GoldMoney Review

| How to Buy & Store | AFE Review | BullionVault Review | Comparison | Fees Summary |

Essential background reading: How to Buy & Store PMs

The Executive Team

James Turk: Founder & Chairman

Geoff Turk: Chief Executive Officer

Peter Wright: Financial Director

Andrew McGowan: Head of Business Development

Alex Preukschat: Head of Marketing

-

-

-

-

-

-

-

-

-

GoldMoney is a profitable, privately owned company without any debt. Its financial position is sound, its books are regularly audited by a Big Four accounting firm, and its shareholders are focused on ensuring the long-term safety and security of its customers’ assets. GoldMoney is backed by strong investors, including IAMGOLD (one of the 10 largest Canadian gold mining companies) and Eric Sprott, Founder & Chairman of Sprott Asset Management.

-

- General

- Buy, Sell and store Gold, Silver, Platinum & Palladium using Allocated Account & LBMA Accredited Storage [Clauses 8C,8D,8E, 8F of GoldMoney Customer Agreement]

- Only provider amongst the 3 under review that deals in platinum and palladium.

- Supports 9 major currencies (USD, CAD, EUR, GBP, CHF, JPY, AUD, HKD & NZD).

- Online payment platform using Digital Gold Currency (DGC). You can pay for or be paid in units of metals instead of national currencies when trading goods and services amongst GoldMoney account holders (Service discontinued on 21st January 2012).

- Able to perform currency exchanges on any cash balance in your account (Service discontinued on 21st January 2012).

- Vaulting

- Transportation and physical custody is operated by VIA MAT International (London, Zurich, Hong Kong) and G4S (Hong Kong only) on behalf of GoldMoney.

- Choose where you want your metals to be vaulted - London (Gold & Silver), Zurich (Gold, Silver & Platinum) or Hong Kong (Gold, Silver, Platinum & Palladium).

- Has a convenient means to swap metals or move metals between vaults (eg. exchange silver in Hong Kong for gold in London).

- Bar Registration

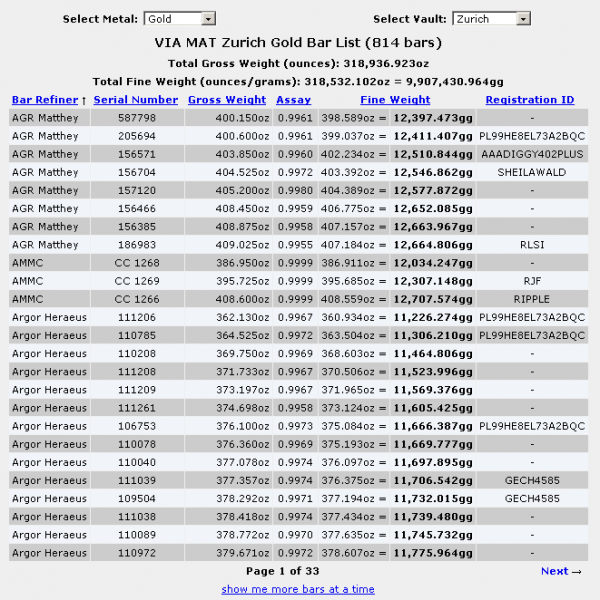

- Bar reservation is very easy, with online facility to select your bars from a Bar List showing serial numbers, refiners and bar weights (see screenshot below).

- Bar registration available for Gold, Platinum and Palladium only. No bar registration available for silver.

- Taking Physical Delivery

- GoldMoney will arrange for delivery of your registered bars (to your home or another private vault) at any time.

- Physical delivery of 400 oz gold bars available for customers in 87 countries.

- If you own less than 400 oz, GoldMoney can fabricate smaller 100g (3.22 oz) or 1kg (32.15 oz) bars for delivery, but this is limited to residents of selected 20 countries only (mostly North America and Europe, excluding Malaysia, Australia and NZ). Residents of other countries can take custody of these smaller bars by arranging for pick up at the fabricator’s (Baird & Co.) premises in London, England.

