Archive

Commodity Money and Fiat Money: A Bushel of Wheat for a Penny

A Bushel of Wheat for a Penny Part 1

by Steve Elwart, IDB Folio Specialist

Republished with permission from Koinonia House

-

This is Part 1 of a three-part series on money: where it comes from, how governments use it to control our lives, and how modern money policy makes the prophecies in the Book of Revelation seem very close to fulfillment.

Everyone reading this article is being robbed. We all use paper money and every day, governments are lowering its value. That value is being stolen from us. To understand how this is happening, we need to get to the basics of money. What is it?

Commodity Money

We learn in Genesis that Abram (renamed later by God to Abraham) was a rich man. How do we know? We are told that “he had sheep, and oxen, and he asses, and menservants, and maidservants, and she asses, and camels.”1 In Biblical times, these things were all media of exchange. No king decided this; he didn’t call in his magi to decide what the medium of ex-change would be. Ordinary people, or “the market” made the decision. Let’s say a king did decree that rocks could be used as money. Would anyone use them? Probably not, because they would not know the value of those rocks. Unless you are building a lot of things (or stoning a lot of adulterers), rocks fail to meet a standard for money: they have no intrinsic value.

If a civilization was to advance though, it had to come up with a convenient way to save and exchange value to buy things. Leather was used in ancient Rome. (Contrary to popular belief, Roman soldiers were not paid in salt. The term salary [from the Latin salārium] was money given to Roman soldiers to buy salt.2) Animal pelts, whiskey, and tobacco leaves were used in the former British Colonies, wampum (strings of beads) was used by the American Indians, dried fish were used in the Canadian maritime colonies, maize or corn was used in Mexico, and salt, iron and farming tools were used in Africa. These things are called “commodity money.” As civilizations became more complex, most forms of commodity money be-came very cumbersome. (Who would want to give or get 300 sheep to buy a car?) Another medium of exchange had to be found.

Over the centuries, the answer came to be the precious metals, gold and silver. These two metals became the basis for money in most of the world. Gold and silver were used as money for very specific reasons and they were chosen by “the market.” People decided that these two metals had all the qualities that made for a good medium of exchange:

- They were easily portable. They had high value to weight ratios. (So if you want to buy a car, you only have to bring 16 ounces of gold rather than 300 sheep.)

- They are fungible. Every ounce is like every other ounce no matter where they were mined. People didn’t have to worry about the quality of the pure metal.

- They are highly divisible. They can be divided into very small parts or coins. The term “pieces of eight” came from the practice of taking a Spanish dollar, a real de a ocho and breaking it up into eight pieces or reales to make change. Diamonds fail the test of being divisible because if you break up a gem-quality diamond, it loses its value. (For that matter, sheep aren’t easily divisible either unless you are very hungry.)

- They are highly durable; the thirty pieces of silver paid to Judas are still in existence today.

- They are naturally scarce. They can’t be multiplied.

Fiat Money

There is another type of money besides commodity money, called fiat money. (Fiat from the Latin fiat, meaning “let it be done.”) This is an item, usually paper or low value metal coins, that is decreed to have value by a government.

A government puts fiat money into circulation first by connecting it to a gold or silver standard, but then cuts the link and says that gold and paper are no longer convertible, making the piece of paper “legal tender for all debts public and private.” It is obvious that debtors would be very happy if the pa-per money lost its value because they could pay their debts with inflated currency. In a letter to Edward Carrington in 1788, Thomas Jefferson wrote, “Paper is poverty … it is only the ghost of money, and not money itself.” Jefferson died bankrupt because of the early United States money (monetary) pol-icy based on paper.

It is not that fiat currency is a new invention. Fiat currency actually made its appearance over 1,000 years ago. China was the first country to issue true paper money around the 10th century A.D. Although the notes were valued at a certain ex-change rate for gold, silver, or silk, conversion was never allowed in practice. The bills were supposed to be redeemed after three years in circulation, but as more bills were printed with the older notes being refused redemption, inflation became evident. Government measures to prop up the currency were unsuccessful and it fell out of favor.3

In Europe, fiat money came into being around the 12th century. Villagers would store their gold and other valuables in their lord’s castle for safekeeping. But during this time of the Crusades and other European Wars, noblemen were always strapped for cash. When times were particularly bad, the noblemen would confiscate the villagers’ gold and silver and issue notes for it, to be redeemed later. Needless to say, the notes weren’t always honored or if they were redeemed, the holder of the note received less of their gold back than what they were promised. This is an early case of price inflation.

