In a Washington Post opinion piece written before Bernanke’s speech at Jackson Hole, James Grant describes how the Federal Reserve has steered off course and need to re-anchor the dollar to gold.

To achieve these desired ends [keep the economy growing, the workforce fully employed, stock prices rising, the banking system under surveillance and the inflation rate modulated] , the Fed manipulates interest rates, plays mind games with the stock market and creates hundreds of billions of dollar bills, with a few taps on a computer keyboard. The Bernanke dollar is lighter than air: a piece of paper or a swarm of pixels.

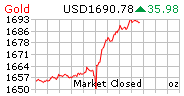

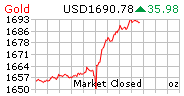

Sure enough, following the Fed Chairman’s comments below, both political metals began a steep climb when priced in paper dollars.

Sure enough, following the Fed Chairman’s comments below, both political metals began a steep climb when priced in paper dollars.

Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labour market conditions.

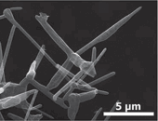

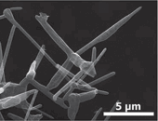

It now looks like his “lighter than air” dollar is no longer good enough. He’s got competition from folks at the Universities of Kiel and Hamburg who used carbon-nanotube technology to produce the lightest solid material ever created - Aerographite. Very soon, he may have to start printing helicopter loads of Aerographite Dollars to support the weight of gold & silver; Unless he returns the Fed to its golden roots…

It now looks like his “lighter than air” dollar is no longer good enough. He’s got competition from folks at the Universities of Kiel and Hamburg who used carbon-nanotube technology to produce the lightest solid material ever created - Aerographite. Very soon, he may have to start printing helicopter loads of Aerographite Dollars to support the weight of gold & silver; Unless he returns the Fed to its golden roots…

-

Ben Bernanke should return the Fed to its golden roots

By James Grant | Washintong Post

More important than anything that Ben Bernanke might say in his long-awaited speech Friday in Jackson Hole, Wyo., is the thing he won’t say, but should.

Positively out of bounds for the chairman of the Federal Reserve is the admission that he is in the wrong line of work. The institution he leads was created to conduct a central banking business. But Congress and he have steered it into the central planning business. In so doing, the Fed has exchanged a job it could do for one it can’t.

When the Fed opened its doors in 1914, its job was to lend against sound collateral to solvent banks and to protect the value of the dollar. The Founders gave no thought to empowering their brainchild to steer the course of the economy. The future would take care of itself if the dollar were sound and the banks were solvent, they reasoned. As for the dollar, it was legally defined as a weight of gold. You couldn’t just materialize it.

Today’s monetary mandate comes in innumerable parts, written and unwritten: to keep the economy growing, the workforce fully employed, stock prices rising, the banking system under surveillance and the inflation rate modulated (neither too high nor — oddly enough — too low). To achieve these desired ends, the Fed manipulates interest rates, plays mind games with the stock market and creates hundreds of billions of dollar bills, with a few taps on a computer keyboard. The Bernanke dollar is lighter than air: a piece of paper or a swarm of pixels.Wisely, the government keeps its hands off most prices most of the time. Adam Smith’s “invisible hand” does the work that the price-fixing bureaus of the communist economies of yesteryear failed to do.Free and mobile prices are the sine qua non of a successful economy. The Fed knows this bedrock truth as well as anyone. Yet it persists in pushing around the price of credit — interest rates — like a pea on a plate.It fixes one rate, the federal funds rate, the basic reference rate in the wholesale money market. It influences other rates and manipulates still others — the cost of mortgage money, for example. It rearranges short- and long-term rates to put its stamp on the yield curve, i.e., the structure of rates across time. Thus do a dozen public servants, who make up the policy-setting Federal Open Market Committee, lead the U.S. economy around by the nose.Command-and-control is 20th-century doctrine. Social collaboration is the way of the 21st. We moderns turn to the Web to share ideas and information (and, to be sure, misinformation). Want to solve a problem? Put it up on the Web and invite the world to take a crack at it.In the same collaborative spirit, we “discover” prices. That’s what all the shouting is about in the trading pits of the Chicago commodity exchanges. Unmanipulated prices, freely discovered, balance supply with demand. They’re what keep the store shelves stocked. They coordinate the moving parts of this infinitely complex economy.

The Fed was founded in a spirit of price discovery. Yes, the new central bank could impose an interest rate on the banking system, the “discount rate.” But it couldn’t just conjure dollars. Up until 1933, the currency in one’s wallet was exchangeable for gold on demand: an ounce for $20.67. Then as now, money went where it was treated well. Gold didn’t sit still. It entered or left the country as America’s financial attraction waxed or waned. Prices, costs, interest rates and politics either attracted or repelled it. While the government could certainly influence these monetary flows, it could hardly dictate them. Merchants, investors and savers the world over — a collaborative network long predating the invention of the computer — made money move by exercising their free choice.

But now that we have the computer — and the Web, the cloud and mobile networks — we’ve lost the collaborative network. In its place, we have brute force. Herbert Hoover, who knew a thing about monetary disorder, entered an eloquent warning in his memoir against the pure paper dollar. Currency convertible into gold at a fixed rate, he wrote, “is a vital protection against economic manipulation by the government. As long as currencies are convertible, governments cannot easily tamper with the price of goods, and therefore the wage standards of the country. They cannot easily confiscate the savings of the people by manipulation of inflation and deflation. They cannot easily enter into currency expansion for government expenditures.”

What the Bank of Bernanke might do next, one can only guess. Manufacture another half-trillion dollars through a third round of “quantitative easing”? Pledge to pin interest rates to the floor for another year or two? Or roll out an improvisation that the Fed’s bright young economists are only now dreaming up? We won’t find out until the chief mandarin holds forth in Jackson Hole.

With every new crisis, the Fed gathers new power. Better — to forestall new crises — that it start to relinquish power. Let interest rates be set free and the dollar be reanchored in gold.

Almost a century old, the Fed is living in the past.

Related Reads:

Like this:

Be the first to like this.

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year