Russian Central Bank’s Gold Reserves to rise further

Congressman Ron Paul was appointed to head the Domestic Monetary Policy Subcommittee of the House Financial Services Committee in December last year. This subcommittee overseas the Federal Reserve. Paul is well known as the author of comprehensive legislation to audit the Federal Reserve Bank, with the goal of providing both taxpayers and world financial markets with full transparency of U.S. central bank actions.

This is where one of the key battles over the role & fate of the Political Metals will be fought - the battle to end the Fed’s relentless effort to suppress the price of PMs in cohort with other central banks and Wall Street bankers.

Today, Ron Paul writes on ”Real Respect for the Constitution“

I wonder: will this welcomed renewed interest in the Constitution lead to a healthy reassessment of all of our policies? Will there be no more wars without an actual congressional declaration? Will the Federal Reserve Act be repealed? Will only gold and silver be deemed legal tender?

I’ll will keep an eye on the progress of the 112th Congress currently in session and share with you any pertinent developments with the “Audit the Fed” initiative.

Now, on to an interesting (but little known) role played by one of the key members of the banking cartel involved in the manipulation of the PM markets. In the interview below, JP Morgan executive Christopher Paton amits that this is “a very important business to JP Morgan” and that it is doing very well. So what’s that “important business”?

As unemployment rises as a result of the crash of 2008 caused primarily by the banking cartel, JP Morgan’s role is to process the rising food stamp benefits. JP Morgan has contracted to provide food stamp debit cards in 26 U.S. states and the District of Columbia. JP Morgan is paid for each case that it handles, so that means that the more Americans that go on food stamps, the more profits JP Morgan make. Considering the fact that the number of Americans on food stamps has exploded from 26 million in 2007 to 43 million today, one can only imagine how much JP Morgan’s profits in this area have soared. More unemployment, more business, more profits!

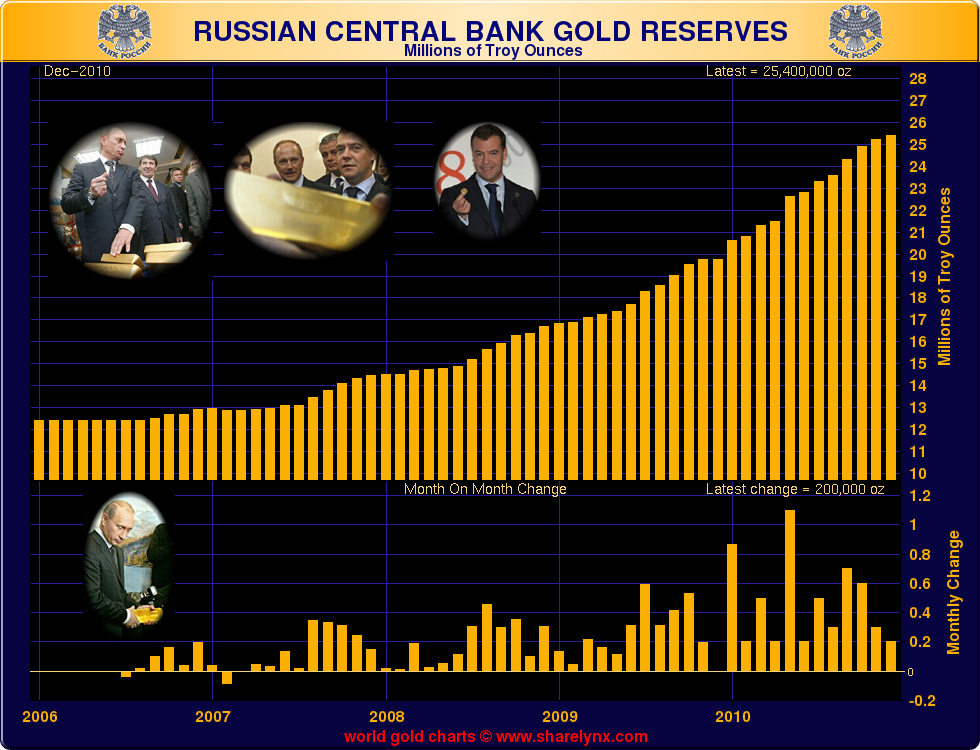

While JP Morgan et al are pushing down the price of paper gold & silver, the Russian Central Bank, and many others, are piling up on the real stuff - physical gold in their reserves. Today, the WSJ reports that the Central Bank of Russia plans to buy from domestic banks 100 metric tons of gold a year in order to replenish the country’s gold reserves. In 2010 Russia’s gold reserve increased 23.9% to 790 tons, or 25.4 million Troy ounces.

One more reason to convert your fiat money into Political Metals.

-

[Updated: 21 Apr 2011 - Central Bank of the Russian Federation reported they bought 600,000 ounces in March, which brings their 'official' holdings up to 26.1 million ounces] Click image to enlarge.

-

February 15, 2011 at 2:54 PM | #1Ron Paul on Foreign Policy, Federal Reserve and Liberty « Political Metals

-

March 5, 2011 at 1:46 PM | #2Ben Bernanke: Consumers don’t want to buy gold. « Political Metals (PMs)

Leave a Reply Cancel reply

Most Popular

Most Recent

- Gold: Is It Really In a Pricing Bubble?

- The Politics of Gold

- Potential sharp moves in gold & silver prices. Which direction?

- Malaysian Central Bank Raided “Gold Investment” Company

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Finding Silver: For a change, forget about the politics and financial aspects of silver. Let's appreciate the science & the engineering behind that beautiful silver coin. |

|

High Frequency Trading: You can get in easily. "Getting out is the problem" David Greenberg, former NYMEX board and executive committee member. Paper gold & silver markets are dominated by HFTs. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- More Stunning Developments In The Gold & Silver Markets October 14, 2012

- Exclusive - Riots & Money Fleeing The Euro Into Gold & Silver October 13, 2012

- Art Cashin - We Are At Risk Of A Frightening Hyperinflation October 12, 2012

- Fleckenstein - Gold & Insane Central Banks Printing Trillions October 12, 2012

- Embry - This War In Gold & Shorts Getting Overrun October 12, 2012

- The $2 Trillion European Bailout Package Is Coming October 11, 2012

- Turk - Expect A Massive Short Squeeze In Gold & Silver October 11, 2012

- Lost Confidence Can’t Be Restored & Gold’s Final Move October 11, 2012

Finance & Economics

Finance & Economics

- Guest Post: Can Government Create Opportunity? October 14, 2012 Tyler Durden

- Did Central Bankers Kill The Single-Name CDS Market (For Now)? October 14, 2012 Tyler Durden

- The Top 15 Economic 'Truth' Documentaries October 14, 2012 Tyler Durden

- Guest Post: How To Spot A Keynesian October 14, 2012 Tyler Durden

- The Punch Line: All The Charts That's Fit To Print October 14, 2012 Tyler Durden

- Why Are Americans So Easy To Manipulate? October 14, 2012 Tyler Durden

- Guest Post: On Currency Swaps And Why Gartman May Be Wrong In Focusing On The Adjusted Monetary Base October 14, 2012 Tyler Durden

- Bernanke – I Want To Pick A Fight With China October 14, 2012 Bruce Krasting

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)