Archive

Surprise Strength in Gold

Submitted by Adrian Ash | BullionVault

Friday, 22 June 2012

Given the challenges it faces, gold so far in 2012 has in fact proven strong…

“GOLD PRICE PLUMMETS” is the obvious headline right now. But fact is, the gold price has in truth been surprisingly strong so far this year.

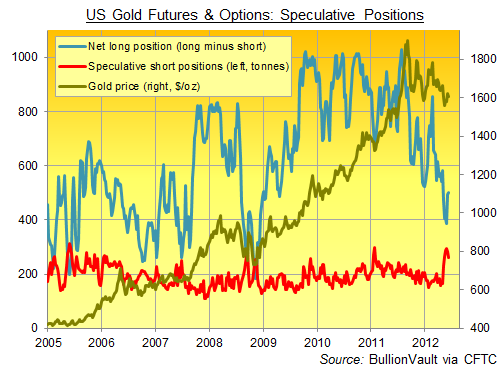

First up, the US gold futures and options market. These contracts rarely run to physical settlement, but still they wag the dog of physical prices near-term. Because the price of gold for future delivery of course affects how much people ask or bid for metal today.

That future price, whether being set by hedge funds or chased by doctors and dentists (private traders risk getting “filled and drilled” by retail brokers, or so goes the joke), is bet on with borrowed money. So credit is a big factor. And credit has vanished since last summer’s big peak in the gold price, just as did when Lehmans collapsed.

Next up, the world’s heaviest physical buyers – Indian households. Now overtaken by Chinese consumers, India buyers are always quiet this time of year (what with the monsoon season, a lack of auspicious festivals, and the post-harvest wedding and Diwali season still four months off). But New Delhi’s active policy of trying to stem gold bullion imports in 2012, plus the record-high prices set by the fast-sinking Rupee, have chewed up this massive support for global demand by perhaps 30% or more on best estimates.

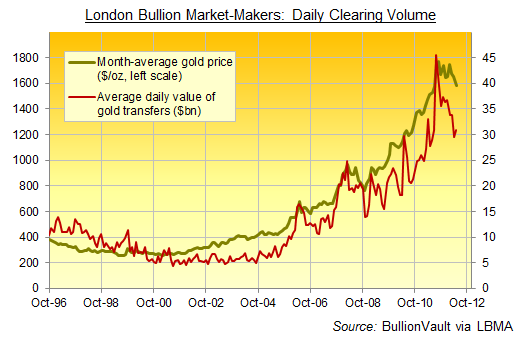

That’s had a big impact on the wholesale physical market – still centered in London, more than 80 years after Britain abandoned its Gold Standard. Physical investment demand from the big institutions has clearly eased off as well.

Here’s what the market-making bullion banks say they’re turning over each day on average between themselves. You can size it up by 5 times or more to get the true market-wide volume.

As you can see, London’s volume by value has sunk one-third by value since last summer’s peak. Yet the gold price has lost only 11% on its monthly average.

Now, perhaps that gap will be closed. Some speculative traders in the futures and options market certainly think so – and they think the gap will be closed by prices falling still further, as well.

See the red line in our first chart above. Speculative traders haven’t held this big a short position in gold since the price was down at $400 or so. But given these factors all weighing on price, “plunging gold” in fact looks pretty hardy. Existing sellers are refusing to slash their offers, and new buyers are still paying historically strong prices to acquire metal today.

Lucky for them, gold’s unique mix of inflation and default insurance is currently cheaper than its peak price of 12 months ago.

-

Adrian Ash is head of research at BullionVault – the secure, low-cost gold and silver market for private investors online, where you can buy physical gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

Central Banks Gold Demand Up, Supply Down in Q2 2011

Central banks’ purchases in the second quarter more than quadrupled compared to the levels in the corresponding period of 2010, according to the council’s report. Central banks are likely to remain net purchasers of gold. “Purchases of 69.4 tonnes during the second quarter of 2011 demonstrated that central banks are continuing to turn to gold to diversify their reserves,” WGC said in the report.

It added that gold supply was 1,058.7 tonnes in the second quarter, a four per cent decline from 1,108.3 tonnes in the same period last year, as a result of an increase in net purchases by central banks.

Ten years ago when the gold price touched $1,000 an ounce, it seemed improbable, and now the industry forecast is pegged at approximately $2,000 by 2015.

Asked if the high price of gold would be reached even earlier than that, Unni told Gulf News: “Considering the current fundamentals, further gains in gold are quite possible, but it will be difficult to envisage a high in the near term.”

He added that gold remains “vulnerable” if investors have to sell positions to cover any sharp fall in equity markets.

As per WGC’s estimates, gold demand in the second half of 2011 is expected to remain “strong”.

“The strength of demand in India and China, coupled with an overall drop in recycling activity this quarter, demonstrates that consumers have adjusted to the current price environment and expect the upward price trend to continue,” Marcus Grubb, managing director, investment, at the WGC, said in the report.

Dubai The rising price of gold is unlikely to impact the trading patterns in the UAE, according to commodity analyst Pradeep Unni. “The UAE, especially Dubai, is largely a trade centre and also a favourite tourist destination. Thus, jewellery trade in the region is unlikely to get effected by the price spikes or drops,” he said, adding that gold trading in Dubai constitutes to about “16 per cent” of the global gold trade.

Retailer Damas, too, does not expect much of an impact on sales in value terms.

“Our belief is that consumers have become slightly accustomed to high gold prices. There is even a strong consumer sentiment that the price might increase further,” said Raj Sahai, director, retail, at Damas.

The UAE emerged as the most resilient market in the Middle East according to WGC report, with second quarter tonnage demand just one per cent below year-earlier levels at 16.1 tonnes.