New Digital Currency backed by nothing outperforming all other fiat currencies

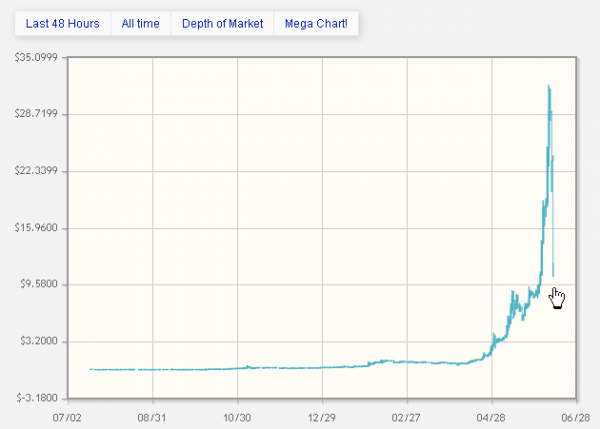

Just around the time silver suffered a waterfall decline, one little known “asset class” experienced an explosive gain of around 800% in a matter of weeks. It’s not gold, certainly not silver.

Just around the time silver suffered a waterfall decline, one little known “asset class” experienced an explosive gain of around 800% in a matter of weeks. It’s not gold, certainly not silver.

It’s BitCoin, a revolutionary 2-year old Digital Currency that’s not issued by anybody nor owned by anybody, and hence not controlled by anybody. Utilising an ingenious decentralized structure, Bitcoin relies on cryptography and mathematics to ensure security and reliability. If you understand P2P technology, you get the idea.

At first glance, it appears to be a just another high-tech virtual currency backed by nothing, certainly not by gold or silver. But how does it compare with other fiat currencies?

The USD (or any local equivalent) in your pocket is backed by nothing save by the “full faith and credit of the US government” and can be created at will out of thin air. Unlike the USD & all other fiat currencies, new BitCoins cannot be created out of nothing by a select few. Work, in the form of computing resources, has to be expended before each new BitCoin can come into existence.

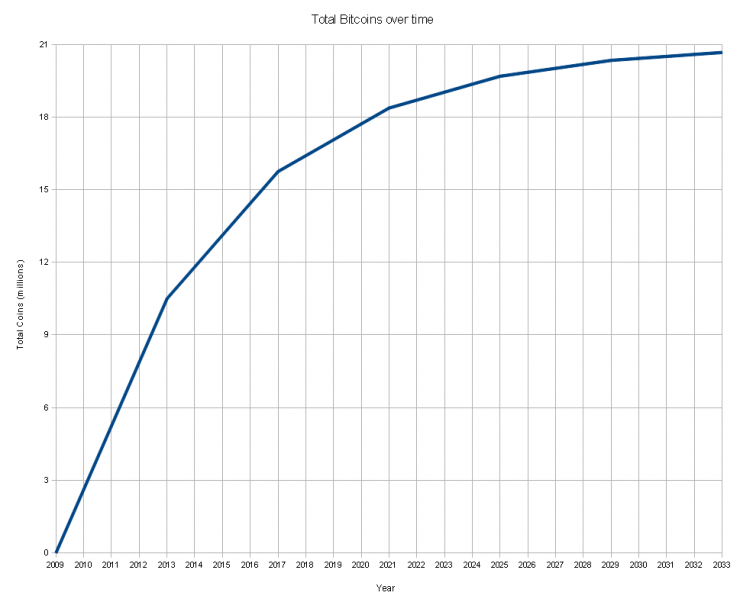

BitCoin creation over time, with a maximum of 21 million. Current BTC in circulation is around 6,519,900

While Ben Bernanke or any other Central Banker is able to create an infinite amount of new fiat money, BitCoin has a built-in mathematical limit of 21 million BTC (unit of BitCoin), expected to be reached in the year 2140.

Perhaps the most significant is the difference in the rate of new money creation. Fiat money is being created at an exponentially increasing rate, while creation of new BitCoins is mathematically restrained to be increasingly more difficult to create over time.

Don’t have any BitCoins but want some? You may want to start Mining for BitCoins before it runs out!… Or considering how difficult it already is, you’ll probably be better off just waiting to invest in a junior BitCoin mining company ![]()

Could this potential scarcity be what’s driving up the BitCoin exchange rate over the past few weeks? Or was it just due to a burst of publicity. Whatever it is, anything that rises in a hyperbolic manner falls just as fast. See the chart below, captured at time of writing (11.30am NZT).

BitCoin Exchange Rate as at June 13 NZT

-

Watch the Startups interview with Gavin Andresen and Amir Taaki, 2 of the developers currently behind BitCoin (recorded when BitCoin was at about $5).

-

You may want to fast-forward to about 7mins into the video

-

Updated: 15 Jun 2011 - BitCoin exchange rate has bounced off its recent low as quickly as it fell. Currently between it’s 10 day and 25 day simple moving average.

Click on the image for live chart

-

Leave a Reply Cancel reply

Most Popular

Most Recent

- Gold: Is It Really In a Pricing Bubble?

- The Politics of Gold

- Potential sharp moves in gold & silver prices. Which direction?

- Malaysian Central Bank Raided “Gold Investment” Company

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Finding Silver: For a change, forget about the politics and financial aspects of silver. Let's appreciate the science & the engineering behind that beautiful silver coin. |

|

High Frequency Trading: You can get in easily. "Getting out is the problem" David Greenberg, former NYMEX board and executive committee member. Paper gold & silver markets are dominated by HFTs. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- More Stunning Developments In The Gold & Silver Markets October 14, 2012

- Exclusive - Riots & Money Fleeing The Euro Into Gold & Silver October 13, 2012

- Art Cashin - We Are At Risk Of A Frightening Hyperinflation October 12, 2012

- Fleckenstein - Gold & Insane Central Banks Printing Trillions October 12, 2012

- Embry - This War In Gold & Shorts Getting Overrun October 12, 2012

- The $2 Trillion European Bailout Package Is Coming October 11, 2012

- Turk - Expect A Massive Short Squeeze In Gold & Silver October 11, 2012

- Lost Confidence Can’t Be Restored & Gold’s Final Move October 11, 2012

Finance & Economics

Finance & Economics

- The Top 15 Economic 'Truth' Documentaries October 14, 2012 Tyler Durden

- Guest Post: How To Spot A Keynesian October 14, 2012 Tyler Durden

- The Punch Line: All The Charts That's Fit To Print October 14, 2012 Tyler Durden

- Why Are Americans So Easy To Manipulate? October 14, 2012 Tyler Durden

- Guest Post: On Currency Swaps And Why Gartman May Be Wrong In Focusing On The Adjusted Monetary Base October 14, 2012 Tyler Durden

- Bernanke – I Want To Pick A Fight With China October 14, 2012 Bruce Krasting

- 23 Miles Of Free Fall - Live Webcast Of Felix Baumgartner's Third World Record Attempt From The Edge Of Space October 14, 2012 Tyler Durden

- More Middle East Escalation: Turkey, Syria Bar Flights Over Each Other's Airspace October 14, 2012 Tyler Durden

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)