Today, fiat money will always bring on inflation for two reasons: 1) Politicians like to induce inflation because it gives the people the illusion of prosperity and 2) its declared value is much higher than the cost of producing it. Whether it is a $1 or $100 bill in fiat money, it costs only 4 cents to produce. In today’s electronic age, the production cost for new money is zero since money creation is just a keystroke and an entry in cyber-space. On the other hand, in history, if you had a $20 gold piece, the cost of that gold piece, less the cost to produce it, was about $20.

The Gold Standard

If the relative value of gold is tracked over the years, one can see how fiat money loses its value over time.

By the 1400s, most countries that had complex trading systems were using gold and silver for transactions. Prices held relatively steady through the early 20th century, except for lo-cal shortages and wars. In the United States the price of gold and the things it bought held its value with exceptions for war-time when the government printed paper money to cover its war debts. After the emergencies and the country went back on the gold standard, prices went back to about where they were. During the First World War, most countries involved in the war suspended the gold standard so they could print enough money to pay for their involvement in the war. After the war, these countries went back to a modified form of the gold standard, but abandoned it during the “Great Depression.”

In 1941, most countries adopted the Bretton Woods system, which set the exchange value for all currencies in terms of gold. Countries that signed the Bretton Woods agreement were obligated to convert their currencies held by foreign countries into gold valued at $35 per ounce. However, many countries just pegged their currency to the U.S. dollar, thus making it the de facto world currency.

In the 1960s the United States had done something unprecedented in its history. The country fought two wars at once. The United States fought a war halfway around the world in Vietnam and a second war at home, the “War on Poverty.” To do this, the United States started to borrow massively and brought on double digit inflation. To curb the inflation, the United States government started to deflate the dollar. 1963 marked the entrance of the new Federal Reserve notes and the disappearance of the $1 silver certificate. This marked the point that no longer did the U.S. Government have to pay in “lawful money.” Finally, in late 1973, the U.S. government decoupled the value of the dollar from gold altogether and the price shot up to $120 per ounce in the free market.4 Since the United States went off the Gold Standard, a dollar is worth only one-sixth of what it was in 1973. (At this writing, gold is priced at $1,220 per ounce.5)

Inflation Always Follows Fiat Money

The history of price inflation in the United States is repeated in every country that uses paper money. Keep in mind, rising prices are not always bad. If a good becomes scarce, its price will go up and may provide the motivation to introduce a new, better product for the market. The reason petroleum became so popular so quickly was because of the rising cost of whale oil. If governments propped up the price of whale oil to keep whalers and whale oil processors employed, it would have taken decades for the world to embrace petroleum as a substitute. And someday, petroleum will go the way of whale oil as long as market forces dictate the transition.

When a government inflates its currency, it increases prices by reducing the purchasing power of the money. The short-term effects though, can seem to be positive. Like a drug addict, inflated money gives the illusion of prosperity, making people feel good. But like the addict, withdrawal follows the high.

At first, the surge of more money makes people feel good be-cause they can pay off their debts with cheaper money and they seem to have more disposable income. As prices catch up, people then find it more expensive to live. In addition, their tax burden goes up, since many government taxes are progressive in nature, meaning the percentage tax increases as in-come or asset values (houses, cars, etc.) increase. Eventually the market will try to correct itself and a depression will follow.

At this point, people start to feel the pinch of their money buying less. They demand that their government do some-thing. Since studies have shown that voters only have a memory of one year when it comes to politics, politicians will make sure that the economy is good in an election year.6 They will artificially stimulate the economy to give voters the illusion that times are good again and reelect the incumbents. This lasts only so long and inflation, with its problems kick in again. This cycle of increasing the currency supply and price inflation ultimately ends with the collapse of the currency, sometimes preceded by hyperinflation. (Hyperinflation and its cultural effects will be covered in Part 3 of this series.) Surprisingly, the country has not learned its lesson and the devalued fiat currency is replaced with yet another fiat currency. Greece is a perfect example of this cycle.

