The US Debt Ceiling & I

-

It’s a given. The debt ceiling will be raised - again. It has been raised 68 times since 1960. Why should this time be different? Maybe what’s different is the intensity of the theatrics.

As Chris Duane puts it, ”All that is going on right now is political posturing for the election. Nothing of any real importance is being fought for. It is a carefully choreographed fight not unlike professional wrestling. The balanced budget amendment will never happen.”

So, while all this “white stuff” is being passed down from the very top to the bottom, we the people at the bottom of the financial food chain should take note of several key points raised by the Paul2 team in their recent interview with Neil Cavuto - and prepare ourselves.

Image courtesy of Casey Research

Cutting the Rate of Increase in Spending is not the same as cutting spending

It’s not a budgetary problem per se, it’s a government philosophy problem.

What they don’t realise and don’t admit is that the country is bankrupt.. there will be a default. The default is occurring. The people are getting less for their money and that’s how big governments and big countries default.

All this debt has to be liquidated for us to get growth again. They don’t want to liquidate debt by declaring bankruptcy… You liquidate debt by paying it off by junk money. You just print the money. And you have run away inflation. That’s an indirect tax on the people. By next summer there’ll be big talk on price inflation.

Monetary reform has to come for the resolution of this crisis we’re facing.

and cryptically “He wouldn’t pay his rent in silver”

[I don't live in the US. You may not too. So why bother? This will be a non-issue for many of us if not for the fact that the US$ is the world's reserve currency, the US is the largest debtor in humanity's history, the largest US banks are holding hundreds of trillions in derivatives and when the US$ goes down, it pulls the rest of us down, like it or not]

-

In the very short term, especially immediately after announcement of any debt ceiling deal, and bearing in mind that there are no markets anymore - just interventions, it’ll be prudent to exercise some caution. In his latest Got Gold Report, Gene Arensberg finds market signals turning against gold.

In the mid to long term, if the Bullish Gold Case #2 plays out, consider converting your savings into hard currencies like gold & silver as part of the preparations for what’s to come.

Here’s a great summary of some recent positive outlook on gold by Jeff Clark

SICA Wealth Management’s Jeffrey Sica: “Right now, I think gold looks better than ever.” He sees a “painfully high probability” of troubling events occurring in the months ahead. “There has been a general loss of confidence in the ability of central banks and governments to manage the economy. That will continue to give gold and other precious metals a boost.”

Empire Economics chief economist Clifford Bennett expects gold to come close to $2,000 an ounce this year and $2,200 an ounce within 18 months. “There is risk in the second half of the year of a bit of a ‘panic spike,’ if you like, as everyone thinks there isn’t enough to go around and starts to hoard. That’s when you’ll really see gold take off towards $2,000 an ounce.”

Franco-Nevada Chairman Pierre Lassonde said the coming mania in gold will make the 1970s run look like child’s play. “In 1980, the only players, or the dominant players, were the Americans. Today the dominant players are China and India; 58% of all the gold sold this year will be sold in these two countries. When we reach that mania phase… watch out, because it will truly make your head spin.”

Antaike analyst Shi Heqing had this to say about Chinese investors: “Record high prices won’t scare away investors… they are likely to chase the rally and continue to buy gold because paper money feels increasingly worthless and they are worried about inflation.” Shi expects China’s gold demand to rise about 20%, due in no small part to the country’s 6.4% inflation rate.

Reuters: ”The case for gold in the longer term is still very strong,” said a Singapore-based trader. “Gold may appeal to new classes of investors who previously avoided the market in favor of more mainstream investments like bank deposits, bonds, and equities. Potentially there’s a whole new market for small-sized gold bars if these investors lose faith in paper.”

Newedge USA predicted gold will hit $1,800 and silver $70 by year-end due to investors seeking a haven asset and physical demand from Asia. “Gold is an excellent hedge in troubled times” said Mike Frawley. “Demand will be very strong long-term from Asia, and the economic trend in the West is improving.”

FX Concepts founder John Taylor: “Gold will climb to $1,900 by October.”

SMC Global: “Evidence of sluggish U.S. growth has shaken investor confidence. Concerns about rising inflation here have also boosted appetite for gold ETFs. Demand is high from small players.”

Minerals and Metals Trading Corp’s Ved Kumar Prakash reported “skyrocketing” demand for gold in India. He predicted that given the company’s brisk sales, gold imports would jump by more than 40% this fiscal year.

The Swiss Parliament is expected later this year to discuss the creation of a gold franc. “I want Swiss people to have the freedom to choose a completely different currency,” said Thomas Jacob, the man behind the gold franc concept. “Today’s monetary system is all backed by debt - all backed by nothing - and I want people to realize this.”

