JP Morgan Chase for Dummies

-

Breaking News:

JP Morgan sent out a notice at 4:30 p.m. that it would be holding a conference call at 5 p.m. which will include CEO James Dimon.

At the conference call, as reported by WSJ, Jamie announced that the the largest US bank has “taken $2 billion in trading losses in the past six weeks and could face an additional $1 billion in second-quarter losses due to market volatility”.

Here’s a Dummy trying to make sense of Wallstreet speak.

The losses stemmed from derivatives bets gone wrong in the bank’s Chief Investment Office, a part of the corporate branch of the bank that manages risk… Jamie announced.

So they lost $2 billion in 6 weeks and possibly another $1 billion over the next month. But what exactly are these derivative bets? Isn’t betting associated with gambling? Did the largest bank in the US take some of their bailout money, went gambling and now calling a press conference to announce their losses?

Mr. Dimon said the so-called synthetic hedge, using insurance-like contracts known as credit-default swaps, was “poorly executed” and “poorly monitored.” He said the bank has an extensive review underway of what went wrong, and that there were “many errors,” “sloppiness” and “bad judgment” on the bank’s part.

Ah… it’s not gambling, it’s actually a “synthetic hedge”. But I don’t even understand what’s a hedge, never mind the difference between synthetic and real! All I know up to this point is they lost big time through derivatives bets, which is a synthetic hedge, also known as credit-default-swaps. That’s quite a mouthful for a mere mortal.

What then are these credit-default swaps?

I know what’s a swap. You give me something, I give you another. But they’re swapping “credit-default” for something else? That sounds like a weird thing to be swapping. Fortunately I have good ole Wikipedia to the rescue:

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a loan default or other credit event. The buyer of the CDS makes a series of payments (the CDS “fee” or “spread”) to the seller and, in exchange, receives a payoff if the loan defaults.

Oh, how could I have missed something so obvious! Didn’t Mr. Dimon say it’s an “insurance-like” contract? Now I get it, so I’ll just call it an insurance. JP Morgan sells insurance and receives an insurance premium. It works something like this: You lend me money, then buy an insurance policy from JPM saying that if I fail to repay your loan when it becomes due, they will pay you for the sum insured.

But insurance companies do payouts all the time. What’s the big deal? Then I recall that when there’s a major disaster - like the recent Christchurch earthquake, the payout was so big that AMI, the insurer, went under and had to be bailed out by the government to the tune of NZ$1 billion.

Now it begins to make sense why the conference call was made in such a haste. I recall that Greece defaulted in their debt triggering a payout around a figure of $3.5 billion, and I know JP Morgan is one of the major insurers and major holders of other types of “insurance contracts” collectively known as OTC Derivatives.

But how big exactly is JPM’s potential liability to these kinds of bets?

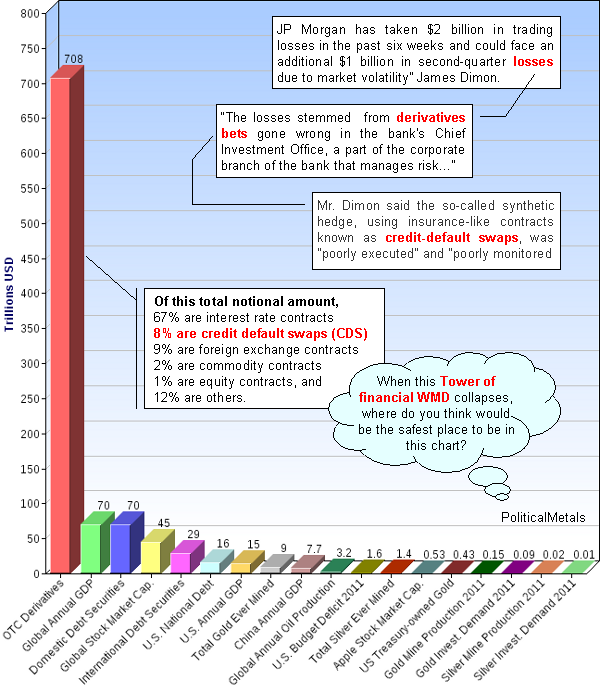

According to the Bank of International Settlements (BIS), which is the Central Bank of all national Central Banks, the total outstanding OTC Derivatives is $708 Trillion. Of this total notional amount,

- 67% are interest rate contracts,

- 8% are credit default swaps (CDS),

- 9% are foreign exchange contracts,

- 2% are commodity contracts,

- 1% are equity contracts, and

- 12% are others.

