China knows about gold price suppression, and U.S. knows China knows

By Chris Powell | GATA

-

China knows that the U.S. government and its allies in Western Europe strive to suppress the price of gold, and the U.S. government knows that China knows, according to a 2009 cable from the U.S. Embassy in Beijing to the State Department in Washington.

The cable, published in the latest batch of U.S. State Department cables obtained by Wikileaks, summarizes several commentaries in Chinese news media on April 28, 2009. One of those commentaries is attributed to the Chinese newspaper Shijie Xinwenbao (World News Journal), published by the Chinese government’s foreign radio service, China Radio International. The cable’s summary reads:

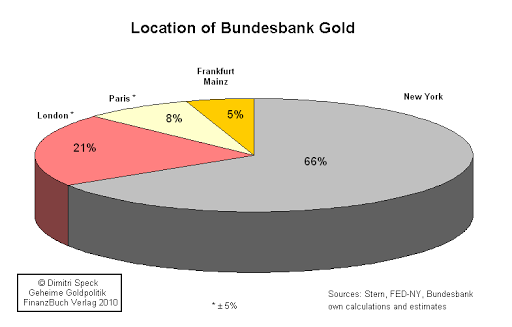

According to China’s National Foreign Exchanges Administration, China’s gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the United States and European countries. The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold’s function as an international reserve currency. They don’t want to see other countries turning to gold reserves instead of the U.S. dollar or euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar’s role as the international reserve currency. China’s increased gold reserves will thus act as a model and lead other countries toward reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the renminbi.

It’s hard to believe that, two years later, China is still leaving so much of its gold with the Federal Reserve Bank of New York and the Bank of England when even little Venezuela has publicly figured out the gold price suppression component of the Western fractional reserve banking system and is attempting to repatriate its gold from the Bank of England and various Western bullion banks:http://www.gata.org/node/10281

http://www.gata.org/node/10286

It is already a matter of record that China dissembled about its gold reserves for the six years prior to the public recalculation of its gold reserves in April 2009 that prompted the commentary in Shijie Xinwenbao. At that time China announced that its gold reserves were not the 600 tonnes it had been reporting each year for the previous six years but rather 76 percent more, 1,054 tonnes:

ZeroHedge, which seems to have broken the story of the Beijing embassy cable this evening, comments:

Wondering why gold at $1,850 is cheap, or why gold at double that price will also be cheap, or, frankly, at any price? Because, as the following leaked cable explains, gold is, to China at least, nothing but the opportunity cost of destroying the dollar’s reserve status. Putting that into dollar terms is, therefore, impractical at best and illogical at worst. We have a suspicion that the following cable from the U.S. embassy in China is about to go not viral but very much global, and prompt all those mutual fund managers who are on the golden sidelines to dip a toe in the 24-karat pool.

The ZeroHedge commentary can be found here:

http://www.zerohedge.com/news/wikileaks-discloses-reasons-behind-chinas-…

In addition to fund managers throughout the world, this cable may be of special interest to the gold bears CPM Group Managing Director Jeff Christian, who says he consults with most central banks and that they hardly ever think about gold, and Kitco senior analyst Jon Nadler, who insists that central banks have no interest whatsover in manipulating the gold price.

In fact, of course, gold remains the secret knowledge of the financial universe, and its price is actually the determinant of every other price and value in the world.

The Beijing embassy cable can be found here:

http://cables.mrkva.eu/cable.php?id=204405

And, just in case, at GATA’s Internet site here:

http://www.gata.org/files/USEmbassyBeijingCable-04-28-2011.txt

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

-

Updated: Sep 6, 2011

Another more recent cable released through Wikileaks provide even more damning evidence of US using gold as the “weapon of choice” in their currency war with China. Gold is the Political Metal.

This time the quick change of the U.S. policy (toward China) has surprised quite a few people. The U.S. has almost used all deterring means, besides military means, against China. China must be clear on discovering what the U.S. goals are behind its tough stances against China. In fact, a fierce competition between the currencies of big countries has just started. A crucial move for the U.S. is to shift its crisis to other countries – by coercing China to buy U.S. treasury bonds with foreign exchange reserves and doing everything possible to prevent China’s foreign reserve from buying gold. The nature of such behavior is a rogue lawyer’s behavior of ‘ripping off both sides’: taking advantage of cross-strait divergences, blackmailing the Taiwan people’s wealth by selling arms to Taiwan, and meanwhile coercing China to buy U.S. treasury bonds with foreign exchange reserves and extorting wealth from the mainland’s people. If we [China] use all of our foreign exchange reserves to buy U.S. Treasury bonds, then when someday the U.S. Federal Reserve suddenly announces that the original ten old U.S. dollars are now worth only one new U.S. dollar, and the new U.S. dollar is pegged to the gold – we will be dumbfounded. Today when the United States is determined to beggar thy neighbor, shifting its crisis to China, the Chinese must be very clear what the key to victory is. It is by no means to use new foreign exchange reserves to buy U.S. Treasury bonds. The issues of Taiwan, Tibet, Xinjiang, trade and so on are all false tricks, while forcing China to buy U.S. bonds is the U.S.’s real intention.”

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year