GoldMoney & BullionVault clients of all people most to be pitied?

-

Gold priced in US$ has been declining from its high in August 2011. Wall street has it that it’s because the euro zone debt crisis is now under control, the US economy is recovering, inflation is low and the US unemployment situation is improving. Oh, not to forget there has been no more money printing and the Dow has gained some 20% since gold’s peak. In short, improving outlook has caused investors to move out of gold’s safe haven into riskier assets.

Less demand leads to lower gold prices as reflected in the chart below. Some analysts say the 11-year bull market in gold is over, gold is in a bubble that has or is about to bust.

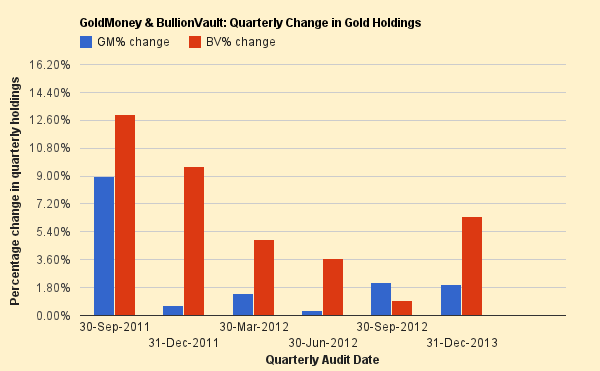

If that be the case, clients of GoldMoney & BullionVault (two of the more established and popular physical gold dealer and custodians) have got it all wrong and hence are “of all men most to be pitied”. Look at how their collective gold holdings have been increasing relentlessly, even during periods of sharp price declines.

This short term chart covering the period since gold’s intermediate top in August 2011 shows steady increase of total holdings from quarter to quarter. The growth at BullionVault is particularly impressive.

-

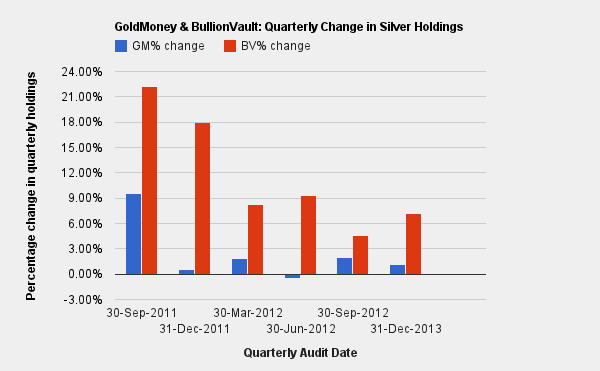

The same goes for silver.

What then can be said of the apparent dichotomy between the declining trend in gold & silver prices and the increasing demand seen in the metal purchases? Just two words:

Paper & Physical

Prices reflected in the charts come about mainly by “traders” trading paper gold & silver. Traders is put between quotes because they are not the normal traders you’d expect to find in a free market. Most of the trades that determine the price trends are placed by very few large bullion banks and High Frequency Trading (HFT) machines. Yes, the prices are greatly influenced by trades initiated by machines preprogrammed with sophisticated algorithms to set the price which ever way the owners wanted them to go. In case you’re wondering, who may be the people on the other side of these trades? It’s people like this, who sets up trades hoping to beat the supercomputers on the other side only to get sucked in and forced to dump when their stops are hit.

On the other hand, real humans are behind the accumulation of physical metals at BullionVault, GoldMoney and many other private vaults. These are the same humans that do not believe the spin of the MSM, but hold on to the view that the financial crisis is not yet behind us. They believe that the worse is yet to come. I’m one of them. We understand that holding our savings and retirement funds in paper assets and paper money is most likely to result in a massive loss of purchasing power through hyperinflation when the real crisis hits.

We’re not 100% sure it will happen, neither can we be 100% sure it won’t happen.

What about you? Paper or physical?

-

Data source

- GoldMoney publishes quarterly audit reports, and they are archived here.

- BullionVault publishes daily audit report here.

-

Related Articles:

- Learn more about Price Discovery - how are prices of gold & silver determined

- Why the current fraudulent Price Discovery Mechanism is being defended, and what’s ahead

- Listen to market analysts discuss gold & silver price manipulation

- Read about latest exposé that prices of PMs are indeed being suppressed

- “There are no buybacks” when prices decline - Andy Hoffman of Miles Franklin

- Gold price manipulation

- Silver price manipulation

- BullionVault & GoldMoney reviews, Detailed comparison of BullionVault & GoldMoney

-

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year