Solving the Golden Cube Puzzle. GoldMoney Foundation puts it at 10% smaller

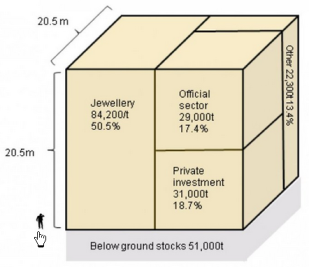

Visualization of the Golden Cube by Deutsche Bank Commodities Special Report (Sep 2012)

An oft-cited gold trivia is that the volume of all gold ever mined in human history can be represented by a cube that sits neatly on a tennis court. How big exactly would that cube be, and does it really matter if its sides were 20m, 20.5m or 20.7m? James Turk of GoldMoney Foundation thinks it does.

The density of gold is 19.32 grams per cubic centimetre (gm/cc), which is equivalent to 19.32 tonnes per cubic meter (t/m3). The cube on the left would weigh 166,444 tonnes, which is close to Deutsche Bank’s estimate based on World Gold Council (WGC) data.

If the sides were increased to 20.7m, it would weigh in at 171,363 tonnes which is close to the widely reported Gold Fields Mineral Services’ (GFMS) estimate of 171,300 tonnes as at December 2011.

GoldMoney Foundation’s estimate based on a recently published study by James Turk assisted by Juan Castañeda concluded that GFMS has overestimated the cube size by 70 centimeters; Equivalent to 16,056 tonnes, or about $877 billion at $1,700 per ounce.

It is significant because that’s an over estimation of 10.3% or more than fve-times the current rate of annual production.

“The level of global physical gold stocks is important in the context of remonetization of gold, which is likely to become increasingly discussed in time, given the accelerating pace of monetary creation by central banks.” GoldMoney Research Director Alasdair Macleod.

The conclusion of their essay reads:

-

A. The size of the gold stock

Our estimate of the 1492 gold stock is 297 tonnes, which is the calculation of Federal Reserve analysts Velde and Webber. Using this estimate as the starting point, we add to it the annual production data available from various sources, as explained in Appendix 3.

According to the World Gold Council, which is using Thomson Reuters data, the world’s gold stock as of December 2011 was 171,300 tonnes. Our research provides a reasonable analytical framework to suggest that the gold stock as of December 2011 is 155,244 tonnes, meaning that Thomson Reuters GFMS overestimates the existing stock by 16,056 tonnes, or 10.3%.

Given that data provided by the World Gold Council is usually taken as the principal reference on this matter, we conclude that a general perception exists which overstates the current gold stock. The amount of the overstatement is more than fve-times annual production, and at the current price of $1,700 per ounce has a nominal value of $877 billion.

B. The importance of the gold stock

The 155,244 tonnes comprising the world’s gold money stock is gold’s M3. Changes in it compared with the supply of national currencies facilitate comparisons of relative purchasing power as explained by the quantity theory of money.

These comparisons show that gold maintains its purchasing power over time because the gold stock expands in a disciplined way, with the result that its annual percentage increases are remarkably similar, even over hundreds of years. These fairly consistent annual rates of growth are the goal of Milton Friedman’s “k-percent rule”. Thus, the quantity theory of money explains why gold maintains its purchasing power over long periods of time.

In contrast, the stock of national currencies is volatile. Increases/decreases in annual growth rates are the result of man-made factors that cause this volatility in the money stock, which result in fuctuating price levels and the erosion of purchasing power.

C. Gold is money

Even though it does not actively circulate as currency anymore, gold continues to fulfl two important functions of money. It is useful in economic calculation, and it preserves purchasing power over long periods of time.

Gold is not a consumable commodity. Like the dollar, euro, pound and other monies, gold has purchasing power, which can be used to acquire goods and services. Thus, gold’s value arises from its usefulness as money.

-

Further reading:

-

The Aboveground Gold Stock: Its Importance and Its Size - Complete essay

Deutsche Bank 18 September 2012 Commodities Special Report

Thomson Reuters GFMS Gold Survey 2012

Leave a Reply Cancel reply

Most Popular

Most Recent

Archives

Featured Reviews

16Oct: Jeff Clark (Casey Research)

$2,300 gold by January 2014

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

>> More forecasts & forecast accuracy

Featured Videos

|

Jim Rickards, author of Currency Wars talks to Max Keiser about Currency Wars |

|

Mike Hampton: Gold Vs Stocks. The seasonal cycle (Presidential election) calls for a correction in the gold market in October that could result in a significant low as early as this week. More at GoldMoney News |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- Deus Ex Machina & Ground Zero Of Fiat Currency Destruction October 21, 2012

- Why Money Is Now Pouring Into Hard Assets All Over The World October 20, 2012

- Incredibly Key Chart, This One Worries The Gold & Silver Bears October 20, 2012

- Turk - One Of The Most Important Gold Charts Ever October 19, 2012

- Richard Russell - What Current & Future Generations Face October 19, 2012

- Embry - London Trader, Commercials & A Spike In Gold October 18, 2012

- Greyerz - Despite Manipulation, Swiss Gold To Become Money October 18, 2012

- London Trader - The LBMA Is A Massive Ponzi Scheme October 17, 2012

Finance & Economics

Finance & Economics

- China, China, Everywhere; But Not A Drop Of QE To Drink October 22, 2012 Tyler Durden

- Q3 Earnings Season To Date Summary: Ugly... And Getting Worse October 22, 2012 Tyler Durden

- Stock Market Fragility Fast Approaching "Flash Crash" Levels October 21, 2012 Tyler Durden

- Chinese Gold Imports Through August Surpass Total ECB Holdings, Imports From Australia Surge 900% October 21, 2012 Tyler Durden

- The Real Reason America Is Drifting Towards Fascism October 21, 2012 George Washington

- In Historic First China Begins Oil Extraction In Afghanistan October 21, 2012 Tyler Durden

- Mass Shooting At Brookfield Square Mall In Wisconsin October 21, 2012 Tyler Durden

- Lessons In Fiat Reality: "Why I Learned To Trade Less And Love The Farm" October 21, 2012 Tyler Durden