Why Borrow When You Can Print?

-

Positive Money is a movement in the UK and NZ campaigning to remove the power of money creation from the hands of private banks. Their solution to the global debt crisis is to empower governments to create debt free (hence interest free) money out of nothing and spend it directly into the economy. It boils down to this idea - Why borrow when you can print?1

Over in the U.S., key proponents of government issued debt-free fiat money are Bill Still, the producer of The Money Masters & 2012 Libertarian Presidential Candidate and Lyndon LaRouche, an 8-time presidential candidate. Still considers the current debt-based money a form of slavery and gold-backed money as the ultimate centralization of the money power - in the hands of “those few best able to buy up the commodity serving as the monetary base”.

No Gold

Given the choice between the current system where governments borrow money from private banks (who created it out of nothing and charging interest which has to be paid from tax payers’ hard earned money) and the Positive Money system where governments create the debt-free money outright, it seems a no-brainer that it should be the latter.

For a nation like New Zealand, where its central bank (RBNZ) owns zero ounces of gold, any form of gold-backed money is not even an option. Hence, empowering the government to create debt-free money backed by nothing seems to be the only way out of the public debt spiral. But will it work?

One of the main objections to such a system is the fear of monetary inflation, leading inevitably to price inflation. While we can’t trust the bankers, what makes us think we can trust the politicians and the government of the day not to print the currency into oblivion? To overcome this fear, proponents of the Positive Money system in NZ have suggested that

decisions on changes in the money supply will be made not by elected politicians but by an independent body (the Monetary Policy Committee). Politicians will have no influence whatsoever on the amount of money that will be created.

So far so good, but unlike the money whose quantity the committee is tasked to control, members of this “independent body” cannot be created out of thin air! They have to be either:-

- appointed by an authority or

- elected into office directly.

Therein lies the problem. If we adopt the model of judicial appointments in NZ, the Executive branch of government would be the authority. While NZ has been fortunate that its judicial appointments have so far been relatively free of party political considerations, the same cannot be said of many countries, including Malaysia and the US. Appointees report to and are often beholden to the appointing authority. If, on the other hand, members were appointed by parliament or were elected directly, we’re back to square one - campaigns, funding, media. Who controls these influences the outcome.

Assuming the appointment or election process were totally free of “political considerations” or vested interests, what is there to prevent such a high profile Monetary Policy Committee from being subject to and influenced by intense lobbying, considering the fact that the fate of the nation’s economy & politics hinges on its decisions.

I see a mirror image of the 12 FOMC members meeting behind closed doors controlling the money supply in the US. Are they not appointed directly and indirectly by the President and confirmed by the Senate, and are supposed to be independent? In fighting against Ron Paul’s Audit the Fed bill, did Bernanke not emphasized that he prefers to keep it the way it is to protect the Fed’s independence? It doesn’t take a brain surgeon to figure out the Fed’s independence or its lack thereof.

Notwithstanding the above-mentioned challenges, being the first to implement such a system under the current environment where all national currencies are debt-based may make NZ stand tall among other indebted nations. I can see the PIIGS nations salivating! As the first nation issuing debt-free money in modern times, the government’s interest-bearing debt at just over 20% of GDP could be rapidly brought down to zero. Tax payers’ money can be channeled to the rebuilding of Christchurch instead of ending up in the coffers of private banks, most of them Australian owned anyway. Debt-laden local councils can be funded directly from federally created new money, thereby lowering rates and improving services.2

The list of merits goes on and on….. until gold is brought into the equation.

Central Banks’ Gold

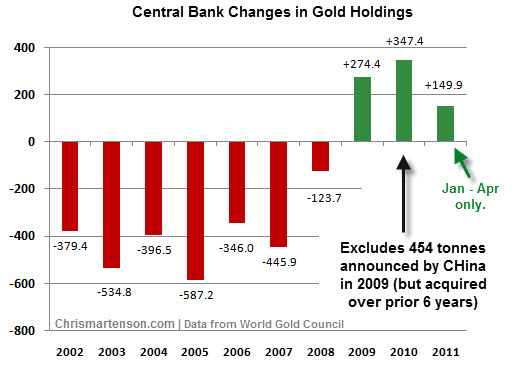

For reasons best known to the RBNZ, the nation’s reserves in gold remains at zero after the last of its 22,505 oz of gold was sold in 1989, while the rest of the world’s central banks have turned net buyers of gold since the financial crisis. Many have been aggressively pilling up on their gold reserves.

