BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

All the gold price charts posted on the web (including those appearing on the right column of this page) do not represent the actual price one would pay for a physical ounce of gold. The price shown is the spot price, the price that is quoted in major exchanges if you want to buy gold today, and are sometimes referred to as the “paper gold” price. Traders buy and sell “paper gold” contracts derived from the spot price for settlement at a future date (gold futures contracts).

Put another way, if you walk into your coin dealer’s office, you will not be able to buy and take delivery of your gold coin at the spot price. The actual price of physical gold transacted is always the spot price plus a premium, the size of which varies from dealer to dealer. You may have noticed that during occasions when the spot price dropped sharply, your dealer will either post an “out of stock” notice or charge you a premium way higher than usual. The same applies for silver, only worse. In other words, the spot price is quite a poor representation of the actual price of gold traded physically on a cash basis. Wouldn’t it be great if we could obtain the actual price charged by all dealers in real time, average them and present it on a real time chart?

While that is a near impossibility, we do have a close approximation in the BullionVault’s electronic trading platform. BullionVault is an online dealer that provides a peer-to-peer trading platform for its customers to buy physical gold (& silver) from the company acting as principal or from any of their customers seeking to sell what they have previously bought. All transactions are in cash and physical bullion. You can only buy metals to the value of your outstanding cash balance and you can only sell metals up to the quantity physically stored in the vault. (See review of the company here).

The above is a ticker displaying the most recent transactions in real time available on their homepage. Way back in May 2009, I wrote to BullionVault requesting them to include this data series in their real time spot price chart. I figure that would give an indication of how much in sync or otherwise is the physical market with the price actions seen on the spot market. Obviously they’ve chosen not to take up the suggestion as the data, though available, is still not published in the form of a real time chart. I suspect it could be because the volume and frequency of transactions is still too low for the chart to look presentable.

Nevertheless, BullionVault today introduced and published the BullionVault’s Gold Investor Index. It seeks to track how private investors react to the price actions in gold. I guess this is BullionVault’s preferred method of monitoring this trend. Read the full article submitted for publication by Adrian Ash below.

-

Submitted by Adrian Ash | BullionVault

Wednesday, 3 October 2012

So, Who’s Been Bidding Gold Higher? A unique, innovative tool for seeing just what private investors are doing in gold…

GOLD was up, up and away in September. But who was doing the buying?

New data we released today here at BullionVault show that private households across Western Europe and the US continue to join the bull market. But their response to QE3 and the latest phase of the Eurozone crisis is more measured – you might even say complacent – than the recent price action alone suggests.

“There has until now been a lack of hard data on self-directed retail investors in gold,” said Marcus Grubb of the World Gold Council, which is a shareholder in BullionVault, at today’s launch here in London of our new Gold Investor Index.

“For instance, the data we produce [the excellent Gold Demand Trends] is more at the macro level, including institutional and private wealth management. This new Gold Investor Index is a real innovation – a unique and useful addition to the data already available. It’s a coincident indicator of what private households are choosing to do with regards to physical gold.”

How so? BullionVault’s new Gold Investor Index is a monthly data point based on actual trading on BullionVault, the world’s largest provider of physical gold ownership to private investors. Since launch in April 2005 it’s now been used by more than 42,000 private investors from 159 countries worldwide.

Almost 90% of BullionVault users live in the UK, US or Eurozone. So the Gold Investor Index shows what the largest pool of private gold investors in the developed Western world is doing with its metal – either buying more or selling, or choosing to sit tight. They can all make that decision as they choose using BullionVault’s peer-to-peer exchange online, a truly international market in physical bullion which is accessible to people all over the world. You will not find a more reliable guide to the wider retail-investment market in physical gold.

How does BullionVault’s Gold Investor Index work? First, it takes the balance of net buyers (who added to their holdings, and so includes new entrants) versus net sellers over the last calendar month. The index then shows that figure as a proportion of all existing gold owners to give a comparable series over time. The index is rebased so that a perfect balance of buyers and sellers would give a reading of 50.0.

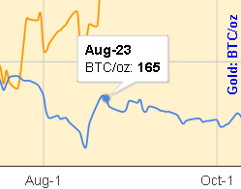

In September this year therefore, and as the chart shows, self-directed investors in the West grew more bullish on gold. Rising from August’s reading of 52.1 to 52.5, however, the Gold Investor Index still lagged levels seen earlier this year, and it was well below the series-record to date – the level of 71.7 hit in September 2011.

