Credit where credit is due

-

“When you own gold you’re fighting every central bank in the world”. Jim Rickards

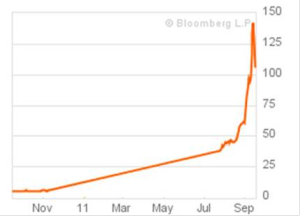

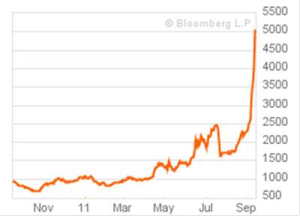

To a great extend, that holds true for silver as well. This week, holders of Political Metals lost a battle, but certainly not the war. Measured against the USD, gold and silver are worth less compared to a week ago by 9.6% and 26.3% respectively.

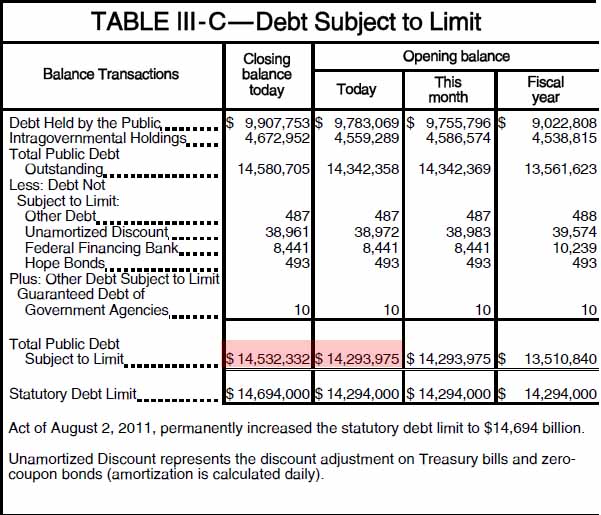

It all started with Ben Bernanke’s statement, following the 2-day FOMC meeting, stating the obvious - that “there are significant downside risks to the economic outlook, including strains in global financial markets”. His antidote was a plan to purchase $400 billion of long-term Treasury bonds and to sell an equivalent amount of short-term debt. More commonly referred to as “Operation Twist 2″, this plan seeks to further reduce long term interest rates, after having pledged to hold short term rates practically at zero until 2013.

That announcement, made in the backdrop of the Eurozone debt crisis and news of slower growth in China, sent global stocks and commodity markets into a waterfall decline. This set up was ideal for the bullion banks who have massive gold and silver short positions. All they needed to do was to pull the trigger, and that’s exactly what they did on Thursday. Silver was pushed down sharply through its key 50 and 200 day moving averages, triggering an avalanche of tech funds selling the following day.

Going for the final kill of the week, news of yet another margin hike by CME (gold by 21%, silver by 16%) leaked into the market towards the end of Friday’s trading day. That further fuelled the selling, pushing silver briefly below $30 before closing at $31.08 - down 26.3% for the week.

In other markets this week, the Dow suffered its biggest loss since 2008. In four days U.S. stocks lost $1.1 trillion in value. The MSCI all-country world share index (tracking thousands of stocks from developed and emerging countries) recorded its second worst quarter in 23 years and the 30-year bond rates dropped 55bps - the biggest move since the 1987 Black Monday.

So there you have it, Dr. Ben Bernanke, bullion banks & CME working together in perfect harmony. I don’t believe for a moment that the resulting market turmoil was any surprise to Bernanke. Despite saying that gold is not money, he’s smarter than most people made him out to be. After all, he achieved an SAT score of 1590 out of 1600, graduated from Harvard and has a PhD in economics from MIT. Contrary to its statutory mandate of foster maximum employment and price stability, this market turmoil I believe is a piece of precision engineering to achieve some larger agenda. This round is yours, congratulations Ben!

This engineered global markets take down could be part of the deflationary phase that Mike Maloney talked about, which is a prelude to the hyper-inflation phase. They have to assist the bullion banks cover their shorts and bring the Political Metals price down to a lower base before starting the next round of QE or equivalent. Marc Faber told ThomsonReuters that “if the S&P drops to around 900-950, we’ll get QE3 for sure”.

Four ways to view the developments over the past week

If you’re reading this blog, you’re not a professional or a day trader, possibly someone already invested in gold or silver, someone holding some Political Metals (I distinguish between investing & holding here) or someone in the process of researching the matter. As non professional traders, we have to look through and not at the turmoil unfolding before us. All of the bloody carnage above are on “paper” or bits on silicon - illusionary financial derivatives of something tangible (like gold and silver) or derivatives of something totally virtual and non-physical (like interest rates, bonds, debts, CDS, etc). Real or imaginary, they are all derivatives backed by nothing more than a promise or lies of a third party.

Unfortunately, in so far as gold & silver is concerned, the outcome of the imaginary paper price wars above gets applied to the physical world. Price discovery currently comes from the paper derivatives market. Banks and multi billion dollar hedge funds throwing thousands of futures contracts or bets at each other (most of which are done through computerised High Frequency Trading algorithms) determine the price of the coin or bar you pick up at your local bullion dealers. Until such time when this absurd situation of the tail wagging the dog changes, I suggest 4 possible ways for you to view the developments over the past week, using silver as an example.

There’s a big difference between Investing(1) & Holding(2). If you adopt approach (1), and are smart enough to handle scenario (3), congratulations! Trading this dip or swapping silver for gold just before the GSR shot over 56 would have reaped a handsome return. After years of following newsletter writers, both paid and free, I came to the conclusion that attempting to achieve (3) is at best illusionary, and at worst risky. This is particularly true in a manipulated market. Take a look at some of the forecasts by well respected industry players here. Either they missed this week’s price action or are not telling us something. Richard Russell puts it this way:

I look at gold and silver, not as a play for profits, but as an accumulation of hard assets, in a world that it drowning in fiat money, and a world that will probably print trillions more of irredeemable paper.

Finally, if you’ve been waiting patiently (4) or have spare dry powder, congratulations! While the paper price of gold & silver gets whacked, physical demand is very strong. KWN reported that Sprott Money temporarily runs out of physical silver. So, get ready to pick up your discount. Not necessarily immediately, but then again, picking the absolute bottom can also be illusionary. Best industry advise is cost averaging.

Updated:

- 28 Sep “On the basis of the hard information available early this week, it is highly likely that gold and silver prices were pushed down rather than fell as a result of free market trading.” Read Patrick A. Heller’s take on how the recent gold & silver market manipulation was orchestrated.

- 30 Sep “Engineered fall in gold and silver; Trying to scare people out of precious metals“ Gerald Celente

-

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year