Compare Fees and Rates of AFE, BullionVault & GoldMoney

-

| How to Buy & Store | AFE Review | BullionVault Review | GoldMoney Review | Comparison |

-

Summary of Fees & Storage Cost

-

-

-

-

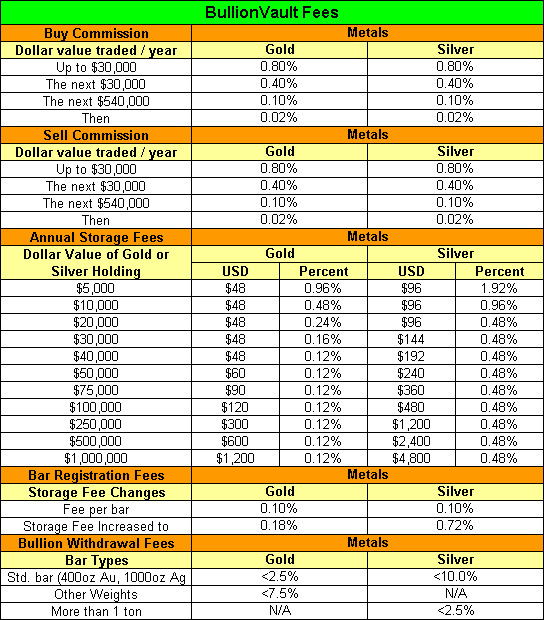

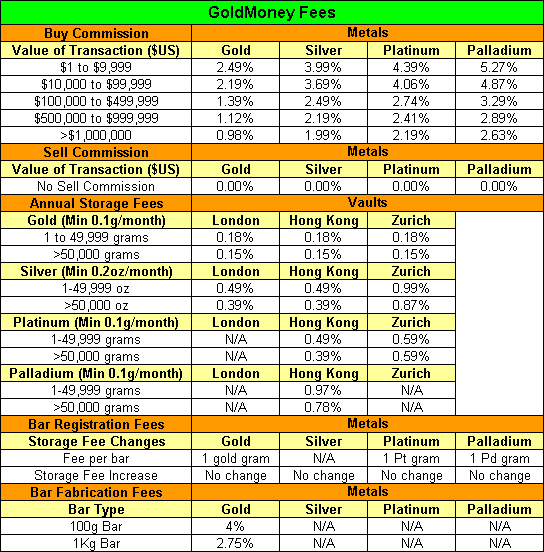

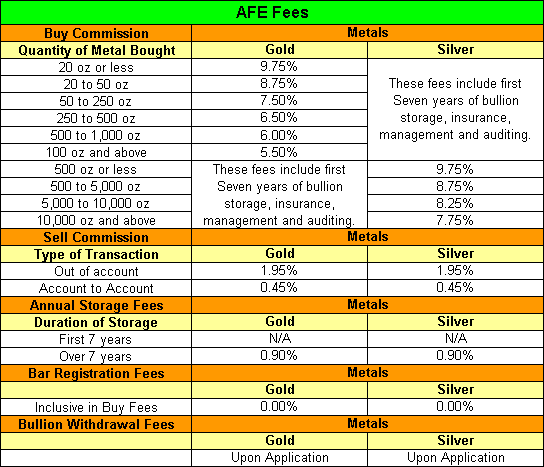

Key differences in transaction fees, storage fees and how the fees are charged by GoldMoney, BullionVault and AFE.

1. Transaction fees

All three providers offer a sliding scale transaction fee schedule, where larger transactions have lower rates. However, only BullionVault maintains this sliding scale fee schedule for transactions accumulated over one calender year. The accumulated transaction volume is reset at the anniversary of your account opening date.

GoldMoney does not currently charge any fees for a “Sell” transaction (although they may do so under extreme market conditions).

2. Storage fees

Both BullionVault and Goldmoney offer a sliding scale storage fees, where larger holdings have a lower rate. BullionVault’s storage fees are calculated based on total holdings across all vaults while GoldMoney applies the fees schedule separately for holdings in each vault.

