Archive

For the first time in history, private investor holdings now exceed official-sector holdings

BullionVault | Adrian Ash

Physical Gold Investment prices in London’s wholesale market recovered half of this week’s near-2% drop on Wednesday, touching $1462 per ounce as global stock markets ticked higher and government bonds eased back.

Brent crude oil rallied to $121 per barrel after falling 6% in two trading days, as Kuwait suspended oil exports due to sandstorms, and Libya’s new “contact group” of politicians called for Colonel Gaddafi to quit Tripoli.

Silver Bullion held above $40 per ounce – and rose against non-US currencies – as the Dollar edged the Euro back down from new 15-month highs.

“For the first time in history, private investor holdings now exceed official-sector holdings,” said Philip Klapwijk – executive chairman of precious-metals consultancy GFMS – at a presentation in London’s Canary Wharf today, commenting on last year’s strong physical Gold Investment demand.

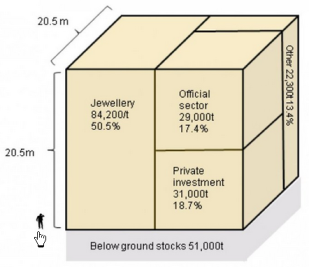

Launching GFMS’s new Gold Survey 2011, he said that privately-owned Gold Bars and coin today account for 19% of the world’s above-ground stocks, estimated at some 166,600 tonnes.

Despite a small net purchase in 2010 – mostly due to regular purchases by Russia – central-bank and other official holdings account for 16%.

Just over half exists in the form of jewelry.

“We are in a continued bull market in gold,” said Klapwijk, pointing to the sharp rise in prices against all currencies. Looking ahead, “The economic backdrop will remain favourable” to Gold Investment in 2011 and potentially 2012, the GFMS chairman said.

Central banks the world over are “reluctant” to raise interest rates, Klapwijk noted, while “a continuation of loose fiscal policies…[also means] inflation expectations will be on the rise, supporting gold’s case. In particular, rolling debt concerns in Europe may infect the Japan and US, where Klapwijk believes it “possible” that Washington’s triple-A credit rating could be called into question by the end of the year. “As confidence in government paper starts to be challenged, that’s got to be good for gold,” Klapwijk said.

The US government will hit its current “debt ceiling” by July, he noted. The Federal Reserve’s current “quantitative easing” program of Treasury-bond purchases is scheduled to end in June. Bank of America Merrill Lynch today joined the chorus of institutions calling for US Treasury bonds to fall, advising clients to switch into equities. Long-term Treasury bulls Pimco – the world’s largest bond-investment manager – now holds a short position on US Treasury debt in its flagship Total Returns Fund. Ten-year US Treasury yields today ticked up to 3.51% as Washington prepared to auction $21 billion in new debt.

“We do wonder about the sustainability long-term” of such strong Gold Investment demand worldwide, Klapwijk warned in his London presentation today. Scrap supplies fell last year but Gold Mining output rose, says GFMS. New growth in jewelry demand came entirely from developing economies.

Second only to 2009′s record level, 2010′s Gold Investment flows equaled $66 billion. But “That’s still a relatively small weight of money compared with traditional assets” such as equities and bonds, said Klapwijk. In contrast with a fall in ETF trust-fund and Gold Futures demand, GFMS’s analysts reported “strong growth” in physical Gold Bar investment – especially in Europe and China – with a “continued tendency…for [Western] institutions to park long-term investment in allocated [physical] gold accounts.”