Financial Repression - What is it and how does it silently steal from you.

-

Financial Repression is here whether you realize it or not, but you’ll be better off if you understand it. Learn about this very important but less discussed topic by reading an an excerpt of the excellent article by Danial Amerman reproduced below or click here and listen to an explanation by James G. Rickards (a.k.a. Jim Rickards).

-

Financial Repression: A Sheep Shearing Instruction Manual

By Daniel R. Amerman, CFA

Overview

“Financial Repression” is currently a hot buzzword in the global economic community, and its effects are even worse than it sounds. Like other recent economic buzzwords such as “monetary sterilization” and “quantitative easing”, the average person will never understand the meaning, if they hear the phrase at all. That is too bad, because governments around the world deliberately and methodically stripping wealth (and therefore security and retirement lifestyle) from hundreds of millions of people is the quite explicit objective of Financial Repression.

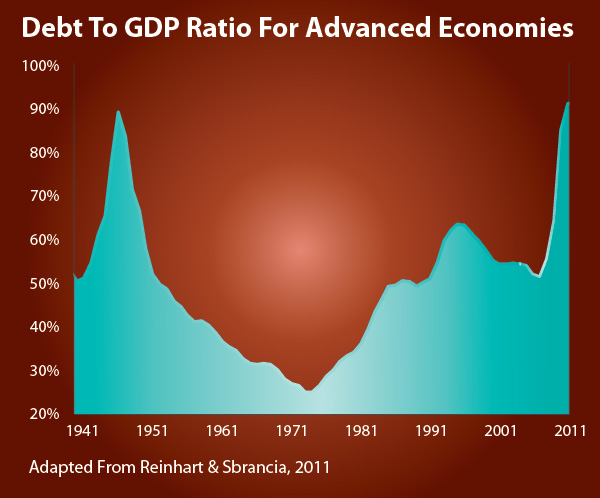

As published in a recent working paper on the IMF website, Financial Repression is what the US and the rest of the advanced economies used to pay down enormous government debts the last time around, with a reduction in the government debt to GDP ratio of roughly 70% between 1945 and 1980. Financial Repression offers a third way out - as it allows governments to pay down huge debt burdens without either 1) default or 2) hyperinflation. If you are a senior government official of a nation that has a huge “sovereign debt” problem – like the United States and almost all of Europe, and you want to stay in power - this proven method is a topic of keen interest.

To understand this miraculous debt cure for governments, you need to understand the source of the funding. As we will explore in this article, the essence of Financial Repression is using a combination of inflation and government control of interest rates in an environment of capital controls to confiscate the value of the savings of the world’s savers. Rephrased in less academic terms - the government deliberately destroys the value of money over time, and uses regulations to force a negative rate of return onto investors in inflation-adjusted terms, so that the real wealth of savers shrinks by an average of 3-4% per year (in the postwar historical example), and it uses an assortment of carrots and sticks to make sure investors have no choice but to accept having the purchasing power of their investments shrink each year.

What the IMF-distributed paper really constitutes is a Sheep Shearing Instruction Manual. The “way out” for governments is effectively to put the world’s savers and investors in pens, hold them down, and shear them over and over again, year after year. Uninformed and helpless victims is what makes Financial Repression work, and it worked very well indeed for 35 years. On the other hand, if you understand what is truly going on, then you do have the ability to turn this to your substantial personal financial advantage. With a genuinely out of the box approach to long-term investment, the more heavy handed the repression - the more reliable the wealth compounding for those who reject flock thinking.

Understanding Financial Repression

Pimco (Pacific Investment Management Co.), one of the largest investment managers in the world, released their three to five year outlook last month, and their CEO predicted that increasing debt problems would lead to higher inflation and a return to “financial repression” in the United States.

Earlier in May, the Economist magazine had published an article on Financial Repression that included the following summary:

“… political leaders may have a strong incentive to pursue it (Financial Repression). Rapid growth seems out of the question for many struggling advanced economies, austerity and high inflation are extremely unpopular, and leaders are clearly reluctant to talk about major defaults. It would be very interesting if debt (rather than financial crisis or growing inequality) was the force that led to the return of the more managed economic world of the postwar period.”

The phrase “Financial Repression” was first coined by Shaw and McKinnon in works published in 1973, and it described the dominant financial model used by the world’s advanced economies between 1945 and around 1980. While academic works have continued to be published over the years, the phrase fell into obscurity as financial systems liberalized on a global basis, and former comprehensive sets of national financial controls receded into history.

However, since the financial crisis hit hard in 2008, there has been a resurgence of interest in how governments have paid down massive debt burdens in the past, and a fascinating study of Financial Repression, “The Liquidation of Government Debt”, authored by Carmen Reinhart and M. Belen Sbrancia, was published by the National Bureau of Economic Research in March, 2011 (link below).

http://www.imf.org/external/np/seminars/eng/2011/res2/pdf/crbs.pdf

The paper is being circulated through the International Monetary Fund, and to understand why it is catching the full attention of global investment firms and governmental policymakers, take a look at the graph below:

The advanced Western economies of the world emerged from the desperate struggle for survival that was World War II, with a total stated debt burden relative to their economies that was roughly equal to that seen today. The governments didn’t default on those staggering debts, nor did they resort to hyperinflation, but they did nonetheless drop their debt burdens relative to GDP by about 70% over the next three decades - and the very deliberate, calculated use of Financial Repression was how it was done.