Both BullionVault and GoldMoney impose a minimum storage fee per month. When your metal holdings fall below their minimum thresholds, the monthly fees as a percentage of your holdings will be substantially higher. For comparison purposes, their minimum storage fees kick in when your holdings fall below the following thresholds:-

BullionVault: 3.125 oz gold, 125 oz silver

GoldMoney: 21.43 oz gold, 490 oz silver

(calculated at current prices of $1600/oz gold and $40/oz silver)

3. Managing your monthly storage fees

BullionVault’s fees are based on the cash value of your holding (weight x market price). Every month, the total calculated storage fees will be debited from your cash balance in your base currency of choice. Your metal holding (weight) remains untouched.

GoldMoney’s fees are based on your metal holdings (weight only). Every month, the total calculated storage fees (in grams for gold, platinum, palladium & ounces for silver) will be debited from your metal holding balances, while your cash balance remains untouched.

For BullionVault, you’ll have to maintain a positive cash balance or sell a small amount of metal each month to cover the storage fees. From experience, they are not strict on occasional negative cash balances as long as you periodically transfer in cash or sell metals to cover the overdue fees. For GoldMoney, you just buy your metals and forget about it.

-

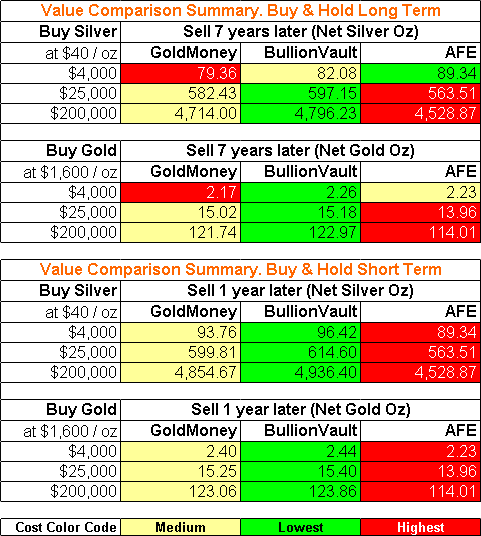

Cost of Ownership Comparison: GoldMoney Vs BullionVault Vs AFE

Due to the differences in the method of storage fee calculation (based on weight Vs cash value) it is rather difficult to make a precise comparison of the overall cost of ownership, especially for small holdings attracting minimum storage fees. Small holdings below their minimum thresholds are especially sensitive to the effect of price changes.

Another difference affecting the cost of ownership (which is difficult to quantify) is the different methods used to determine buy or sell prices. GoldMoney offers to buy and sell you metals based on spot prices, with no spread. BullionVault’s realtime system allows you to buy and sell based on ask and bid prices of other users (including BullionVault), with a spread that vary according to market conditions.

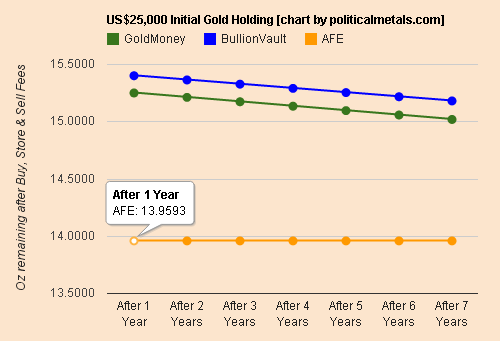

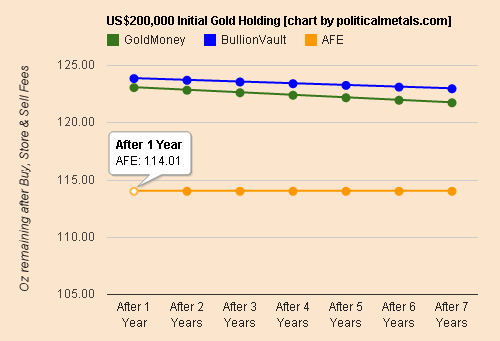

To obtain a general broad picture comparison, we translate the fees schedule in the tables above into charts for several scenarios below:-

