Central Banking and the Federal Reserve System (FED)

-

The Federal Reserve System is the central banking system of the US. Also called the Fed, it is the issuer of the world’s reserve currency and hence lies at the heart of today’s global financial & monetary architecture. Irrespective of where you live, what currencies earn or save in, the Fed affects you. When it goes down, it will suck in the rest of the global central banking system like a black hole.

Understanding its history and current practices helps put things in perspective as we ride out the seemingly endless socio-economic, financial and monetary storms that keep coming our way. As holders or potential holders of Political Metals, it is pertinent to have a good grasp of the inner workings of this powerful but little understood organization.

-

An introduction to Central Banking and a brief history of the FED

-

Here’s a detailed lecture on the origin and role of the FED (1hr 11min)

In the beginning…

On the evening of November 22, 1910, seven men, together representing about one fourth the world’s wealth at the time, left New Jersey on a train in complete secrecy purportedly on a duck hunting trip on Jekyll Island. Listen to Edward Griffin, author of the book The creature from Jekyll Island, as he narrates the story of how the system was conceived, brought into existence, operates and consequently controls the man on the street.

52m:30s into the video, Griffin talked about the Fed’s role in the bailouts for the too big to fail (TBTF). That was around 1974, when the book was published. Fast forward to 2008. The Fed dished out bailouts through the TARP and TALF to the tune of almost a trillion dollars.

1hr:6m into the video, Griffin talked about slaying the creature (abolishing the Federal Reserve System, and together with it fiat money and the fractional reserve banking system). Fast forward to December 2010. Congressman Ron Paul and author of End the Fed was appointed to head the Domestic Monetary Policy Subcommittee of the House Financial Services Committee - the subcommittee that overseas the Federal Reserve. It was an event 34 years in the waiting! The possibility to scrutinize and audit, if not end, the Fed is finally at hand.

-

A more scholarly account of “The origins of the Federal Reserve” by Murray Rothband concludes:

The financial elites of this country, notably the Morgan, Rockefeller, and Kuhn Loeb interests, were responsible for putting through the Federal Reserve System, as a governmentally created and sanctioned cartel device to enable the nation’s banks to inflate the money supply in a coordinated fashion, without suffering quick retribution from depositors or noteholders demanding cash.

-

A cleverly crafted creature it is…

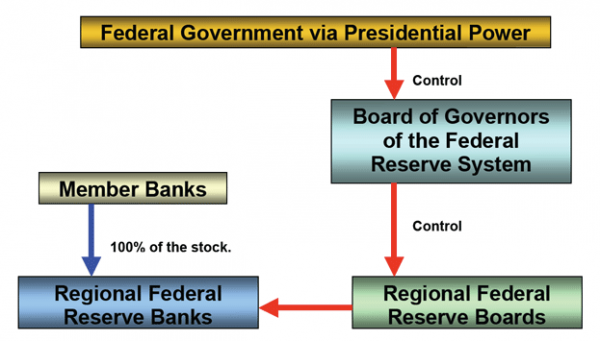

Private member banks hold 100% stocks of the twelve regional federal reserve banks that make up the Fed. These stocks may not be sold or pledged as collateral for loans. They Member banks receive a 6 percent dividend annually on their stock. The balance 94% goes to the US treasuries although they do not hold any stocks.

Regional federal reserve banks elect their own board of directors (9) while the chairman & vice chairman are appointed by the Board of Governors of the Fed, whose 7 members, including the chairman and vice chairman are appointed by the President of the US. So, who actually owns and controls the Fed? The chart below and this article from the Ludwig von Mises Institute tells the story.

-

[Updated: March 26, 2011]

| First published in 1994, The creature from Jekyll Island remains a best seller. Watch Edward Griffin discuss the Fed in the Glenn Beck Friday show.GB takes you through the early history of the FED as told by the FED, leading to a concise version of the story as told in the Griffin’s book.Griffin joins the discussion and fills the gaps 13 mins into the video. |

-

[Updated: June 10, 2011]

| Part 1: Edward Griffin talks to Sean of SGTReport about the difference between a Government & a Protectorate.The purpose of state is not to govern us, not to provide for us, not to take care of us, not to tell us what to do.We don’t need a government. We need is a Protectorate - to protect our lives, liberty and property.How true! | |

| Part 2: Mr. Griffin recaps the history & formation of the Federal Reserve System, which was initially sold to the public as a means of controlling the banks…but the Federal Reserve Act was actually written by the people behind the banks in the secrecy of Jekyll Island in 1910….. it’s a fraud.They did not create a government agency, but a a cartel instead. We can see it in action today, everyday! | |

| Part 3: Why is the public so indifferent to all this fraud around them? Conditioning of the public through the educational system!Action Time.Short term - Get out of debt, have enough gold, silver & food.Longer term - Retake the system back. Recapture our governments. Promote Individualism instead of Collectivism. Join Freedom Force International. Subscribe to RealityZone.

|

--

Here’s another documentary worth watching: Monopoly Men - Federal Reserve Fraud (47 Mins)

Permit me to issue and control the money of the nation and I care not who makes its laws. — Mayer Amsched Rothchild

I believe that banking institutions are more dangerous to our liberties than standing armies.” – Thomas Jefferson

-

Updated: Apr 19, 2011

Eric deCarbonnel of Market Skeptics explains in vivid details yet another fraudulent practise by the Fed - Selling Put Options on Treasuries Bonds to drive down yields (long term interest rates). In simple terms, it’s selling insurance on your own debt. If you or I attempt this, we’ll be in jail!

-

Related Articles:

-

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year