Since CDS makes up only 8% of the total OTC Derivatives, and a relatively minor default by Greece caused such a significant loss for JPM, imagine what will happen to JPM and the likes of JPM when the other PIGS countries ( Portugal, Italy, Greece and Spain) actually go into default. Also imagine what will happen when the interest rate contracts, comprising the bulk of OTC Derivatives actually triggered?

There must be good reasons why derivatives are referred to as Financial Weapons of Mass Destruction (WMD). Trying to time the explosion or implosion of this WMD is futile. Preparing for its consequences is vital. Take a look at the chart below, and see if you can spot where in this crazy world of finance is the safest place to be.

Mouse over each bar for details. Click to read data source

Updates:

- J.P. Morgan Chase fell 9.2%, its biggest percent drop since August

- Federal Reserve Officials investigating JPM’s losses

- Bernanke’s speech on May 10 “Conditions in the banking system-and the financial sector more broadly-have improved significantly in the past few years..”

- Derivatives: The $600 Trillion Time Bomb That’s Set to Explode

- Double or Nothing: How Wall Street is Destroying Itself (using Martingale system)

- Jim Willie explains JPM’s precarious position, new global financial system & why the USA will be a 3rd world state going forward

-

Leave a Reply Cancel reply

Most Popular

Most Recent

- Gold: Is It Really In a Pricing Bubble?

- The Politics of Gold

- Potential sharp moves in gold & silver prices. Which direction?

- Malaysian Central Bank Raided “Gold Investment” Company

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Finding Silver: For a change, forget about the politics and financial aspects of silver. Let's appreciate the science & the engineering behind that beautiful silver coin. |

|

High Frequency Trading: You can get in easily. "Getting out is the problem" David Greenberg, former NYMEX board and executive committee member. Paper gold & silver markets are dominated by HFTs. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- More Stunning Developments In The Gold & Silver Markets October 14, 2012

- Exclusive - Riots & Money Fleeing The Euro Into Gold & Silver October 13, 2012

- Art Cashin - We Are At Risk Of A Frightening Hyperinflation October 12, 2012

- Fleckenstein - Gold & Insane Central Banks Printing Trillions October 12, 2012

- Embry - This War In Gold & Shorts Getting Overrun October 12, 2012

- The $2 Trillion European Bailout Package Is Coming October 11, 2012

- Turk - Expect A Massive Short Squeeze In Gold & Silver October 11, 2012

- Lost Confidence Can’t Be Restored & Gold’s Final Move October 11, 2012

Finance & Economics

Finance & Economics

- The Top 15 Economic 'Truth' Documentaries October 14, 2012 Tyler Durden

- Guest Post: How To Spot A Keynesian October 14, 2012 Tyler Durden

- The Punch Line: All The Charts That's Fit To Print October 14, 2012 Tyler Durden

- Why Are Americans So Easy To Manipulate? October 14, 2012 Tyler Durden

- Guest Post: On Currency Swaps And Why Gartman May Be Wrong In Focusing On The Adjusted Monetary Base October 14, 2012 Tyler Durden

- Bernanke – I Want To Pick A Fight With China October 14, 2012 Bruce Krasting

- 23 Miles Of Free Fall - Live Webcast Of Felix Baumgartner's Third World Record Attempt From The Edge Of Space October 14, 2012 Tyler Durden

- More Middle East Escalation: Turkey, Syria Bar Flights Over Each Other's Airspace October 14, 2012 Tyler Durden

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)