When will the paper currency you’re holding be the next victim of this global currency war?

-

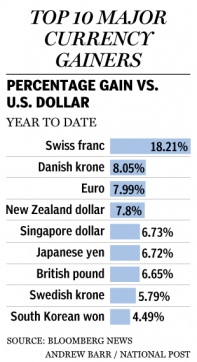

Top 10 currency gainers as at Aug 2011

Two weeks ago, the Swiss Franc was one of the most sought after currencies. Yesterday, a short statement from the Swiss National Bank (SNB) turned the tide.

The current massive overvaluation of the Swiss franc poses an acute threat to the Swiss economy and carries the risk of a deflationary development.

The Swiss National Bank (SNB) is therefore aiming for a substantial and sustained weakening of the Swiss franc. With immediate effect, it will no longer tolerate a EUR/CHF exchange rate below the minimum rate of CHF 1.20. The SNB will enforce this minimum rate with the utmost determination and is prepared to buy foreign currency in unlimited quantities.

Even at a rate of CHF 1.20 per euro, the Swiss franc is still high and should continue to weaken over time. If the economic outlook and deflationary risks so require, the SNB will take further measures

That’s how fragile the so called safe haven currencies are. Their value and potential devaluation is just a few keystrokes away. This was not the first time the SNB intervened to devalue its currency. It quadrupled its foreign currency holdings in the first half of 2010 in a similar effort to manage the CHF resulting in a record $21 billion loss. Going further back, it pegged the Franc to the German Mark at 0.80 in 1978 resulting in soaring inflation.

Yesterday’s intervention resulted in this dramatic move in the price of gold priced in CHF. That’s not surprising considering the fact that it pledged to ” buy foreign currency in unlimited quantities”. Unlike Greece and other Eurozone countries in crisis, the SNB can print unlimited quantities of CHF to honour that pledge.

-

Putting a floor below 1.2 EUR/CHF appears to be worse than the much criticized move by Malaysia to peg the Ringgit at 3.8 to the USD in 1998. Unlike a peg, a floor allows the CHF to weaken but not strengthen against the EUR. One has to wonder, what will happen to this “former safe haven” currency if the Euro collapsed.

Of late, currency devaluation, capital controls and aggressive central bank interventions have become acceptable, if not respectable, as seen in Brazil, Japan, Switzerland, Iceland, Vietnam & the once almighty US, just to name a few.

When will the paper currency you’re holding be the next victim of this global currency war?

Related Articles:

- Gold is the only safe-haven asset that will not do QE, put in capital controls, or complain

- As Swiss devalue their franc, gold may be last currency standing

- 20 Quotes From European Leaders That Prove That They Know That The Financial System In Europe Is Doomed

-

Leave a Reply Cancel reply

Most Popular

Most Recent

- Gold: Is It Really In a Pricing Bubble?

- The Politics of Gold

- Potential sharp moves in gold & silver prices. Which direction?

- Malaysian Central Bank Raided “Gold Investment” Company

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Finding Silver: For a change, forget about the politics and financial aspects of silver. Let's appreciate the science & the engineering behind that beautiful silver coin. |

|

High Frequency Trading: You can get in easily. "Getting out is the problem" David Greenberg, former NYMEX board and executive committee member. Paper gold & silver markets are dominated by HFTs. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- More Stunning Developments In The Gold & Silver Markets October 14, 2012

- Exclusive - Riots & Money Fleeing The Euro Into Gold & Silver October 13, 2012

- Art Cashin - We Are At Risk Of A Frightening Hyperinflation October 12, 2012

- Fleckenstein - Gold & Insane Central Banks Printing Trillions October 12, 2012

- Embry - This War In Gold & Shorts Getting Overrun October 12, 2012

- The $2 Trillion European Bailout Package Is Coming October 11, 2012

- Turk - Expect A Massive Short Squeeze In Gold & Silver October 11, 2012

- Lost Confidence Can’t Be Restored & Gold’s Final Move October 11, 2012

Finance & Economics

Finance & Economics

- Guest Post: Can Government Create Opportunity? October 14, 2012 Tyler Durden

- Did Central Bankers Kill The Single-Name CDS Market (For Now)? October 14, 2012 Tyler Durden

- The Top 15 Economic 'Truth' Documentaries October 14, 2012 Tyler Durden

- Guest Post: How To Spot A Keynesian October 14, 2012 Tyler Durden

- The Punch Line: All The Charts That's Fit To Print October 14, 2012 Tyler Durden

- Why Are Americans So Easy To Manipulate? October 14, 2012 Tyler Durden

- Guest Post: On Currency Swaps And Why Gartman May Be Wrong In Focusing On The Adjusted Monetary Base October 14, 2012 Tyler Durden

- Bernanke – I Want To Pick A Fight With China October 14, 2012 Bruce Krasting

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)