The Utah Legal Tender Act was signed into law by Governor Herbert last month. “Good monetary policy is an important part of a healthy and prosperous economy,” said Senator Mike Lee. He and other Republicans also introduced legislation to eliminate federal capital gains taxes on gold and silver coins. “Since the Federal Reserve Act of 1913, the dollar has lost approximately 98% of its value. This bill is an important step towards a stable and sound currency whose value is protected from the Fed’s printing press.”An “Iranian gold rush” is under way, according to an article by Reuters. “Usually as the price of an item increases, demand will decrease - but in the case of gold, it seems that higher prices are creating more demand,” said an unnamed Tehran gold retailer. “The reasons that people are drawn to these safe assets - gold coins and hard currency - are firstly a limited choice of investment opportunities, and secondly a fear from the weakness of the national currency,” said an economist who asked not to be named.

CIBC World Markets’ Peter Buchanan remains bullish even if the debt ceiling talks resolve. “Even in the likely event Congress agrees to a debt ceiling rise, recent uncertainties are likely to reinforce central banks’ ongoing efforts to diversify from the dollar into gold and other assets.”

Citigroup Global Markets reported that silver may more than double to $100 an ounce if the current bull market follows similar patterns seen between 1971 and 1980. “If the final rally in the last bull market repeated, then we can expect $100 over the long term… While the high so far this year was at the same level as the peak in January 1980, we are not convinced that the long-term trend is over yet.”

Gold Forecaster analyst Julian Phillips: “This is not typical of a ‘bull’ market that will eventually fall back from whence it came. We believe gold is not in a ‘bull’ market, because it is changing its shape and nature permanently. Our reasoning is not academic posturing, but a reflection of the realities that have taken place over time and those that confront us now. Because it is perceived to be an alternative wealth-preserving asset, a counter to a failing monetary system, it is not a simple commodity moving up and down with the flows and ebbs of economic cycles; it is a valid measure of monetary values.”

American Precious Metals Advisors Managing Director Jeffrey Nichols: “A recent survey of 80 central bank reserve managers predicted that the most significant change in their official reserve holdings in the next 10 years will be their intentional build up in gold reserves. They also predicted that gold will be their best performing asset class over the next year, and sovereign debt defaults will be their principal risk.”

Gloom Boom and Doom editor Marc Faber: “I just calculated that if we take an average gold price of say around $350 in the 1980s and compare that to the average monetary base and the average U.S. government debt in the 1980s…and then if I compare this to the price of gold to today’s government debts and monetary base, gold hasn’t gone up at all. It’s actually gone against these monetary aggregates, and against debt it’s actually gone down. So I could make the case that gold is today probably very inexpensive.”

GoldMoney founder James Turk: “In reality there are very few participants currently in the gold market… when I look at the price action, it suggests to me that a lot of this big money on the sidelines wants to be in. Therefore we are seeing some aggressive bidding on any pullbacks.”

Reuters Money reports that eBay’s “gold and silver outpost” has seen gold bullion sales jump more than 60% from 2007 through 2010. More significantly, “almost half of the silver and gold buyers in the first quarter of 2011 never purchased these items on eBay before.”

Sprott Asset Management chief investment strategist John Embry: “I think it will be really exciting when silver clears $50, because then it will be in absolutely new ground. There is, without question, major physical shortages of physical silver, and demand is robust. Once silver gets rolling, it’s going to levels people cannot imagine.”

It’s hard to go one day without seeing comments like these. The chorus is growing, and as these bullish views spread further and further into the mainstream, the number of investors attracted to precious metals will swell and continue to drive prices higher.

Is this growing consensus the sign of a top? As I said about gold stocks, taking the contrarian view in response to this information would be the wrong move. Fiscal and monetary issues are getting worse, not better, and I think we’re simply seeing more investors recognize the inevitable. We’ll worry about exiting this sector when real interest rates are positive and the dollar is once again a revered currency. Until then, it’s hard to imagine a scenario that isn’t bullish for gold. Any pullback should thus be viewed as a sale price.

Is the impetus for a mania building? I don’t know if we’re on the doorstep of that phase or not, but the fundamental reasons to hold gold are as strong as they’ve ever been. Indeed, it’s getting more critical to have meaningful exposure to precious metals. Keep in mind that when the debt ceiling talks reach a resolution - whatever it may be - the fundamental problems of excessive debt and further deficits will still be unresolved.

Will gold correct if agreements are reached on the debt talks? Probably, but I think the more appropriate question to ask is this: If these analysts are correct, do I own enough ounces?

