-

This is a continuation of my previous post - Gold & Silver: Precious Metals or Political Metals?

-

Updated: May 1-6, 2011 Silver volatility. Click for details

Volatility & counter-intuitive price actions are the order of the day for any holders of gold & silver. When you see an apparently “unexplainable” price movement in gold and silver (as is the case since the first trading day of 2011 till the time of this writing), it’s when you have to start viewing them as Political Metals to be held and owned rather than Precious Metals to be invested in. Otherwise, you’ll either never get on-board the PMs bandwagon, end up loosing lots of sleep if already on-board, or worse still, doing the unthinkable – sell in a panic during a bull market hoping to buy back lower. It’s worth noting what a gold veteran, Franklin Sanders, said:

You never make the big money in trading, but in getting it right and WAITING. Ultimate peak of this bull market lies three to ten (3 to 10) years away. Hold on. Wait….

This strategy began to make even more sense to me when, in addition to viewing gold & silver as Political Metals, I stopped thinking of my purchase of PMs as an “investment”. According to Wikipedia,

Investment is putting money into something with the hope of profit. More specifically, investment is the commitment of money or capital to the purchase of financial instruments or other assets so as to gain profitable returns in the form of interest, income (dividends), or appreciation (capital gains) of the value of the instrument.

If I had viewed buying PMs as an investment, I would have started out with a certain percentage of my savings, say “X” dollars. I would have bought “Z” ounces of gold and hoped to sell it for “Y” dollars in the future. If Y was greater than X, it was a good investment and I would have made some money. I would have increased the amount of dollars I hold and hence increased my asset base. Since money has 3 basic functions (a medium of exchange, a unit of account and a store of value), I would have used paper currencies as a store of value (means of savings). Gold was just a financial instrument which I owned temporarily, hoping to exchange it for more money in the future.

I did not, and here’s why.

Today’s paper money is a poor store of value

The above mainstream view of money and investment in gold & silver holds true as long as paper currencies continued to perform its third function (store of value) faithfully. Sadly, this is not the case as shown in the chart below. The world’s reserve currency has lost as much as 98% of it’s purchasing power since the creation of the Federal Reserve System in 1913. The massive loss of purchasing power holds true for all other currencies, many of them much more severe than the US$.

-

How and when your US Dollar lost 98% of its purchasing power.

-

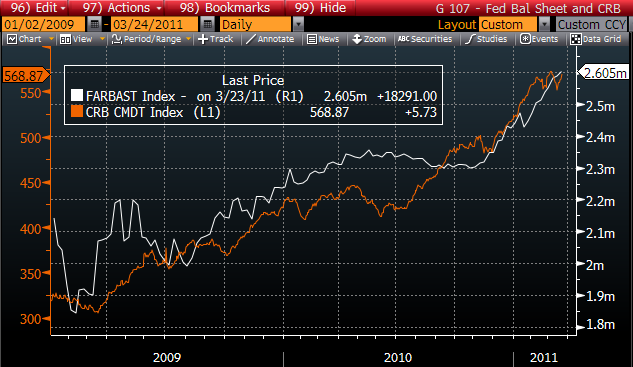

Since the financial disaster in 2008, the US Federal Reserve has increased it’s monetary supply like never before in it’s history. The chart below extracted from a WSJ article Get Ready for Inflation and Higher Interest Rates indicates how much money they have created out of thin air (money that never existed before) and pumped into the financial system. When even a small portion of this newly created money begins to flow into the economy as Currency in Circulation (CinC), it’s not hard to imagine what that 2 cents that’s left over from the original dollar will be further reduced to!

-

Exploding Money Supply

The US is not alone. See who else is cranking up their printing press.

Feb 25 Update: The Printing Continues

-

However, when I consider PMs to be a store of value and a means of account while utilising paper currencies only as a medium of exchange, things become a lot simpler. I will be keeping track how many ounces of gold and silver I have as my savings rather than counting how many dollars I have in my bank account or how many dollars my Precious Metals “investment” portfolio is worth at any time. In my example above, “Z” will be more important to me than “Y” because I hold PMs. I don’t invest in PMs. Short term price volatility becomes a non-issue because fundamentally, the limited supply of physical PMs makes them a superior store of value compared to the unlimited quantity of paper or electronic money that can be created at will out of thin air by bankers.

That sharp rise of monetary supply seen in the chart above happened after the first round of Quantitative Easing (QE1) amounted to slightly less than a trillion dollars. Since then, another round of monetary base expansion referred to as QE2 was announced in November 2010. It is currently ongoing and will run till the third quarter of 2011. QE2 is estimated at $900 billion. Try to figure how the chart above will look like by the end of this year! I’ll be highlighting this as it develops.

Take a 2-minute break to watch this video on paper currencies versus gold & silver as money. It pretty much summarises what you’ve read so far.

-

Update on Aug 24, 2011

[Watch a full feature documentary that explains these issues in depth: Why $20,000 Gold doesn't excite me.]

-

Finite quantity of gold Vs infinite quantity of Fiat (paper or electronic) money

So much about paper money. Consider some gold facts & figures:

Total above-ground gold ever mined is estimated at around 130,000 tonnes (a cube with sides of 19 m, smaller than the length of a tennis court). Divided amongst the population of the world there are about 20 grams (0.64 oz) per person.

Annual production rate is estimated at 2,600 tonnes (2% per year). Comparing these facts with the two charts above gives an idea of paper money supply increase versus gold supply increase. The figures for gold’s monetary cousin, silver, is even more staggering.

