The New Trend in Gold (& Silver)

By Jeff Clark | Casey Research

It’s not too often that you see a major shift within the gold market.

The last such recalibration in sentiment for gold investors was the introduction of the first gold-backed ETF in 2004, and the subsequent explosion in exchange-traded products (ETPs) for bullion and precious-metals equities.

Today, another tidal change is under way, as the flow of funds into structured bullion products ebbs. I think this shift - as you’ll read about in a moment - signals two things. First, it confirms that growing numbers of investors are increasingly nervous about the reckless monetary and fiscal paths being pursued on a global scale. Identifying this trend early on will let investors position themselves accordingly.

Second, it tells me that acting now - securing the gold you want and need - is critical to withstanding the likely fallout ahead from the mountain of unpayable government debt and promised benefits. If we’re correct about the dismal future of all major currencies - the dollar’s inexorable decay in purchasing power and the “race to the bottom” between it and other currencies - then failing to act will greatly degrade your future standard of living.

What is this new trend? It’s simple, yet powerful…

Investors are shifting from paper to physical.

I began to watch this trend after it was reported last year that billionaire hedge fund manager John Paulson dumped his shares in the ETF GLD, opting instead to purchase physical metal. Since then, the shift out of paper proxies for gold and into the metal itself has picked up steam, and it’s now clear that a new investor trend is under way.

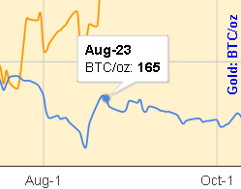

Here’s the evidence. The following chart shows the total purchases since 2001 of gold coins and bars versus the net additions to gold ETPs.

(Click on image to enlarge)

Total coin and bar purchases are up 96% since 2009, while net additions to ETPs are down 73% over the same period.

While ETPs include the ownership of physical bars, it’s clear that increasing numbers of investors are buying more bullion than proxies. This is a remarkable shift, especially given the claimed popularity of GLD.

The shift is even more dramatic with silver.

(Click on image to enlarge)

Investors have tripled their silver bullion purchases since 2007, while the exchange-traded vehicles sold 26 million ounces more than what they bought to back their funds last year.

Why is this happening? And what does it mean?

Certainly some of the shift stems from concerns with the funds themselves. While I discount allegations that these funds don’t possess the metal they claim to hold, there are other issues, such as complicated custodial structures and the possibility of leasing or substituting paper certificates for physical metal.

Another reason for the shift is certainly due to global economic, fiscal, and monetary concerns. As fears of systemic risk ratchet higher, it’s only natural for investors to gravitate toward the safest methods for holding physical metal. Throw in events like what happened to MF Global last year, and it’s easy to understand why many investors would prefer holding their own bullion over a fund.

More important, what should we do as a result of this trend?

First, this is not a “keeping up with the Joneses” debate. We support the overall thrust of this shift into physical metal; gold is not an obscure metal that sits in a vault and “does nothing.” It offers direct and immediate financial protection for you and your family like nothing else can.

Remember that gold is above all else the world’s best, time-tested form of money - something people were duped into doubting in the 20th century, but are now beginning to remember. Today’s environment is exactly one in which gold shines: eroding purchasing power of paper currencies, vulnerable global economies, fears of inflation and/or deflation, a shaky banking system, insurmountable public debt levels, and fanciful money-printing schemes… if there were ever a time to own gold, this is it.

Having metal in your control and at your disposal empowers you in times of turmoil and lets you avoid dependence on counterparties.

Second, this trend carries a subtle signal: diversify. If risks are at a level sufficient to encourage holding physical metal, it’s also worth diversifying that risk. Stash some at home, use private vaults, and store some internationally. Even large institutional investors frequently use more than one facility. No single method or location is risk-free, so spread it around.

An easy way to do that is with a new breakthrough program we helped establish and fully endorse: Hard Assets Alliance Storage locations include Zurich, London, Melbourne, New York, and Salt Lake City (with Singapore coming soon). You can conduct all services online, and the metal is fully allocated and registered in your name. Selling and taking delivery are as easy as buying or selling GLD. Perhaps most attractive is that your order is bid out to a network of dealers who compete for your business, ensuring you get the best available price.

Remember: once Main Street enters the precious metals market - whether it’s an overnight event or a slow awakening over time - we expect supply for physical metal to become increasingly spotty, premiums to rise, and much higher gold and silver prices to ensue. That process may be under way now, so our advice is to make sure your stash of gold and silver is big enough to get to the other side of the crisis intact.

Bottom line: this is a trend you want to be a part of - and you don’t want to be late.