Archive

Central Banks of USA, EU, Japan & China planning coordinate actions

In today’s JS MineSet commentary, Jim Sinclair writes

In today’s JS MineSet commentary, Jim Sinclair writes

… it is possible that coordinated central bank actions in the USA, EU, Japan and China are being discussed. The economic problems are so severe, so international, so global, so entwined, so insoluble and still caused primarily by the greed of 1990 to present finance in the form of OTC derivatives that only coordinated global action can kick this can one more time.

Gold is truly going to and through $3500. The gold business is the best business to be in.

Like this:

JP Morgan Chase for Dummies

-

Breaking News:

JP Morgan sent out a notice at 4:30 p.m. that it would be holding a conference call at 5 p.m. which will include CEO James Dimon.

At the conference call, as reported by WSJ, Jamie announced that the the largest US bank has “taken $2 billion in trading losses in the past six weeks and could face an additional $1 billion in second-quarter losses due to market volatility”.

Here’s a Dummy trying to make sense of Wallstreet speak.

The losses stemmed from derivatives bets gone wrong in the bank’s Chief Investment Office, a part of the corporate branch of the bank that manages risk… Jamie announced.

So they lost $2 billion in 6 weeks and possibly another $1 billion over the next month. But what exactly are these derivative bets? Isn’t betting associated with gambling? Did the largest bank in the US take some of their bailout money, went gambling and now calling a press conference to announce their losses?

Mr. Dimon said the so-called synthetic hedge, using insurance-like contracts known as credit-default swaps, was “poorly executed” and “poorly monitored.” He said the bank has an extensive review underway of what went wrong, and that there were “many errors,” “sloppiness” and “bad judgment” on the bank’s part.

Ah… it’s not gambling, it’s actually a “synthetic hedge”. But I don’t even understand what’s a hedge, never mind the difference between synthetic and real! All I know up to this point is they lost big time through derivatives bets, which is a synthetic hedge, also known as credit-default-swaps. That’s quite a mouthful for a mere mortal.

What then are these credit-default swaps?

I know what’s a swap. You give me something, I give you another. But they’re swapping “credit-default” for something else? That sounds like a weird thing to be swapping. Fortunately I have good ole Wikipedia to the rescue:

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a loan default or other credit event. The buyer of the CDS makes a series of payments (the CDS “fee” or “spread”) to the seller and, in exchange, receives a payoff if the loan defaults.

Oh, how could I have missed something so obvious! Didn’t Mr. Dimon say it’s an “insurance-like” contract? Now I get it, so I’ll just call it an insurance. JP Morgan sells insurance and receives an insurance premium. It works something like this: You lend me money, then buy an insurance policy from JPM saying that if I fail to repay your loan when it becomes due, they will pay you for the sum insured.

But insurance companies do payouts all the time. What’s the big deal? Then I recall that when there’s a major disaster - like the recent Christchurch earthquake, the payout was so big that AMI, the insurer, went under and had to be bailed out by the government to the tune of NZ$1 billion.

Now it begins to make sense why the conference call was made in such a haste. I recall that Greece defaulted in their debt triggering a payout around a figure of $3.5 billion, and I know JP Morgan is one of the major insurers and major holders of other types of “insurance contracts” collectively known as OTC Derivatives.

But how big exactly is JPM’s potential liability to these kinds of bets?