So, September 2012′s reading on the Gold Investor Index undoes any talk of a “gold bubble” amongst Western households. Because the private investor response to QE3 and the latest phase of the Eurozone crisis is far more measured than the last time gold prices reached their current level. This may give succour to central bankers and other policymakers hoping to buy time. The index suggests households are less anxious about inflation or a currency crisis than bank analysts and managed wealth advisors.

It’s hard to find any gold bears amongst professional investors right now. Amongst self-directed retail investors too, sentiment towards gold is bullish. But hard transactional data from the world’s largest pool says they’re not as bullish – in aggregate – as they were earlier in the year. And sentiment towards gold is way below the moments of extreme investor stress seen previously in this financial crisis, such as late-summer 2011.

The new Gold Investor Index confirms what we’re hearing from our friends and contacts in the coin and small-bar business. Sales have been lacklustre since spring. That may change, however, if the UK’s over-valued Pound, the Eurozone’s unceasing crisis, and the US fiscal cliff crash into each other towards New Year. Either way, the new Gold Investor Index will clearly show how private investors respond.

Attachments

Gold-Investor-Index-Sept-12-2.png (size: 21.83 KB)

GoldInvestorIndexSept12.xls(size: 35 KB)

Leave a Reply Cancel reply

The Race to Debase

Monitoring the Currency Wars

Most Recent: Australia Interest Rate Cut

Watch List: HKMA's 8th intervention in 2 weeks

|

Currency Wars Simulation |

Most Popular

Most Recent

Archives

Featured Reviews

16Oct: Jeff Clark (Casey Research)

$2,300 gold by January 2014

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

>> More forecasts & forecast accuracy

Featured Videos

|

Mike Maloney on the Fiscal Cliff with Lauren Lyster of Capital Account, RT. |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- Falling Markets & Why Gold Shorts Are Getting Suckered November 11, 2012

- What’s Next For Gold As Governments Become More Desperate November 10, 2012

- Celente - Gold, Silver, Riots, Theft & Global Collapse November 10, 2012

- The Greatest Fear Of A $100 Billion Asset Mgr. Going Forward November 10, 2012

- ’87 Market Crash & Stocks Today, Apple, Gold, Silver & the VIX November 9, 2012

- Huge Moves Coming In Gold, Silver, US Dollar & The Euro November 8, 2012

- This Is How Gold & Silver Will Fare If Stocks Are Crushed November 8, 2012

- What You Need To Know About The Coming Gold & Silver Move November 7, 2012

Finance & Economics

Finance & Economics

- Israel Launches A Missile Into Syrian Territory For The First Time In 39 Years November 11, 2012 Tyler Durden

- Ron Paul: A New Beginning November 11, 2012 Tyler Durden

- Deep Sunday Morning Thoughts From Bill Gross November 11, 2012 Tyler Durden

- Shuffle Rewind 05-09 Nov " Wake Up " (Rage Against The Machine, 1992) November 11, 2012 AVFMS

- If The Greek Elections Were Held Today November 11, 2012 Tyler Durden

- Barclays' Barry Knapp Batters Bullish Believers November 10, 2012 Tyler Durden

- Spain's "Terrible And Inhumane" Situation Prompts End To Evictions November 10, 2012 Tyler Durden

- Why Did CIA Director Petraeus Suddenly Resign … And Why Was the U.S. Ambassador to Libya Murdered? November 10, 2012 George Washington

This is an interesting analysis. What I think it shows though is that most private investors are bad at timing, which has been proved many times before with equity and fund investing - see monkeywithapin.com for example. They invest at the wrong time ie the tops of the market (ie Oct 11) and they don’t when the market gets cheap (ie summer 2012). Therefore I very much doubt this analysis will be much use to anyone I’m afraid.

Having said that, it does confirm that the recent price rises are not due to retail investors directly - they are via retail/hedge funds, the professional investors and central banks.

Hi Pete,

Yes, it’s unfortunate the index correlates positively with the price. As defined by BullionVault, the index measures the number of clients making purchases at a particular price point, but not the quantity of gold purchased.

I have some charts tracking the total weight of gold and silver held by BullionVault & GoldMoney’s customers here and here (updated quarterly). Looking at these charts together with the index chart, we may conclude that while the number of private investors buying gold decreases during periods of corrections or dips, the volume of metals held does not drop. In fact they continue to rise, albeit at a slower rate. It indicates that these holders of gold & silver fall into the “strong hands” category.