Another great reason to hold PMs

When compared to paper money, it has been shown that PMs act as a more superior store of value (means of saving). It has also been shown to outperform currencies in 2010 by as much as triple digit percentages. But how do PMs perform in the longer term and relative to the other asset classes? The chart below plots the relative performance of gold, silver and the S&P 500 over the last decade referenced to dollar prices on 2nd January 2001 until the time of writing. Gold and silver have increased in value by over400% and 500% respectively while the general stock market remained flat over that period. When adjusted for inflation, a typical investor in equities would have booked a loss in real terms over this period.

Political Metals, gold & silver, outperforms stocks in general over the last 10 years

Update on Aug 24, 2011

[It may seem "unfair" to compare PMs with stocks at the peak of the dotcom boom. The same stellar performance of PMs (especially silver) Vs stocks using the March 6, 2009 low following the 2008 financial crisis as the reference point can be seen in this chart and the follow up article Why $20,000 Gold doesn't excite me.]

-

-

Three Phases of a Bull Market, Four Phases of a Bubble. Where are we now?

Gold and silver priced in USD (and many other currencies) are at or near their all time nominal highs. They are however far from their approximate 1980 inflation-adjusted highs of $7,600 and $450 respectively.

Have I missed the boat? Isn’t it already too late to buy? What if the “gold bubble” bursts soon after I buy? These would be the obvious questions in the minds of anyone who is not yet holding any PMs.

It is timely to look at the big picture and see where we are in the current PMs secular bull market.

-

Stealth, Awareness, Mania, Blow-off phases of a bubble. Reproduced with permission of Dr. J.P. Rodrigue

-

The Stealth Phase (Stage 1)

This is the early stage of the bull market. A time when gold and silver has been so beaten up by the previous bear market that no body wants to talk about them, much less buy and hold on to them. However, those who understand the fundamentals realize an emerging opportunity for substantial future appreciation. So the “smart money” and contrarian investors move in, often quietly and cautiously. This category of investors tends to have better access to information and a higher capacity to understand it. Prices gradually increase, but often completely unnoticed by the general population. In this current PMs bull run, the Stealth Phase ran from 2001-2006.

The Awareness Phase (Stage 2)

Also called the “Wall of Worry” phase, the Awareness Phase is when institutional and the savvy investors come into the arena. These investors start to realize the momentum, bringing additional money in and pushing prices higher. There can be a short-lived sell off phase (bear trap) taking place as a few investors cash in their first profits (there could also be several sell-off phases, each beginning at an higher level than the previous one). The smart money takes this opportunity to reinforce its existing positions. In the later stages of this phase the mass media starts to take notice and those getting in are increasingly “unsophisticated”.

….when gold climbed above $1,000, it only entered its second stage. - James Turk of GoldMoney. Nov 23, 2009

Silver is still in stage one. It won’t advance into stage two until $50 is exceeded, just like gold did not enter stage two until its previous high of $850 was hurdled. - James Turk of GoldMoney. Feb 14, 2011

The Mania Phase (Stage 3)

It begins when commentators who have been consistently wrong about PMs will be telling everyone willing to listen to buy gold. The excitement created by the mainstream media convinces everyone that this is where fortunes are made. The crowd starts rushing into PMs. These “trend followers” don’t walk — they run to get on board due to their herd mentality. You will know that the mania phase phase is here when lines begin to form in coin shops, everyone at the party talks about PMs, your taxi driver and favourite shoe-shine man tells you they are buying PMs. Prices goes parabolic, and towards the later part of this phase, the smart money and contrarian investors begin to move out as quietly as they moved in during the Stealth phase.

The Blow Off Phase (Stage 4)

The tipping point is hit. Confidence and expectations encounter a paradigm shift. Prices drop, followed by a rebound during the denial phase when many try to reassure the public that this is just a temporary setback. Fear sets in and capitulation follows in earnest. After hitting the bottom in despair, it re-bounces and approaches the mean trend line, ready for the next cycle.

This brings me back to where I started.

I heard one group of analyst exclaiming “buy now before the price explodes!”, and another saying “sell - gold is in a bubble”. Yet another said “wait for a correction - the price has gone up too much recently”.

It’s your turn to make your call.

I trust that by going through the thought process behind my journey in recognizing gold and silver as Political Metals having a great potential to act as a reliable store of value, you would have received some food for thought. Invest some time to continue your own research and do your own due diligence.

A good place to start is navigating through some of the menu links at the top of the page. You find some selected research materials from reputable sources I’ve personally relied upon when I was accumulating PMs.

Should you decide to convert part of your savings in paper currencies into PMs as a hedge against inflation and potential currency debasement, make sure you land up holding physical gold & silver and not “paper gold” like Gold Certificates, Gold Savings accounts, Pooled gold accounts, Gld or Slv ETFs or anything besides real physical metals with atomic numbers 79 and 47!

Owning physical gold and silver has NO Counterparty Risk. All other PMs financial instruments are merely paper or electronic representations of gold or silver.

Remember, in a crisis, any paper (or electronic) representation of anything maybe worth only the paper it’s printed on.

For more information, see How to buy & store PMs.

-

Be prepared for a financial catastrophe - Not because we’re 100% sure it will happen, but because we can’t be a 100% sure it won’t happen. - Chris Martenson

-

—

More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year More Charts: 1-Month, 1-Year, 5-Year, 10-Year

More Charts: 1-Month, 1-Year, 5-Year, 10-Year