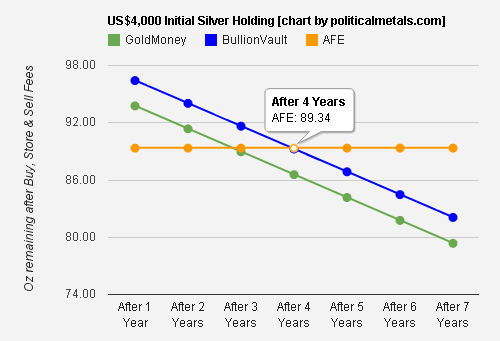

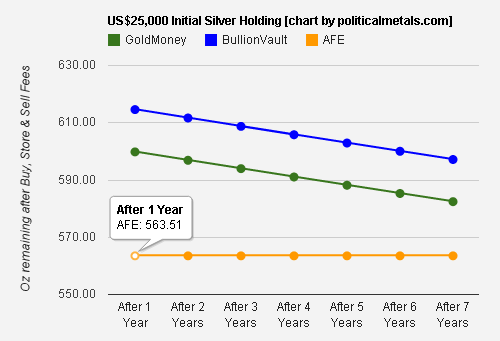

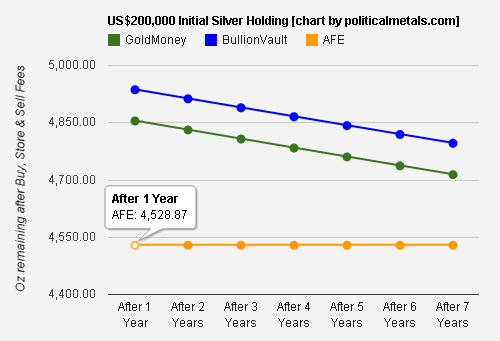

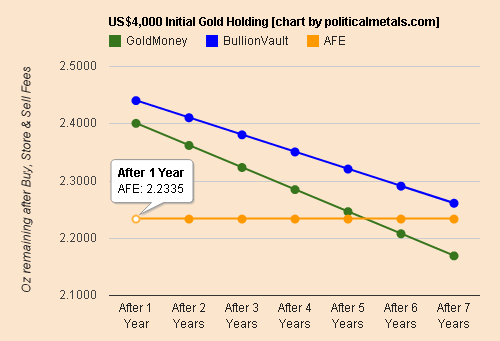

If an initial sum of US$4,000 were utilized to buy silver at $40 per ounce at GoldMoney, BullionVault and AFE, you’ll have 96.16, 99.21 and 91.12 oz respectively after applying their “Buy” fees as per the table above. If you sell the metals after storing it for 7 years, you’ll end up with a net metal value of 79.36, 82.08 and 89.34 oz respectively after applying their storage and “Sell” fees. Repeating this exercise with $25,000 and $200,000 for silver and the same three initial sums for gold, your net metal value after holding them for a 1-year and 7-year period is summarized in the table & charts below. Detailed spreadsheet calculations & assumptions can be found here.

Summary of Cost Comparison (GoldMoney Vs BullionVault Vs AFE)

GoldMoney is the most costly for long term small holdings (less than 21.43 oz gold, 490 oz silver). This is due to the relatively high threshold for minimum storage fees. For long term small silver holdings, AFE offers the best deal. Overall, and not accounting for spreads, BullionVault offers the lowest cost, followed by GoldMoney and AFE.

Note however that cost is only one of many factors to consider when selecting a bullion service provider. You should consider other factors here.-

-

Detailed Comparison by Charts

-

-

-

-

-

-

Updated 0n August 5, 2011.

Please post your comments & share your experience, especially if you’ve used this service. Thank you.

Disclaimer: The above information is provided on a best-effort basis. It’s accuracy is not guaranteed, and may not reflect the most recent changes made by the service providers. Please perform your own due diligence and verify the information from their respective websites before making any decisions. The reviews are the personal opinion of the author and does not constitute any endorsement or recommendation.

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

This was exactly what I needed! Thanks for sharing. Appreciate your info.

Thanks a lot for these charts. I found them immensely useful.