The Greek drachma was minted in gold and silver in ancient Greece and made its reappearance as a fiat currency in 1841. Since then, the value of the drachma decreased. During the German-Italian occupation of the country from 1941-1944, hyperinflation ravaged the country, ending with the issuance of 100,000,000,000 (100 billion)-drachma notes in 1944. After Greece was liberated from Germany, old drachmae were ex-changed for new ones at the rate of 50,000,000,000 to 1. Only paper money was issued, again a fiat currency. Greece then went on a program of deficit spending for social programs and inflation started once again.

In 1953, in an effort to halt inflation, Greece joined the Bretton Woods system and the drachma was revalued at a rate of 1000 old drachma to one new drachma. In 1973 the Bretton Woods System was abolished; over the next 25 years the official exchange rate gradually declined, from 30 drachmas to one U.S. dollar to a ratio of 400:1. On January 1, 2002, the Greek drachma was officially replaced as the circulating currency by the Euro (again a fiat currency).7

Today, Greece is once again is in trouble. After years of continued deficit spending and the government’s easy monetary policy, Greece’s financial situation was badly exposed when the global economic downturn struck. Very quickly, the government’s “creative accounting” practices were exposed. The national debt, put at €300 billion ($413.6 billion), is bigger than the country’s entire economy, with some estimates placing it at 120 percent of gross domestic product in 2010. The country’s deficit—how much more it spends than it takes in—is 12.7 percent.

This time though, Greece just can’t inflate their way out of the problem. Now that they are on the Euro (in the “Euro-zone”), they have little control over their monetary policy. All their loans are in Euros and they must pay back the loans in Euros. One way to balance the national books is to implement harsh and unpopular spending cuts. Another way is to default on their debt. This would seriously damage the Euro as other countries look at default as a way out of their financial problems. (In fact, financial experts are predicting the demise of the Euro in as early as five years.8) A third way out is to separate itself from the Euro, go back on the drachma (fiat currency again) and then set an exchange rate of the drachma to the Euro at an artificially high number. The cycle of fiat money would then begin again.

As long as a country is on a fiat currency, inflation is sure to follow. Using a fiat currency could well reduce a civilization to work an entire day for a “bushel of wheat.”

In Part 2 of this series we will look at central banking and how the banks can change a society.

Notes:

- Genesis 12:16b (KJV).

- “The American Heritage Dictionary of the English Language, 4th edition”. Answers.com. Retrieved 2010-06-05.

- Ramsden, Dave (2004). “A Very Short History of Chinese Paper Money.” James J. Puplava Financial Sense.

- History of the Gold Standard: http://useconomy.about.com/od/monetarypolicy/p/gold_history.htm

- Monex Precious Metals: http://www.monex.com/monex/controller?pageid=prices.

- “Voters Respond to Economic Woes” Economics and Public Policy: http://knowledge.wpcarey.asu.edu/article.cfm?articleid=1668.

- Greek Drachma, Wikipedia: http://en.wikipedia.org/wiki/Greek_drachma#First_modern_drachma.

- “Euro ‘will be dead in five years’”: http://www.telegraphic.com.uk/finance/financetopics/budget/7806065?Euro-will-be-dead-in-five-years.html

The Crime Against Silver

Submitted by Richard (Rick) Mills | Ahead of the Herd

-

As a general rule, the most successful man in life is the man who has the best information

-

In 1873, the Fourth Coinage Act was enacted by the US Congress. Western silver miners labeled this measure the “Crime of ’73″ because it stopped the printing of US silver dollars. The US had, unofficially, abandoned its bimetallic standard in favor of a monometallic one – gold.

The supply of silver not being used for coinage increased - European Nations had just gone from a silver to a gold standard, the US was no longer coining silver dollars and these two factors, when coupled with massive new silver discoveries in the American west, caused the price of silver to collapse.

There was once a time in history when people acted. . . . Farmers were trapped in debt. They were the most oppressed of Americans, they experimented with cooperative purchasing and marketing, they tried to find their own way out of the strangle hold of debt to merchants, but none of this could work if they couldn’t get capital. So they had to turn to politics, and they had to organize themselves into a party. . . . The populists didn’t just organize a political party, they made a movement. They had picnics and parties and newsletters and classes and courses, and they taught themselves, and they taught each other, and they became a group of people with a sense of purpose, a group of people with courage, a group of people with dignity.

Lawrence Goodwin, author of The Populist Moment

Western miners, seeking the right to turn silver directly into money, mid-western grain and southern cotton farmers (who both had immense debts because of price deflation caused by overproduction) rallied to silver’s cause and the movement became known as Free Silver. The Populist Party had a strong Free Silver element and its merger with the Democratic Party moved Democrats from being in support of a monometallic gold standard to the Free Silver position.

