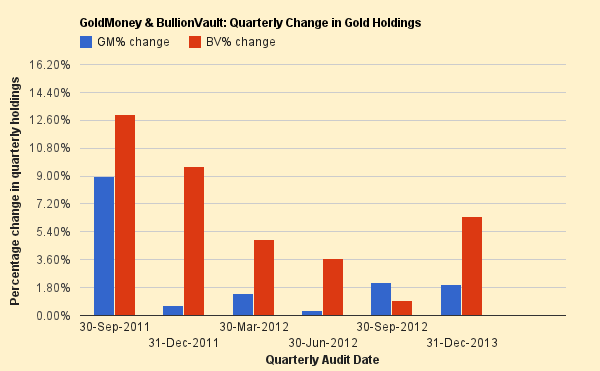

BullionVault’s total gold holding is increasing at a much higher pace than that of GoldMoney over the past 3 quarters. The reason for the rapid increase despite gold price declining over the same period can be found here.

-

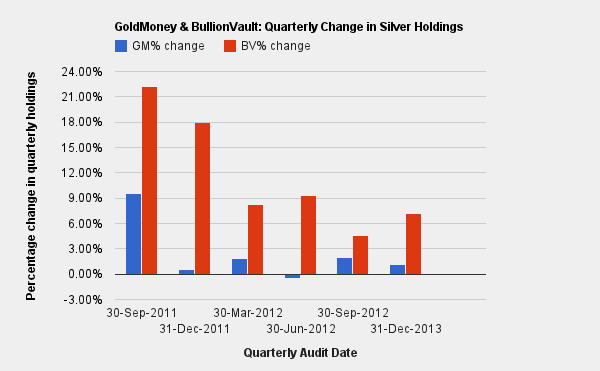

BullionVault: Silver Holdings in London

Currently only available vault for silver is in London. Despite decreasing prices since the intermediate top in May 2011, silver holdings continue to rise, confirming the trend that owners of physical silver are not selling. It’s paper silver that’s being sold!

BullionVault’s silver holding is increasing at a much higher pace than that of GoldMoney over the past 3 quarters. The reason for the rapid increase despite silver price declining over the same period can be found here.

-

Screenshot: Trading platform

-

The above is a typical screenshot showing Market Depth for gold traded and stored in Zurich. You can see buy and sell offers (at price intervals as low as $1) on queue together with the spread. What I like about BV is their low commission plus very low spread (seen here at 0.28%). When you buy, the sell offers can come from other BV clients or from BV themselves (through their trading robots - more details here). So in a way, they are competing to give you the lowest price. The same holds true when you sell. You are also able to see Market Spread at all their vaults in a single screen as shown below.

-

Tip: You often get better deals by breaking up your order into multiple small orders.

-

Screenshot: Daily Audit. Click here to view current report online.

-

You can easily open an account here and start playing around with their trading platform with a free gram of gold and a small amount of cash (not sure if you also get some silver. I didn’t ‘cos they did not trade silver when I opened mine). These are yours to keep when you fund your account!

-

Visit BullionVault website for more information or Sign Up

Read review on AFE and GoldMoney, or check out the comparison chart

–

Please post your comments & share your experience, especially if you’ve used this service. Thank you.

-

Disclaimer: The above information is provided on a best-effort basis. It’s accuracy is not guaranteed, and may not reflect the most recent changes made by the service providers. Please perform your own due diligence and verify the information from their respective websites before making any decisions. The reviews are the personal opinion of the author and does not constitute any endorsement or recommendation.

-

I wish Bullion Vault Co.,Ltd. could get Compensation from Lloyds TSB Bank Errors on Technicals&Careless.

“I would LOVE to know where to find such research, because I have searched the net and found nothing, with the exception of places like this, where people make reviews based on hearsay.

Lesson learned! No reviews is just as good as no reviews, because like anything else, trust needs to be earned!

I registered for this site using my real name and email address, to give validity to my experience.

I have had an account with this “business” for three months now. In this time I have wired money three times. Now when I say WIRED, I mean WIRED, so please do not question how the money was sent like their EXTREMELY unprofessional, so called “representatives” have EVERY time this situation has occurred.

WIRED has one definition. The sender goes to their bank IN PERSON, pays a fee to WIRE money directly from the senders account into another account. This takes no longer then 24 hours and today, with computers and ANY quality bank, takes as little as an hour. Since the bank you are required to wire money to is Bank of America, I seriously doubt the problem is the banks fault. When money is WIRED, it posts IMMEDIETELY to the senders account so please do not ask when the money posted to my account.

