Gold Manipulation

The manipulation, or more specifically the suppression, of the price of gold by western governments through their central banks has been very well documented by the Gold Anti Trust Action Committee (GATA) since 2000. Despite being derided as a “conspiracy theory” organization in their early years, reputable analysts and prominent players in the gold and silver industry are beginning to embrace GATA’s assertions, especially after the global financial crisis of 2008.

Hence the volume of information and commentaries covering this topic has exploded in the alternative media, although it is still shunned by the MSM. This page is a compilation of some of the more notable resources covering this topic. If you’re new to this, a good place to start would be this recent speech delivered at the Pi Capital Dinner in London on Oct 10 2011 by Chris Powell, Secretary/treasurer of GATA.

Chris Powell: Gold price suppression purposes and proofs

-

September 6, 2011 | PoliticalMetals

A recent cable (April 2009) release by Wikileaks exposes the truth behind the purpose and function of gold manipulation from the U.S. Embassy in China..

According to China’s National Foreign Exchanges Administration, China’s gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the United States and European countries. The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold’s function as an international reserve currency. They don’t want to see other countries turning to gold reserves instead of the U.S. dollar or euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar’s role as the international reserve currency. China’s increased gold reserves will thus act as a model and lead other countries toward reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the RMB.

An even more recent cable (Feb 2010) released by Wikileaks disclosed that China thinks that the United States is trying to prevent China’s foreign exchange surplus from being converted into gold because the U.S. and its European allies plan a return to a gold standard that will favour them because they hold most of the world’s gold reserves.

“This time the quick change of the U.S. policy (toward China) has surprised quite a few people. The U.S. has almost used all deterring means, besides military means, against China. China must be clear on discovering what the U.S. goals are behind its tough stances against China. In fact, a fierce competition between the currencies of big countries has just started. A crucial move for the U.S. is to shift its crisis to other countries - by coercing China to buy U.S. treasury bonds with foreign exchange reserves and doing everything possible to prevent China’s foreign reserve from buying gold. The nature of such behavior is a rogue lawyer’s behavior of ‘ripping off both sides’: taking advantage of cross-strait divergences, blackmailing the Taiwan people’s wealth by selling arms to Taiwan, and meanwhile coercing China to buy U.S. treasury bonds with foreign exchange reserves and extorting wealth from the mainland’s people. If we [China] use all of our foreign exchange reserves to buy U.S. Treasury bonds, then when someday the U.S. Federal Reserve suddenly announces that the original ten old U.S. dollars are now worth only one new U.S. dollar, and the new U.S. dollar is pegged to the gold - we will be dumbfounded. Today when the United States is determined to beggar thy neighbor, shifting its crisis to China, the Chinese must be very clear what the key to victory is. It is by no means to use new foreign exchange reserves to buy U.S. Treasury bonds. The issues of Taiwan, Tibet, Xinjiang, trade and so on are all false tricks, while forcing China to buy U.S. bonds is the U.S.’s real intention.”

-

February 20, 2011 | PoliticalMetals

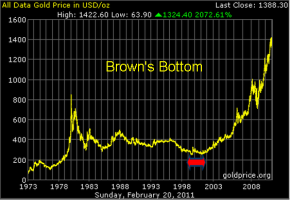

For decades, major central banks have been engaged in the downward manipulation of gold price by selling massive quantities of gold from their reserves. Here’s one of the most infamous Central Bank gold sale.

Brown’s Bottom

The former UK Prime Minister, Gordon Brown, sold almost 400 tonnes of UK’s gold reserves between 1999-2002 when he was Chancellor of the Exchequer (Minister of Finance).

The manner in which the sale was conducted, and the speed at which it was undertaken, without consultation with the Bank of England, made many of the City of London’s financiers a bit uneasy. The sale was purportedly conducted to support the nascent Euro or as a bailout and to prevent default of London-based bullion banks who were heavily short the precious metals.

[Note: Since 2009, the tide has changed, and as a group, they have shifted from being net sellers to net gold buyers. That's one of the reasons for the recent rapid gold price rise].

August 8, 2009 Brown’s Bottom. by MaxKeiserTV

-

Other Gold Manipulation Articles

- A short history of the gold cartel - James Turk (GoldMoney)

- Gold suppression is public policy and public record, not ‘conspiracy theory’ - Chris Powell (GATA)

- Providing Oversight With One Eye Closed - CK Diong (PoliticalMetals)

- Gold Market Manipulation Coming Unravelled - Adrian Douglas (Market Force Analysis)

- Piercing the mystery of the gold market - Chris Powell (GATA)

- Gold Market is not “Fixed”, it’s Rigged - Adrian Douglas (Market Force Analysis)

- Proof of gold price suppression - Adrian Douglas (Market Force Analysis)

- John Embry: Even Gold Mining Shares are manipulated - Eric King (KingWorld News)

- The politicians can’t erase the dire message of gold - Richard Russell (Dow Theory)

- COMEX & LBME at a heightened risk of default - Patrick Heller (Numismaster)

- The Devaluation Against Gold Is The Inflation - James G. Rickards (LarsSchall)

- Coordinated Central Banking Selling of Gold minutes before announcement by SNB (audio at 5m15s) - Ben Davies (KingWorld News)

- Central Banks waging war on gold at this hour - Dan Norcini (Professional Trader)

- How central banks use ETFs to keep gold down - Izabella Kaminska (Financial Times)

-

-

Does the US still have all the gold it claims to own?

March 8, 2011 | PoliticalMetals

-

David Morgan and Mike Maloney discusses how most of the US Treasury’s gold has been handed over to the Fed, which in turn has been leasing them to bullion banks to be sold into the market - to suppress its price. On top of that, the cannot be audited and the gold at Fort Knox has not been audited since the ’50s.

The world’s central banks stand ready to lease gold in increasing quantities should the price rise - Alen Greenspan’s testimony to Congress in 1996

Is there gold in Fort Knox? Maloney & Morgan In Las Vegas

-

-

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

Recent Comments