Free Silver supporters were called “Silverites.”

Silverite’s argued that silver should continue to be part of the monetary standard with gold, their slogan was “16 to 1″ – sixteen ounces of silver would be equal in value to one ounce of gold, using the ratio established in the Coinage Act of 1834.

Silverites also wanted “free coinage of silver” as authorized under the Coinage Act of 1792. Free coinage meant anyone who possessed uncoined gold could bring it to one of the United States Mints and trade it for its equivalent in gold coins, less a small deduction - Free Silver advocates wanted the mints to accept silver on the same principle. These inflationary measures would have increased the amount of money in circulation and helped debtors pay off their debts, while harming creditors and savers.

Opponents to the Free Silver movement were mostly the financial establishments of the Northeast - the moneylenders, creditors, banks, leaseholders, and landlords - they backed a monometallic gold standard - the expanding economy had constrained the money supply available on a gold only standard, this had made the dollar stronger and decreased prices, opponents of Free Silver wanted to keep it that way.

The Republican Party was against Free Silver, the party’s position being that the best way to national prosperity was “sound money.” Republicans favored a continued strong dollar, which rewarded savers and creditors.

Battle lines were drawn, on one side were the Free Silver proponents – miners, farmers, debtors and Democrats - who wanted a bimetallic standard, the free coinage of silver and inflation. On the other side of the line were the creditors and Republicans who wanted to keep a strong currency using a gold only standard.

Intense pressure caused the U.S. government to agree to the Bland-Allison Act of 1878, this act directed the Treasury to purchase silver at a high price. The Sherman Silver Purchase Act was enacted on July 14, 1890. It didn’t authorize the free and unlimited coinage of silver that the Free Silver supporters wanted, but it did increase, by a large amount, the amount of silver the government was required to purchase every month.

Using a special issue of Treasury Notes that could be redeemed for either silver, or gold, the US government became the second largest silver buyer in the world - after the government of India.

By 1893 the US was in one of the worst depressions in American history and people were turning in the new Treasury Notes for gold and depleting the government’s gold reserves. President Grover Cleveland (R) forced the repeal of both the Bland-Allison and Sherman Silver Purchase Acts.

Democrats failed to win any presidential elections in which the Free Silver issue was front and center. When a Democrat, Woodrow Wilson, won in 1912 he signed into law, in 1913, the Federal Reserve Act that created and set up the Democrats version of a Federal Reserve - having congressional oversight.

The Republicans had their own Aldrich Plan for a Federal Reserve - it gave control to private bankers. There was strong opposition, mostly from rural and western states. They feared that the Fed would become a tool of rich and powerful eastern bankers based in New York City - the “Money Trust.”

In 1913 the Pujo Committee Report concluded that a group of influential financial leaders had gained control of US manufacturing, transportation, mining, telecommunications and financial markets - no less than eighteen different major financial corporations were under control of a cartel led by J.P Morgan, George F Baker and James Stillman.

Silver metal was recognized as more precious than gold when bartering in ancient Egypt - this recorded as early as 930 BC. Silver’s use as money in coin form began around 2600 years ago. Silver and gold have stood the test of time, as a medium of exchange, a storehouse of value and a safe haven in times of turmoil.

Back to the future where we find the little bit of history, just presented, made even more fascinating by events unfolding in a Far Far Away place - Washington. Interesting to read a bit about the history of both sides in the now concluded debt ceiling debate.

One might think that the recent drama over the debt ceiling involves one side wanting to increase or maintain spending with the other side wanting to drastically cut spending, but that is far from the truth. In spite of the rhetoric being thrown around, the real debate is over how much government spending will increase.

No plan under serious consideration cuts spending in the way you and I think about it. Instead, the “cuts” being discussed are illusory, and are not cuts from current amounts being spent, but cuts in projected spending increases. This is akin to a family “saving” $100,000 in expenses by deciding not to buy a Lamborghini, and instead getting a fully loaded Mercedes, when really their budget dictates that they need to stick with their perfectly serviceable Honda. But this is the type of math Washington uses to mask the incriminating truth about their unrepentant plundering of the American people.