- Physical delivery of silver available only if you have at least 30,000 ounces of silver, which is roughly one pallet of thirty 1,000 ounce bars.

- Physical delivery of platinum and palladium are in standard bars, about 130 oz and 100 oz respectively.

- Fees (See Fees Summary Chart)

- Gold

- Buy commission ranges from 2.49% to 0.98% depending on size of each order.

- No Sell Commission (except in extreme market conditions).

- Annual Storage & Insurance ranges from 0.18 to 0.15% depending on quantity, charged monthly in grams of gold, with minimum of 0.1 gold grams per month. Fees are the same in all vaults with rates calculated independent of holdings in other vaults.

- Fabrication fees for 100g and 1kg bars are 4% and 2.75% of fine weight respectively.

- Bar registration for 400 oz bar is 1 goldgram (about 0.008%), with no additional storage fees.

- Silver

- Buy commission ranges from 3.99% to 1.99% depending on size of each order.

- No Sell Commission (except in extreme market conditions).

- Annual Storage & Insurance ranges from 0.49% to 0.39% depending on quantity, charged monthly in ounces of silver, with minimum of 0.2 silver ounces per month for London and Hong kong vaults. Zurich vault fee ranges from 0.99% to 0.87%. Rates calculated independent of holdings in other vaults.

- Platinum

- Buy commission ranges from 4.39% to 2.19% depending on size of each order.

- No Sell Commission (except in extreme market conditions).

- Annual Storage & Insurance ranges from 0.49% to 0.39% depending on quantity, charged monthly in grams of platinum, with minimum of 0.1 platinum gram per month for Hong kong vault. Zurich vault fee is 0.59% flat. Rates calculated independent of holdings in other vaults.

- Bar registration is 1 platinum gram for each bar, with no additional storage fees.

- Palladium

- Buy commission ranges from 5.27% to 2.63% depending on size of each order.

- No Sell Commission (except in extreme market conditions).

- Annual Storage & Insurance ranges from 0.98% to 0.78% depending on quantity, charged monthly in grams of palladium, with minimum of 0.1 palladium gram per month. Available in Hong Kong vault only.

- Bar registration is 1 palladium gram for each bar, with no additional storage fees.

- Gold

- Buy and Sell mechanism

- Place an online Buy or Sell order based on the spot price, with no spread. GoldMoney’s Buy Fees will be added on top of the spot price, and the new Buy Rate will be displayed. You have a 5-minute window to confirm your order at this “locked-in” Buy Rate.

- Upon confirmation of an online order, the metals will not be added to your holdings before 3.00pm GMT (London PM Fix) the next working day. You will however see your order status as “Pending” in your holding account, and your cash balance remains unchanged.

- However, if your order exceeds the daily trading limit (2,000 goldgrams, 2,000 silver ounces, 1,000 platinum grams and 1,000 palladium grams) that qualifies for this “locked-in” mechanism, the order will be executed based on the next London PM Fix rate (3:00pm GMT).

- Unlike BullionVault, you buy and sell exclusively through GoldMoney and cannot trade with other GoldMoney clients directly.

- Account Opening, Client Identity Verification and Account Funding

- Accepts customers from 87 countries and conditions for account opening and account type vary depending on your country of residence.

- For 28 Fast Track countries, the sign-up process for a Basic Holding (limited facilities) takes only a few minutes, and involves filling in an online application form and uploading scanned copies of your bank statement and a photo ID document, such as a passport or drivers licence. You can then fund your account and start buying metals. Upgrade to Full Holding (with complete range of facilities) upon submission of notarized hard copies of bank statement and photo ID documents can be done in your own time.

- For applicants not in the 28 Fast Track countries, notarized notarized hard copies of bank statement and photo ID documents have to be posted to GoldMoney for approval before account can be funded for metals purchase. Once approved, you’ll have a Full Holding account.

- If the amount of funds remitted exceed a certain threshold, you will be required to send in notarized documents indicating your “Source of Funds”.

