Andy Schectman: 90% of the new business is in silver

While sales of gold coins at the US Mint are on track for the best month in a year amid the worst commodities rout since 2008, the same pent up demand for physical bullion is observed at the dealers’ level, as revealed by Jeff Clark’s interview with Andy Schectman of Miles Franklin.

By Jeff Clark | BIG GOLD

Jeff Clark: Andy, tell us about your industry contacts and how you get the information you’re privy to.

Andy Schectman: We source our product from three of the largest six primary U.S. mint distributors. Having 20 years of experience with these sources, as well as the dealers in the secondary market, we’re as tied into the industry as anyone.

Jeff: You made some interesting comments to me about supply and premiums. Tell us what you’re hearing and seeing in the bullion market right now.

Andy: I feel as though I’m the boy who cries wolf, or that I’ve been beating the same drum for too long. But in reality, it has been my feeling since late 2007 that ultimately this market will be defined less by the price going parabolic – which I think ultimately will happen – and more by a lack of supply. You see occasional reports that state it’s just a lack of refined silver or lack of silver in investable form. But as far as I’m concerned, there is a major supply deficit issue, and it’s getting worse.

Take the U.S. Mint, for example. Right now, as we talk, you can barely get Silver Eagles. We’re seeing delivery delays of three to four weeks, and premium hikes of a dollar or more in the last three weeks. Most of the suppliers in the country are reluctant to take large orders on Silver Eagles because they don’t know (a) when they’ll get them, and (b) what the premiums will be when they arrive.

I was talking to the head of Prudential Bache and asked him about Silver Eagles. He said, “You know, as soon as the allocations come in, they’re sold out. We can’t keep them in.” This is coming from one of the largest distributors of U.S. Mint products in the country.

And this is all occurring in an environment that has only minimal participation by the masses. Few people in this country have ever even held a gold or silver coin. So, if it’s this difficult to get bullion now, what’s it going to be like when it becomes evident to the masses they need to buy? This is what keeps me up at night.

Jeff: Some analysts say it’s a bottleneck issue, that the mints have enough stock but just need more time or more workers to fabricate the metal into the bars and coins customers want.

Andy: No, I don’t believe that. What business do you know that if they had that much profit potential wouldn’t increase production and hire more workers to meet demand? To me, the “inefficient model” argument is an excuse.

Look at what the U.S. Mint alone has done: they haven’t made the Platinum Eagle since 2008. They make maybe one-tenth as many gold Buffalos as they do Gold Eagles. They’ve made hardly any fractional-ounce Gold Eagles. Heck, they can’t even keep up with the demand for the products they do offer. Does that sound like a bottleneck to you? Or is it because there is far more demand than there is available supply? It’s pretty clear to me it’s the latter.

Jeff: What are you seeing in the secondary market? Are investors selling bullion?

Andy: There is no secondary market. Absolutely none. Nobody is selling back anything, at least not to us. Think about that: if this was a traditional investment and your portfolio went up 100% in the last year, like silver has, you’d think some investors would take some profits and ride the rest out – but nobody’s selling anything.

This is why I think the lack of supply is the single biggest issue in this market. And in time, I think it will become much more obvious. [Ed. note: We’re using the term “secondary market” in this instance to mean sellers of bullion and not the scrap market.]

There are only five major mints – U.S., Canada, South Africa, Austria, and Australia. Yes, there is a Chinese mint and a couple Swiss mints and some private refiners, but they amount to very little in the overall scheme of things. We’re in a situation where the mints are limiting the selection and raising the premiums, and this is occurring at a time when most people own no bullion. As it becomes more apparent that people want bullion instead of paper dollars, I think you’ll see premiums go parabolic and supply get even tighter.

Jeff: Are you getting a lot of new buyers to the bullion market?

Andy: More than ever. One of the interesting things we’re seeing is a lot of younger people dipping a toe in the water, buying little bits of silver here and there. We’re also seeing bigger orders, as well as more frequent phone calls from financial advisers asking us if we can help their clients. So yes, the base is broadening.

Jeff: That’s very interesting. So are you seeing more demand for gold or silver right now?

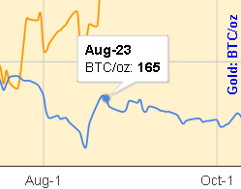

Andy: 90% of the new business is in silver. And I think that’s indicative of the state of the economy. People are trying to get into precious metals, but they think gold is too high. I think they’re buying silver because they realize the fundamentals for owning gold also apply to silver. They think the profit potential is better in silver, too. This has actually made the supply for gold better than it is for silver right now, and a lot of that has to do with price.

Jeff: Why are premiums fluctuating so frequently?