-

The Mechanics Of Financial Repression

The specifics of financial repression took somewhat different forms in each of the advanced economies, but they shared four characteristics: 1) inflation; 2) governmental control of interest rates to guarantee negative real rates of return; 3) compulsory funding of government debt by financial institutions; and 4) capital controls.

1) Inflation. First and foremost, a government that owes too much money destroys the value of those debts through destroying the value of the national currency itself. It doesn’t get any more traditional than that from a long-term, historical perspective. Without inflation, Financial Repression just doesn’t work. Historically, the rate does not have to be high so long as the government is patient, but the higher the rate of inflation, the more effective financial repression is at quickly reducing a nation’s debt problem.

For example, per the Reinhart and Sbrancia paper, the US and UK used the combination of inflation and Financial Repression to reduce their debts by an average of 3-4% of GDP per year, while Australia and Italy used higher inflation rates in combination with Financial Repression to more swiftly drop their outstanding debt by about 5% per year in GDP terms. As the crisis is much worse this time around, a substantially higher rate of inflation than that experienced in the 1945 to 1980 period is going to be necessary.

2) Negative Real Interest Rates. In a theoretical world, some would say that governments can’t inflate away debts because the free market would demand interest rates that compensate them for the higher rate of inflation. Sadly, this theoretical world has little to do with the past or present real world.

In the past (and all too likely in the future), there were formal government regulations that determined the maximum interest rates that could be paid. As an example, Regulation Q was used in the United States to prevent the payment of interest on checking accounts, and to put a cap on the payment of interest on savings accounts.

Regulation Q is long gone, but government control of short term interest rates has been near absolute over the last decade in the United States. As described in detail in my article linked below, “Cheating Investors As Official Government Policy”, the Federal Reserve has been openly using its powers to massively manipulate interest rates in the US, keeping costs low for the government while cheating tens of millions of investors.

http://danielamerman.com/articles/2011/Cheating.htm

So long as the Federal Reserve keeps control, there is no need for explicit interest rate controls. However, should the Fed begin to lose control, there is a strong possibility that interest rate controls will return to the US financial landscape, with similar regulatory controls being re-imposed in other nations.

3) Involuntary Funding. With this popular component of Financial Repression, the government establishes reserve or “quality” requirements for financial institutions that make holding substantial amounts of government debt mandatory - or at least establish overwhelming incentives for financial institutions such as banks, savings and loans, credit unions and insurance companies to do so. Of course, this is publicly phrased as “mandating financial safety”, instead of the more accurate description of mandating the making of investments at below market interest rates to help overextended governments recover from financial difficulties.

This involuntary funding is sometimes described as a hidden tax on financial institutions, but let me suggest that this perspective misses the important part for you and me. Because all financial institutions operating within a country are required to effectively subsidize this liquidation of government debt by accepting less than the rate of inflation on interest rates, the gross revenues ofall financial institutions are depressed, and therefore less money can be offered to depositors and policyholders. Because financial institutions make their money not on gross revenues, but on the spread between what they pay out and take in, then arguably, financial institution profits are not necessarily reduced, rather the guaranteed annual loss in purchasing power is passed straight through to depositors and policyholders, i.e. you and me.

As an example, if a fair inflation-adjusted return were 8%, and the spread kept by the financial institution was 2%, then we as investors would get 6%. If financial institutions, through involuntary funding, are uniformly forced to accept a 3% return on the government debt that must constitute a big portion of their portfolios, then they still keep 2%, but only pass through 1%. So the financial institution keeps 2% either way, and we as savers are the ones who ultimately pay this “hidden tax” in full, by getting a repressed 1% instead of a fair market 6% return.

4) Capital Controls. In addition to ongoing inflation that destroys the value of everyone’s savings and thereby the value of the government’s debts, while simultaneously making sure that interest rate levels lock in inflation-adjusted investor losses on a reliable basis, there is another necessary ingredient to Financial Repression: participation must be mandatory. Or as Reinhart and Sbrancia phrase it in their description / recipe for Financial Repression, it requires the “creation and maintenance of a captive domestic audience” (underline mine).

The government has to make sure that it has controls in place that will keep the savers in place while the purchasing power of their savings is systematically and deliberately destroyed. This can take the form of explicit capital and exchange controls, but there are numerous other, more subtle methods that can be used to essentially achieve the same results, particularly when used in combination. This can be achieved through a combined structure of tax and regulatory incentives for institutions and individuals to keep their investments “domestic” and in the proper categories for manipulation, as well as punitive tax and regulatory treatment of those attempting to escape the repression. A carrot and stick approach in other words, to make sure behavior is controlled.

Read the full article at Turning Inflation into Wealth

-

Financial Repression Explained

-

James G. Rickards (a.k.a. Jim Rickards), Senior Managing Director for Market Intelligence at Omnis, Inc explains Financial Repression in this interview with Eric King of KWN. You’ll have to bear with the first 1min 20sec of the advertisement & promotion.

-

-

Further Reading:

Lars Schall’s excellent interview with James Rickards, where he talks about the Fed’s role in maintaining negative real interest rates, how the Fed measures inflation and the managed “orderly” rise in gold. He touched on the workings of “Financial Repression” without referring to it directly.

Carmen M. Reinhart, economist & a fellow at the Peterson Institute for International Economics writes on Bloomberg News ”Financial Represssion Has Come Back to Stay“. Op-Ed article dated 12 Mar 2012

-

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

So what’s the out?