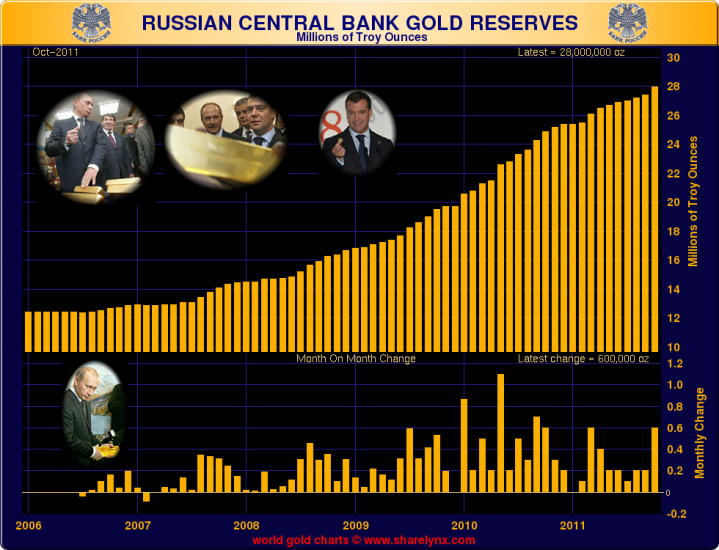

A case in point is Russia. They had the foresight to be steadily accumulating gold as reserves years before the 2008 financial crisis struck.

While China does not report its gold reserves as transparently, it’s widely known that it is silently converting part of its US$3 trillion reserve into hard money in the form of the yellow metal. As the world’s largest gold producer, none of the locally mined gold is allowed to be exported while reports pop up every now and then about massive gold imports through Hong Kong. They’ve even started scrapping the golden barrel of cash-strapped North Korea with a total import of 2 tons over the past year. The Voice of Russia recently reported that “China wants to increase gold reserves six-fold“.

India’s central bank was one of the first to reverse the trend with its massive 200 tons purchase from the IMF way back in 2009, creating a sharp spike and and a sustained rise in the price of gold.

And it’s not just the giants. According to the World Gold Council, central banks of other countries that have been stacking gold include Argentina, Bolivia, Mexico, Sri Lanka, Bangladesh, Thailand, Philippines, South Korea, Kazakhstan, Turkey and Ukraine, Estonia, Malta, just to name a few, not forgetting the repatriation of Venezuela’s 211 tonnes of gold last year. Paraguay became the latest central bank buyer, sharply boosting their gold reserves from a few thousand ounces to over 8 tonnes.

And it’s not just the giants. According to the World Gold Council, central banks of other countries that have been stacking gold include Argentina, Bolivia, Mexico, Sri Lanka, Bangladesh, Thailand, Philippines, South Korea, Kazakhstan, Turkey and Ukraine, Estonia, Malta, just to name a few, not forgetting the repatriation of Venezuela’s 211 tonnes of gold last year. Paraguay became the latest central bank buyer, sharply boosting their gold reserves from a few thousand ounces to over 8 tonnes.

Across the ditch, Australia has been sitting tight on their 80 tons watching their reserves in gold rise steadily.

It is evident that central bankers are placing increasing importance on the role of gold as part of a nation’s reserve. Why? They are not telling. Why is RBNZ not hoarding any gold? They are not telling either.

All we need is one, just one major player to announce that they are pegging their national currency to gold for existing debt-based fiat currencies and the proposed debt-free fiat currencies to be dropped like hot potatoes in favor of the new gold-backed currency. This is especially so after the world has witnessed the disastrous failure of a 40-year global experiment with debt-based fiat currencies.

