Can you spot the Bubble(s)?

-

With gold and silver gradually heading south since leap day, many PMs investors are beginning to get cold feet. Then we have, over the weekend Charlie Munger, Berkshire Hathaway’s No.2 commenting that “civilized people don’t buy gold”. Not surprising - why would anyone bother since “gold is a barbaric relic” anyway. And with Bill Gates saying he’s in the same camp with Buffett & Munger, are we missing something?

Today, GATA posted an “encouragement from Embry and Sinclair”, while Jim Sinclair wrote in his “Answering The Cries For Help” email despatch:

Today has been interesting in a perverse way. I have heard from every gold short who knows my name. I have heard from every weak gold holder that knows my name yelling for help. This time I cannot answer all the incoming communications. Nobody could.

A month ago I got over 3500 incoming emails in less than three hours. The shorts exulting by email really cannot expect an answer. Even the weak gold and frustrated gold share holders cannot expect me to assuage their pain one at a time. ..

It sure does look or sound scary out there. If I were a PMs investor, I’d probably be among the first to heed Sinclair’s advise “If you cannot stand the heat you must get out of the kitchen”.

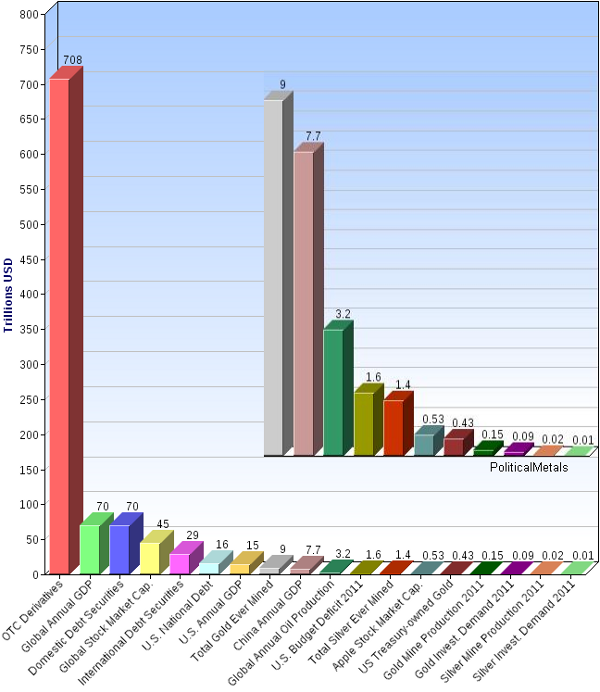

But if you’re not investing in gold or silver, merely holding them as a form of currency, there’s really no need to panic. Take a minute to study the chart below. It puts things into perspective. And while you’re at it, try to see if you can spot a bubble or two!

Perspective: The BIG Picture

Mouse over each bar for details. Click on bars for data source.

Why did Buffet, Munger & Gates say what they said? The answer is in this video.

-

Sources:

- Bank of International Settlements: Amounts outstanding of OTC derivatives

- Wikipedia: List of countries by GDP

- Bank of International Settlements: Domestic Debt Securities

- The World Bank: Market capitalization of listed companies

- Bank of International Settlements: International debt securities - all issuers

- U.S. National Debt Clock

- Wikipedia: Economy of the United States

- World Gold Council: Investment

- Wikipedia: Economy of the People’s Republic of China

- Wikipedia: List of countries by oil production

- Wikipedia: 2011 United States federal budget

- Gold-Eagle.com: Silver Revisited

- Yahoo! Finance: AAPL

- U.S. Department of Treasury: Current Report: April 30, 2012

- World Gold Council: Gold Demand Trends 2011, Pages 22

- World Gold Council: Gold Demand Trends 2011, Pages 21

- The Silver Institute: Supply & Demand, Silver Production

- Kitco News: Thomson Reuters GFMS

- Jason Hommel’s Silver Stock Report

- The Greatest Truth Never Told

?modestbranding=1

-

May 13, 2012 at 9:55 AM | #1Gold And Silver Jewelry Etiquette | China Silver Jewelry

-

May 14, 2012 at 1:52 PM | #2Quick Bite: Turbulence 28 - Invest Silver Malaysia | Invest Silver Malaysia

Leave a Reply Cancel reply

Most Popular

Most Recent

- Gold: Is It Really In a Pricing Bubble?

- The Politics of Gold

- Potential sharp moves in gold & silver prices. Which direction?

- Malaysian Central Bank Raided “Gold Investment” Company

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Finding Silver: For a change, forget about the politics and financial aspects of silver. Let's appreciate the science & the engineering behind that beautiful silver coin. |

|

High Frequency Trading: You can get in easily. "Getting out is the problem" David Greenberg, former NYMEX board and executive committee member. Paper gold & silver markets are dominated by HFTs. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- More Stunning Developments In The Gold & Silver Markets October 14, 2012

- Exclusive - Riots & Money Fleeing The Euro Into Gold & Silver October 13, 2012

- Art Cashin - We Are At Risk Of A Frightening Hyperinflation October 12, 2012

- Fleckenstein - Gold & Insane Central Banks Printing Trillions October 12, 2012

- Embry - This War In Gold & Shorts Getting Overrun October 12, 2012

- The $2 Trillion European Bailout Package Is Coming October 11, 2012

- Turk - Expect A Massive Short Squeeze In Gold & Silver October 11, 2012

- Lost Confidence Can’t Be Restored & Gold’s Final Move October 11, 2012

Finance & Economics

Finance & Economics

- Shuffle Rewind 08-12 Oct " Sleeping Satellite " (Tasmin Archer, 1992) October 14, 2012 AVFMS

- The REAL Reason America Used Nuclear Weapons Against Japan October 14, 2012 George Washington

- The 21st Century Monolith October 14, 2012 Tyler Durden

- Beta Testing QE 4 - "Large Amount" Of $100 Bills Stolen From Federal Reserve October 13, 2012 Tyler Durden

- Guest Post: The Problem With Centralization October 13, 2012 Tyler Durden

- The US Fiscal 'Moment': Cliff, Slope, Or Wile E. Coyote? October 13, 2012 Tyler Durden

- German Self-Immolates In Front Of Reichstag October 13, 2012 Tyler Durden

- On China's Transition October 13, 2012 Tyler Durden

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)