Just before I hit the “Publish” button, gold takes a hit.

Leave a Reply Cancel reply

Most Popular

Most Recent

- Gold: Is It Really In a Pricing Bubble?

- The Politics of Gold

- Potential sharp moves in gold & silver prices. Which direction?

- Malaysian Central Bank Raided “Gold Investment” Company

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Finding Silver: For a change, forget about the politics and financial aspects of silver. Let's appreciate the science & the engineering behind that beautiful silver coin. |

|

High Frequency Trading: You can get in easily. "Getting out is the problem" David Greenberg, former NYMEX board and executive committee member. Paper gold & silver markets are dominated by HFTs. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- More Stunning Developments In The Gold & Silver Markets October 14, 2012

- Exclusive - Riots & Money Fleeing The Euro Into Gold & Silver October 13, 2012

- Art Cashin - We Are At Risk Of A Frightening Hyperinflation October 12, 2012

- Fleckenstein - Gold & Insane Central Banks Printing Trillions October 12, 2012

- Embry - This War In Gold & Shorts Getting Overrun October 12, 2012

- The $2 Trillion European Bailout Package Is Coming October 11, 2012

- Turk - Expect A Massive Short Squeeze In Gold & Silver October 11, 2012

- Lost Confidence Can’t Be Restored & Gold’s Final Move October 11, 2012

Finance & Economics

Finance & Economics

- John Taylor On Poor Policy And This Recovery's Broken 'Plucking' Model October 15, 2012 Tyler Durden

- ECB's Weidmann On Gold: "Money Is A Social Convention" October 15, 2012 Tyler Durden

- Out Of The 'Liquidity Trap' Frying Pan And Into The 'Liquidity Lure' Fire October 15, 2012 Tyler Durden

- Investor Sentiment: In a Vacuum October 15, 2012 thetechnicaltake

- S&P Futures Are Testing Draghi's Dream October 15, 2012 Tyler Durden

- About QEternity's Mortgage-Based Housing Boost? October 15, 2012 Tyler Durden

- I will never forget the name "Gavyn Davies!" October 14, 2012 lemetropole

- Guest Post: Can Government Create Opportunity? October 14, 2012 Tyler Durden

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)

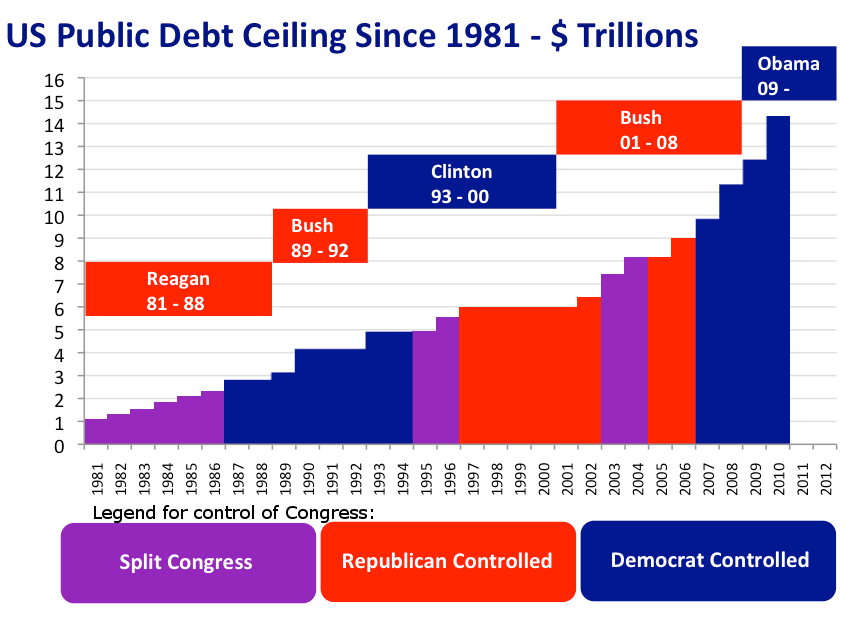

Is the bar chart in inflation-adjusted dollars? The Reagan years might be as bad as the Obama years.

Hi Dave,

That chart was from Wikipedia (http://en.wikipedia.org/wiki/2011_U.S._debt_ceiling_crisis), and there was no mention of the figures being inflation adjusted. Another source (http://en.wikipedia.org/wiki/History_of_the_U.S._public_debt) cites similar figures to that of the chart for Regan up to Obama years with no mention of inflation adjusted figures. I assume they are nominal figures. If you can determine otherwise, kindly advise. Thanks.