In all three situations, it has taken a minimum of 5 BUSINESS days for the money to be deposited into my BullionVault account. In the last situation, the Money was WIRED on 1/8/2012 and the last reply I received from this company was that they would deal with it on Monday. How convenient when the price of all the metals they deal in have risen dramatically. In every situation I have gotten the absolute most unprofessional responses from their “staff”(I can’t even refer to them as “customer service”). They treat you like you are a child, they do nothing but give you the run around and they love to delay things further by taking advantage of the time zone difference between the US and the UK, where they actually operate. The fact that they operate in the UK is THE primary reason why you should not deal with this company and should only deal with a US company.

Like others, I have not had any problems once they actually acknowledge that they have your money, but having delays on EVERY deposit, with no acceptable explanation except to blame it on the banks, when this problem never occurs with a US company, is a clear sign that this is NOT an uncommon practice. Seeing just one other person having the same problem is enough for me to also say that this is not uncommon.

I STRONGLY RECOMMEND that you avoid this company at all costs. When it comes down to it, there are no advantages to dealing with a company such as this and there are PLENTY of disadvantages.

When it comes to investing your hard earned dollars and you do not find any reviews positive OR negative, be very very cautious as no good news should be assumed to be good news. When it comes to a company that doesn’t even operate in the US where our laws protect us, I would recommend not using them at all, because there are many companies like these that take advantage of the trust we Americans have in the laws that protect us here in the US that don’t elsewhere. If you are a metal investor to avoid what may happen if a system fails, then I would NOT trust this company because if a system failed, their system would DEFINITELY fail and the money you invested to protect yourself will be gone!(For you anyway)”

Hi Michael,

Thank you for your comments, but I take exception to the opening statement of your comment:

“I would LOVE to know where to find such research, because I have searched the net and found nothing, with the exception of places like this, where people make reviews based on hearsay.”

Please note that everything written in this review is based on facts extracted from BullionVault’s current website or from archived versions of the website dating back to 2004. All significant facts are hyper-linked to the source. Based on the facts and my personal experience using their service, I stated my opinion under the “Summary & Opinion” section. Nothing is based on hearsay.

PLEASE NOTE:

We are sorry that this user has not had the best experience sending money to the Client Account. But we have done everything in our power to help, including courteous, timely and professional customer service. The first email alerting us to this delayed transfer was answered inside 40 minutes. The user then asked we telephone him instead, which we did at the specified time, only to reach voicemail. We then emailed and telephoned again, one business day later, but again with no response.

The issue arises because the user thinks he wired funds. However, when the funds arrived, six business days after they were sent, the transfer documentation clearly showed the funds had been sent by ACH and not by wire. Wire transfers can be as quick as 24hrs. ACH transfers typically take three business days. The first time the user sent money it arrived in the Client Account on the 3rd business day and was assigned to him then. The second transfer (he’s never referred to a third transfer before) took six business days to arrive. It would have been posted that day if the user had not requested the funds to be returned, which they were.

Six business days for an ACH transfer is longer than we would expect and, as communicated to the user, the issue has been escalated to the highest level at Lloyds TSB, the bank which holds the Client Account, and for whom BoA acts as agent in the US. However, evidence of his transfers being made by ACH - and not by wire transfer - has also been sent to the user, and we hope he now sees fit to correct the false, damaging statements published on this site and others. As he says above, once his funds cleared he had no problems using our service. We have many thousands of satisfied customers in the USA and worldwide, and numerous users have posted positive reviews regarding the speed of depositing funds.

I have been buying gold at BV for a little more than a year now. Having only very modest means for savings, the BV platform allows me to buy gold in even so modest quantity. I automatically transfer money from my belgian bank on a monthly basis and thus buy a few gramms every month. It is safe, secure and transparant. No credit card data, unlike with all other online shopping is used. Only an official swift bank transfer is accepted by BV.

I have used BV for many years now - since about 2004 or 2005. I have had nothing but excellent service and find the website to be very informative and easy to use. My experience with customer service has been excellent, especially given the low charges. It was almost impossible to buy allocated bullion directly before these guys appeared, except in large quantities and with large storage costs. The service that matters is providing access to gold without the huge premium on bullion coins.

One minor inconvenience of BV is the use of one linked bank account for me to fund or withdraw cash. I wanted to close my linked account for other reasons, but the hassle of switching to a new bank account meant I stuck with the original. However, they clearly explain that this is to prevent money laundering (money flowing in from one account, through some bullion trades, and then out to another bank account). So they need to verify any new account carefully. Also this is a security feature, since no one can hack in, sell my gold and send it to their own account.

One criticism though. You can only fund through Lloyds TSB in the UK (which is where they hold client cash funds on your behalf). I’d like more flexibility here, for example to be able to use a bank in Switzerland to hold the client cash funds. I’ve suggested this before to them, but it was a long time ago. Maybe now that the business has grown this is something they could consider.