- Account Management

- Remitting funds into your GoldMoney account can be done from any of your bank accounts as long as the name of your bank account matches the name of your GoldMoney account

- Before remitting funds into your GoldMoney account, you need to make an “Add Funds” request online. A reference number will be given, and it has to be included in all bank wire instructions.

- You can configure up to 5 bank accounts to transfer funds out of GoldMoney. These need not be the same accounts from which you remit funds into GoldMoney.

- Security & Safety features

- SMS confirmation to registered mobile phone for transactions involving payments or fund transfers out of your GoldMoney account

- You can ‘lock’ the bank accounts which are linked to your Holding so that no further bank account details can be added. If someone manages to gain access to your Holding, they are unable to send funds anywhere but to the bank accounts you have previously assigned.

- Optional “IP Restrictions” login. If enabled, login is permitted only from a specific IP address or specific block of IP address to minimise unauthorized access.

- Optional email login notification for every login session.

- Performs ultrasonic testing on every gold bar to ensure there are no fakes (see video below).

- Corporate Profile and Corporate Governance

- Started operations as an online newsletter in 1996. In 2001, the Digital Gold Currency online payment system was launched. The buy and store service as we know it today started in 2002.

- GoldMoney is the registered business name of Net Transactions Limited, which is based in Jersey, British Channel Islands. GoldMoney’s affiliate company is called Net-Gold Services Limited, which acts as the broker in the purchase and sale of precious metals. Net-Systems Software Limited is the entity that owns the technology property rights of the GoldMoney Group. GoldMoney Network Limited is the holding company for the group and owns the patents covering digital currency and payments.

- Good transparency & good governance, with quarterly SAS 70 Type II independent audit reports by Deloitte available online.

- Other online reports & certificates include:- Quarterly Vault inventory reports, Inventory audit certificates, Quarterly control reports, Monthly total value report, Evidence of insurance certificate and Certificates of registration.

- Communications & Client Relations

- A secure online messaging system within their website where correspondence between GoldMoney and clients are conducted. This is more secure than communications through normal emails.

Summary & Opinion

- Safe, Secure, Reliable. You are the outright owner of professional grade bullion (Good Delivery Bars).

- More suitable for those who do not plan to trade actively due to less sophisticated trading platform and higher trading costs (See Service Comparison Table & Fees Summary).

- Great for diversification as it offers the widest selection of metals, vaults and currencies amongst the 3 providers under review.-

Visit GoldMoney website for more information or Sign Up

Read review on AFE and BullionVault, or check out the comparison chart

-

Gold Money: Gold Holdings by Vaults (Data Source)

GoldMoney’s customers prefer Zurich and Hong Kong vaults over London, which has not seen any growth since Dec 2006

Gold Money: Silver Holdings by Vaults (Data Source)

Declining growth at Zurich vault since Hong Kong vaults (Via Mat & G4S) came into service. Zurich’s storage fees that are double that of London and Hong Kong may be a contributing factor.

-

Ultrasonic testing of gold bars by GoldMoney

-

Screenshot: GoldMoney’s Buy Transaction - Very Simple & Easy to Use

-

Screenshot: Registering bullion bars in your own name at GoldMoney.

-

Visit GoldMoney website for more information or Sign Up

Read review on AFE and BullionVault, or check out the comparison chart

-

Please post your comments & share your experience, especially if you’ve used this service. Thank you.

-

Disclaimer: The above information is provided on a best-effort basis. It’s accuracy is not guaranteed, and may not reflect the most recent changes made by the service providers. Please perform your own due diligence and verify the information from their respective websites before making any decisions. The reviews are the personal opinion of the author and does not constitute any endorsement or recommendation.

-

As We Speak the economy is so extreme and lots of people definitely really don\’t get what on earth is Actually transpiring! It is actually mind blowing the quantity of sheepel just go along with the crowd and do not think for their selves. Me personally I invest in silver considering that it is REAL money and not just a piece of paper that will get printed when ever anyone bats an eye. I am grateful friend for the fantastic blog post, a lot more individuals should be knowledgeable in finances!