Bernanke Fails To Move Gold Market Lower

By Jeff Nielson | Silver Gold Bull

Following the solid gains in the price of gold last week and the much more explosive rise in the price of silver, all expectations (even among normally bearish commentators) were that bullion prices would continue rising this week. That all changed Monday morning, however.

At that point the Corporate Media released their Script for this week (written by the banking cabal itself). They “predicted” that B.S. Bernanke would “disappoint the market” when his prepared remarks would be released to the world on August 31st.

Experienced commentators and investors alike immediately understood the game being played, since it’s been played on countless occasions in the past.

- The Corporate Media announces in advance that “all eyes” are awaiting some upcoming propaganda bulletin, and then hype it day after day as the event approaches

- The bankers focus all of their market-rigging activities on that day, so when the “prediction” comes true (surprise, surprise) they can pounce on the market and (initially) drive prices lower based, on the “reason” being hyped by the Corporate Media all week.

- Once the downward momentum has been built up, the bankers then attempt to drive all leveraged traders out of their positions; creating yet more downward momentum and causing all sorts of “technical damage” on the charts.

- The Corporate Media then hypes that technical damage as a further “reason” to do more gold- and silver-selling.

It’s such a blatant tag-team act that it no longer surprises any sophisticated Players in the market. Instead, knowing that the manipulation is on the way; sophisticated investors (led by the Big Buyers) allow the bankers and Corporate Media to work for them.

Once the Script has been written that an attack is coming, these Buyers stop buying – and simply wait for the Ambush to arrive. Thus Monday morning I informed readers that we could forget about all the upward momentum from the previous week. The market would move (more or less) sideways until Friday morning (and the bankers’ Ambush).

Experienced investors understood that all that would have been ‘gained’ by pushing prices higher this week was that the bankers (and media) would be able to engineer a sharp reversal in the market (creating much worse optics) and a much greater probability of medium-term success for this manipulation operation.

So, instead, it is the Big Buyers who wait to execute their own Ambush; perhaps more properly characterized as a counter-attack. They let the market drift prior to the announced propaganda – giving no opportunity for the bankers to engineer any sort of “sharp reversal” on their day of attack.

Knowing the market is going to instantly be driven lower the moment the propaganda is released; the Big Buyers gleefully await that instant drop in price – and then they start buying…big. At that point the battle is commenced. When the bankers’ propaganda reigns supreme, this buying is unable to reverse the downward move, merely abbreviate it. However, when the bankers’ propaganda is no longer of sufficient potency we see a much different picture – like today.

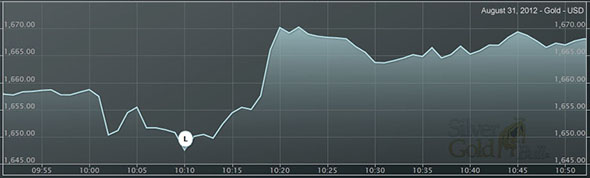

The entire ambush-event itself is so brief on such days that we must literally look at a gold chart showing the minute-by-minute action in order to watch the battle unfold. Today, the propaganda ammunition (courtesy of B.S. Bernanke) was released at 10:00 am Eastern time.

The bankers immediately drove the price of gold lower (as expected), but could only manage a feeble move of about $10/oz lower, to a low of $1647/oz, with the low price of the day coming a mere 10 minutes after the announcement. Twelve minutes after the propaganda was released, a bullion website known for parroting all of the bearish propaganda released this headline: Comex Gold Backs Down as Bernanke Holds Off on Fresh U.S. Monetary Stimulus Package

However, by that time the Big Buyers had already started buying, and the price of gold started to rise. A mere 10 minutes after the bankers had taken the price of gold to its low of the day; the Big Buyers totally reversed this downward move – and took the price of gold to what was (at that moment) its high price of the day.

As I’m writing at this moment, the price of gold has moved above $1680/oz, a greater than $30/oz reversal – and a devastating defeat for the banking cabal. About the only thing more “bullish” than a rising chart is a chart showing the price being pushed down, and then strongly reversing higher.

This picture tells any/all knowledgeable investors that this is a buoyant market, one which is ‘trying’ to move higher. Since most of the traders (i.e. gamblers) who dominate daily action in markets don’t understand the fundamentals; they allow themselves to be totally guided by such momentum indicators.

We now have back-to-back weeks in the bullion market each painting a different picture of the bankers’ (new) inability to cap prices. Last week, we saw a market steadily rising day-by-day. Following nearly six months of totally indecisive price-action, it was a strong indication that “the next rally” was here.

Today we received reinforcement of that message: the bankers attacked the market with one of their coordinated operations – and were soundly thrashed by the “longs”. The rally has been confirmed. Now it almost appears as if it is the Bulls in the market who have been “writing the script.”

Not only do we see two consecutive weeks of unequivocal bullish strength to proclaim a new rally in the gold and silver markets, but both gold and silver are poised to complete what is known as “the Golden Cross.” This is where not only the current price, but all shorter-term moving averages (price-averages) “cross” above the long-term (200-day) moving average.

This is the single, ultimate indicator of longer-term technical strength; thus providing both a shorter-term picture and a longer-term picture of a market which has just begun an(other) explosive rise. Looking at the market from even a more long-term perspective, the 18 months of sideways-to-lower price action has “built a base” (a huge base) in a market in the middle of the longest/strongest bull-run in market history.

This, in turn, shows a market capable of now moving higher (without any significant interruption) for many, many months. Cautious bulls might want to make themselves aware of one more future event: next Friday’s jobs-propaganda from the U.S. Bureau of Labor Statistics.

There are two reasons, however, why I am already expecting this next potential “ambush date” to represent another failure for the banking cabal. First, their attempt to move the market lower on last month’s (phony) jobs report was another dismal failure.

The reason why that attack failed was that anyone who looked at the details of the July report saw that the BLS had made a gigantic “seasonal adjustment” (higher) in the jobs numbers – to reflect predicted lay-offs (in the auto industry) which were canceled at the last minute. Having padded last month’s jobs-report with somewhere in the vicinity of 200,000 fantasy-jobs; those fantasy-jobs must be subtracted in this month’s report (to reflect what actually took place).

This means we will see one of two things in next Friday’s U.S. jobs numbers. We will see a terrible, negative number – as current job-losses plus the huge, downward revision from last month produce a large, net job-loss. Or, we will see the BLS suffer a(nother) bout of ‘amnesia’; fail to subtract the imaginary jobs it added in the prior month; and destroy its credibility with a much larger segment of the mainstream public.

Note that this stunning break-out in the gold and silver markets occurs just as gold and silver are entering their traditional “strong season.” Sound the horns, and proclaim the march forward! The bankers are now in full retreat.

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year