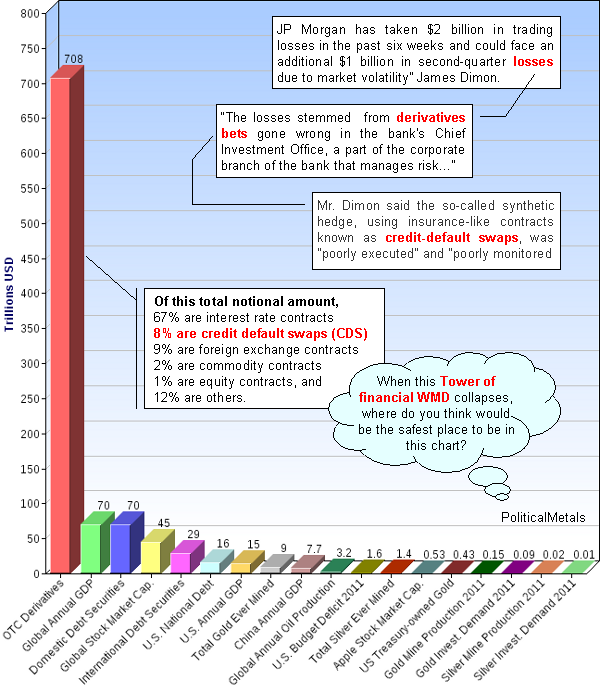

According to the Bank of International Settlements (BIS), which is the Central Bank of all national Central Banks, the total outstanding OTC Derivatives is $708 Trillion. Of this total notional amount,

- 67% are interest rate contracts,

- 8% are credit default swaps (CDS),

- 9% are foreign exchange contracts,

- 2% are commodity contracts,

- 1% are equity contracts, and

- 12% are others.

Since CDS makes up only 8% of the total OTC Derivatives, and a relatively minor default by Greece caused such a significant loss for JPM, imagine what will happen to JPM and the likes of JPM when the other PIGS countries ( Portugal, Italy, Greece and Spain) actually go into default. Also imagine what will happen when the interest rate contracts, comprising the bulk of OTC Derivatives actually triggered?

There must be good reasons why derivatives are referred to as Financial Weapons of Mass Destruction (WMD). Trying to time the explosion or implosion of this WMD is futile. Preparing for its consequences is vital. Take a look at the chart below, and see if you can spot where in this crazy world of finance is the safest place to be.

Mouse over each bar for details. Click to read data source

Updates:

- J.P. Morgan Chase fell 9.2%, its biggest percent drop since August

- Federal Reserve Officials investigating JPM’s losses

- Bernanke’s speech on May 10 “Conditions in the banking system-and the financial sector more broadly-have improved significantly in the past few years..”

- Derivatives: The $600 Trillion Time Bomb That’s Set to Explode

- Double or Nothing: How Wall Street is Destroying Itself (using Martingale system)

- Jim Willie explains JPM’s precarious position, new global financial system & why the USA will be a 3rd world state going forward

-

Like this:

Most Popular

Most Recent

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Felix Moreno on competitive devaluation, Euro/USD, gold & silver |

|

Gerald Celente talks about QE3 and the wars that are ahead on Alex Jones Channel |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- The Central Planners Are Going To Need A Bigger Boat September 21, 2012

- The Only Way They Can Stop This Is Bring Out A New Currency September 20, 2012

- Ben Davies - This Move In Gold Will Take It To $2,400 -$2,500 September 20, 2012

- Here Is the Key To The Global Markets Right Now September 20, 2012

- Embry - We’re Witnessing A Historic & Frightening End Game September 19, 2012

- Why Gold Is Heading Higher & Governments Can’t Stop It September 19, 2012

- Richard Russell - Life, The Markets & Gold September 19, 2012

- Rick Rule - Look For Sharply Higher Gold & Silver Prices September 18, 2012

Finance, Economics, Geopolitics

Finance, Economics, Geopolitics

- Have the Last 5 Years Been Worse than the Great Depression? September 21, 2012 George Washington

- Guest Post: The iKrug September 21, 2012 Tyler Durden

- The US Will Spend Between $3 And $7 Per Gallon Of Gasoline "Saved" By Consumers Driving Electric Vehicles September 21, 2012 Tyler Durden

- The Commodity Matrix: What Is The Resource Of Tomorrow, And Who Will Benefit From It? September 21, 2012 Tyler Durden

- The Zero Hedge Daily Round Up #130 - 09/20/2012 September 21, 2012 dottjt

- “Forceful And Timely Action” To Nowhere September 21, 2012 testosteronepit

- The Payoff: Why Wall Street Always Wins - An Excerpt September 20, 2012 Tyler Durden

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)