Andy: Premiums are almost impossible to gauge right now. Because the availability of product is getting smaller and smaller and the demand is getting stronger and stronger, premiums are changing literally overnight. And it doesn’t take many large investors around the country to force premiums higher.

The net of this is that it’s really hard for us to be able to say what the premium for a specific product will be two weeks out.

Jeff: You mentioned increased interest from fund managers. Tell us the kind of comments you’re hearing and why they’re buying bullion.

Andy: I think it’s coming from their clients. It’s my impression that people are taking it upon themselves to study a little bit more – to be more accountable for their assets – and I think they’re telling their financial advisors to buy gold. And in some cases it’s because they don’t want a paper derivative.

It’s no secret that financial advisors don’t like gold and silver. Once money goes to a bullion dealer, it’s not coming back to a stock portfolio any time soon, so they discredit it. But now it’s my impression they’re being asked by their clients to buy it. So it’s not necessarily because the financial advisor wants gold as much as it is the client requesting it.

Here’s a good example. There’s a firm here in Minneapolis that represents the Pillsbury fortune, and they asked me to talk to their partners about precious metals a few months ago. At the end of the conversation they said, “Okay, we’re going to place an order for one of our clients.” Upon hearing it was for one client, I thought it would be in the range of $50,000 to $100,000. Well, the order was for $5 million.

There are two astonishing things about this. First, that’s twice as big as the largest order I’ve ever had. It was one order, for one client, who’s brand new to the market. How many more potential buyers are out there like that? Second, they made it abundantly clear to me that it was out of pressure from one of their clients that they sought me out. So clients are increasingly demanding bullion, regardless of what their financial advisers say.

Jeff: Hearing about all this new buying might make some think we’re near a top in the market. Could that be the case?

Andy: No, no [chuckles]. I think Richard Russell says it best: “Bull markets die of exhaustion and over-participation.” Well, we’re nowhere near that point when so few people in this country own gold and silver. Heck, I’m a bullion dealer, and most of my peers don’t own any gold and silver! Yes, you’re seeing more commercials, but there are just as many commercials to buy gold as there are to sell it. I think that’s an indication this market is not exhausted.

Remember that in the year 2000 everyone and his brother had some NASDAQ shares. That’s an example of an exhausted or over-participated market. We’re nowhere near that.

Jeff: Where are the best premiums for silver?

Andy: The very best buy in silver right now is junk silver. And by the way, I think the term “junk” is unfair. It isn’t junk any more. It used to be junk in the ‘90s when silver was three or four bucks an ounce and it was sold basically at melt value and carried no premium. So I’d call it “90% dimes and quarters.” Anyway, junk silver has the lowest premium right now and, in my opinion, offers the best upside potential.

Next would be 10- and 100-ounce silver bars. And then one-ounce silver coins – but the Eagles are very expensive at the moment, if you can get them. The Austrian Philharmonic has the best value in a one-ounce silver coin right now, and they’re available. But again, premiums for all silver coins are escalating.

Jeff: What about gold?

Andy: Gold is not as bad. In fact, I would say that gold availability is decent right now for one-ounce coins and bars. There isn’t much available in fractionals. And Buffalos are still kind of hard to get. Other than that, the one-ounce coins with decent availability are Canadian Maple Leafs, Australian Kangaroos, and Krugerrands. And they all have decent premiums.

Jeff: So the take-away message is what?

Andy: First, I think you said it best with your recommendation to “accumulate.” Not only will it smooth out the volatility in price and premiums you pay, it will also give you a bird in the hand. If I’m right about this market, and I really believe I am, it will be defined by lack of availability of refined product. To combat that, just accumulate month in and month out, and be thankful when you’re able to get what you want.

Second, it’s about the number of ounces you own. You want to get as many ounces as you can without being penny wise and pound foolish. Stick with the most recognized products – don’t buy 1,000-ounce bars, for example, because they’re illiquid. You want to maximize your liquidity, and you do that by buying the most common forms of bullion – one-ounce coins, bars, and rounds; 10- and 100-ounce products; and junk silver.

Last, keep in mind that premium and commission are two different animals. Commission is what the dealers make on top of the premium. Premium is what the industry bears. So if the U.S. Mint is selling Silver Eagles for $3 over spot to the distributors, that’s before they’re marked up to the public. So even though the “premium” is high, you’re actually going to get most of that back when you sell. [Ed note: It’s not uncommon for the buyer to recapture most of the premium when they sell, particularly during periods of high demand.]

So, buy gold and silver while it’s available, even if you don’t buy it from me, because if I’m right, getting it at all could soon be your biggest challenge.

-