Ron Paul (R)

Only a third of mined silver production comes from the production of primary silver mines, the rest comes from mined production of other metals, namely zinc and lead, 25% is from production of copper mines (Chile has very little primary silver production but is the fifth largest silver producing country) and the rest is from production at gold mines.

Mined silver production rose by 2.5 percent to 735.9 M oz in 2010 - gains came from primary silver mines and as a by-product of lead/zinc mining activity. Silver produced as a by-product of gold mining fell four percent in 2010.

Tom Albanese, CEO Rio Tinto Group, the world’s second largest mining company, said that the copper industry has struggled to maintain supply because of declining ore grades (ore grades averaged 0.76 percent copper content in 2009, compared with 0.9 percent in 2002), delays to mine expansions and disruption from strikes. Christine Meilton, chief consultant at CRU Group said there was a risk some copper projects, expected to come on stream in 2012 and 2013, will be delayed because of red tape, poor infrastructure and funding difficulties.

A Report by the APS Panel on Public Affairs and the Materials Research Society coined the term “energy-critical element” (ECE) to describe a class of chemical elements that currently appear critical to one or more new, energy related technologies.

Energy-related systems are typically materials intensive. As new technologies are widely deployed, significant quantities of the elements required to manufacture them will be needed. However, many of these unfamiliar elements are not presently mined, refined, or traded in large quantities, and, as a result, their availability might be constrained by many complex factors. A shortage of these energy-critical elements (ECEs) could significantly inhibit the adoption of otherwise game-changing energy technologies. This, in turn, would limit the competitiveness of U.S. industries and the domestic scientific enterprise and, eventually, diminish the quality of life in the United States.

The focus of the report was on energy technologies with the potential for large-scale deployment so the elements they listed are energy critical: silver was listed as one of their choices based on its use in advanced photovoltaic solar cells, especially thin film photovoltaics.

Conclusion

Silver investment rose by 40% during 2010 to 279.3 million ounces, almost double the amount for 2009. Demand increased to 167.0 M ozs (+5.1%) for jewelry and 101.3 M ozs (+22%) for coins. Other major usage categories are photography (72.7 M ozs, down 8.3%), and silverware (50.3 million ozs).

Industrial use accounted for the bulk of silver fabrication demand in 2010, 487.4 million ounces, up from 403.8 million ounces in 2009 - an annual increase of 20.7 percent.

Total silver demand in 2010 jumped 14.59 percent while the silver surplus - the difference between supply and fabrication demand - dropped 12 percent to 173.4 million ounces. Primary silver mining cash costs were unchanged at $5.27 an ounce in 2010.

The Federal Reserve first issued its debt based paper money in 1913. Since then the US dollar has lost plus 95% of its value. The history of fiat money has always been one of failure. The US dollar was backed by gold and silver, then just gold - the dollar use to be the rock all the worlds currencies were anchored to but when it became fiat, all the worlds currencies became fiat.

The Hong Kong Mercantile Exchange (HKMEx) has recently announced that they will roll out Yuan denominated silver futures contracts. This exchange will:

- Grant Asian investors direct access to silver futures

- Blunt U.S. dominance in silver trading by reducing the importance and influence of the Chicago Mercantile Exchange (CME)

According to the HKMEx China is already becoming a factor in the silver market. From 2008 to 2010, silver demand soared 67% in China and China accounted for nearly 23% of global silver consumption in 2010.

In 2010 India consumed 2,800 tonnes of silver, 2011’s consumption is forecast to rise to 5,000 tonnes. India’s state-owned trading company - Minerals and Metals Trading Corporation (MMTC) said it would import 1,200 tons of Silver in 2011-12 as demand for the precious metal is rising fast.

The rising demand for silver bullion products with 99.99% fineness has started a new trend - silver denominated notes reminiscent of turn of the century American silver certificates are becoming quite popular in India, the difference is, these Indian notes are actually made of silver.

The silver notes closely resemble the country´s rupee and are very popular among the country´s younger generation and rapidly growing middle class. The nominal value of each note corresponds to its respective weight in silver - a note with a face value of 10 rupees is equal to 10 grams of silver.

Silver should be on every investors radar screen. Is it on yours?

If not, maybe it should be.

Richard (Rick) Mills

[email protected]

www.aheadoftheherd.com

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 300 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Uranium Miner, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, and Financial Sense.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard Mills does not own shares of any companies mentioned in this report.