Bear in mind that the once almighty US$, the global reserve currency following the Bretton Woods agreement after WW2, is currently under threat. Its petro-dollar status is also under threat, and significantly so by the same nations stock pilling gold at a frantic pace. The competition (by China, according to WikiLeaks cable) for the next global reserve currency is underway among the economic powerhouses, and a gold backing may just tip the balance.

All other smaller countries have not much choice other than to be prepared to go with the flow.

Conclusion

While the debt-free money concept is the way to go, perhaps it should be just the first step towards sound money whose quantity is regulated directly or indirectly by something tangible rather than press statements from a small group of people meeting behind closed doors.

-

Notes:

1 Don Richards of Positive Money NZ wrote to Bill English, Minister of Finance seeking a meeting to present the proposal. Here’s the Minister’s reply and Don’s response.

2 Sue Hamill of Positive Money NZ’s submission before the select committee on the Local Government Act 2002 Amendment Bill 27-1.

Additional Resources

- IMF Working Paper “The Chicago Plan Revisited” by Jaromir Benes and Michael Kumhof. Discussion on government-issued money, 100% reserve banking as opposed to our current fractional reserve banking, and removal of private banks’ privilege to create new money by the extension of credit.

- From Canada to NZ, and everywhere in between, people are waking up!

- Watch The Money Masters, a full length historical documentary at the Calm Before the Storm page.

- |

- This short clip by Positive Money UK explains the process of money creation out of thin air using mortgages & housing as an example.

- If your curiosity over the subject of money creation was piqued by this video, consider reading “Modern Money Mechanics” – by The Federal Reserve Bank of Chicago. It may change your thinking about what to do with your money.

Leave a Reply Cancel reply

The Race to Debase

Monitoring the Currency Wars

Most Recent: Australia Interest Rate Cut

Watch List: HKMA's 8th intervention in 2 weeks

|

Currency Wars Simulation |

Most Popular

Most Recent

- Turkish prime minister says gold should replace dollar

- China: “Gold plays a very important role in the formation of the financial market system”

- Obama’s Second Coming & Streets of Gold

- Why Are These IP Addresses Important?

- Gold-Backed Bonds & Europe’s New Gold Standard

- Relooking At Man’s Addiction To Gold

Archives

Featured Reviews

16Oct: Jeff Clark (Casey Research)

$2,300 gold by January 2014

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

>> More forecasts & forecast accuracy

Featured Videos

|

Mike Maloney on the Fiscal Cliff with Lauren Lyster of Capital Account, RT. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- Richard Russell - Multi-Trillion Dollar Question, Stocks & Gold November 13, 2012

- Turk - The Fed Is Playing An Extraordinarily Dangerous Game November 12, 2012

- Embry: China To Import A Staggering 775 Tons of Gold In 2012 November 12, 2012

- The Die Is Cast And Only One Question Remains November 11, 2012

- Falling Markets & Why Gold Shorts Are Getting Suckered November 11, 2012

- What’s Next For Gold As Governments Become More Desperate November 10, 2012

- Celente - Gold, Silver, Riots, Theft & Global Collapse November 10, 2012

- The Greatest Fear Of A $100 Billion Asset Mgr. Going Forward November 10, 2012

Finance & Economics

Finance & Economics

- Degrees For Dollars: Students Petition Uncle Sam To Refund Student Loans For Worthless Diplomas November 13, 2012 Tyler Durden

- Q2 Total Gross Notional Derivatives Outstanding: $639 Trillion November 13, 2012 Tyler Durden

- The Totally 'Normal' 2% Dump-And-Pump Silver Market November 13, 2012 Tyler Durden

- Bob Janjuah Waves Goodbye To The Greater Fool November 13, 2012 Tyler Durden

- Quote Of The Day: "That Was Not A Joke" November 13, 2012 Tyler Durden

- The Strange (and Worrisome) Symmetry Of Bernanke's Bull Market November 13, 2012 Tyler Durden

- Wall Street Prepares For Bonus Season Pain As Comp Set To Slide November 13, 2012 Tyler Durden

- On The Game-Theoretic Market Crash 'Solution' To The Fiscal Cliff November 13, 2012 Tyler Durden