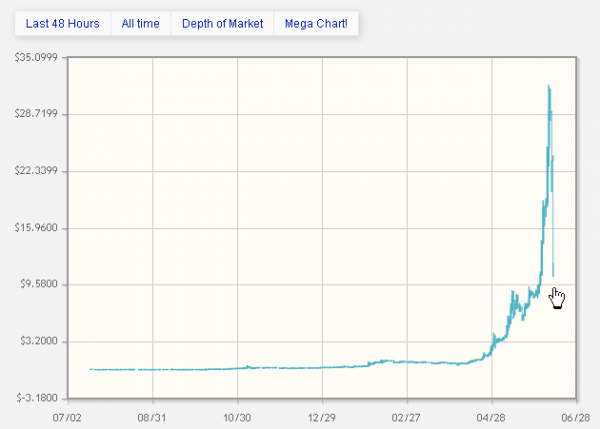

Just around the time silver suffered a waterfall decline, one little known “asset class” experienced an explosive gain of around 800% in a matter of weeks. It’s not gold, certainly not silver.

Just around the time silver suffered a waterfall decline, one little known “asset class” experienced an explosive gain of around 800% in a matter of weeks. It’s not gold, certainly not silver.

Why $20,000 Gold doesn’t excite me

-

It scares me!

Gold punched through $1,900 today. If the current financial system can withstand the stress and remained intact till the day gold trades at $20,000 an ounce, what will life be like then?

If we’re holding gold at that time, we may be doing fine but we are not likely to be 10 times richer. That’s because nothing much has happened to our gold. Rather, paper currencies would have lost so much purchasing power that it would take 10 times more of the same to buy what we could buy today. A Big Mac will most likely cost around $43 in the US. In Malaysia, NZ and Britain, it’ll like be around RM76, NZ$54 and £25 respectively (estimates based on Big Mac Index). When a basic meal costs that much, life can be very tough for savers who continued holding on to their paper currencies or other paper assets.

Many of my friends and relatives, from retired professionals to missionaries have been ill advised to rely on supposedly safe or high yielding investments like mutual funds, government managed pension schemes, term deposits or hot stocks to generate passive income or preserve the value of their retirement funds. Despite being presented with information from this website and elsewhere, there’s little affinity shown towards gold or silver. This scares me and for their sake, I hope gold does not get anywhere close to $20,000 before they get on board.

What’s even scarier is the fact that an enormously huge segment of society do not have the means to get on board, even if they wanted to. We’re looking at the 1.4 billion people living on less than NZ$2.25 a day. That’s less than 0.05 ounces of silver! They worry not about the Fed nor the Cartel but about how to provide food, clothing, housing and healthcare with that amount each day. It’s about survival, not savings. Pause for a moment to imagine their plight when gold hits $20,000. Spare them a thought today, and check out their appeal for assistance.

Why $20,000 gold?

In this recently released documentary, Mike Maloney presents the case for $20,000 gold by stepping back and looking at the big picture. He takes us back, very far back, and paints us a very big picture. This excellent educational video is a must watch, especially if you’re new to the Political Metals space. It’ll be your 90 minutes well spent.

But if you can’t spare the time, I’ve highlighted some of his key points with some new charts below for a quick read.

-

Dow/Gold Ratio Chart: Where are we in the Wealth Cycle?

Using the Dow Jones Industrial Average (Dow) as a measure of performance of the equities market in general, the ratio of the Dow to the price of gold indicates the performance of equities market relative to gold. Currently each point of the Dow is worth about 6oz of gold. During the process of correction after the biggest stock market bubble in history, the ratio is expected to head towards the historical mean (4oz) and overshoot it before finding its fair value again.

The bigger the bubble (deviation from mean), the larger the overshoot. During the present cycle, Mike expects the overshoot to touch 0.5:1 (1 oz of gold worth 2 points of Dow). In its extreme, the Dow would have to collapse from 11,000 to 950 if the price of gold remains at current level of $1,900. Conversely, gold will increase to $22,000 if the Dow remains at current levels.

Relative performance of Dow Vs Gold & Silver since Jan 2000

(Worst reference point, at peak of stock market bubble)

Relative performance of Dow Vs Gold & Silver since March 2009

(Best reference point, at the start of QE1)

-

Currency Supply Chart: Where are we in the Inflation/Deflation Cycle?

For simplicity, “money” & “currency” are used interchangeably here. Watch the video to see the difference.

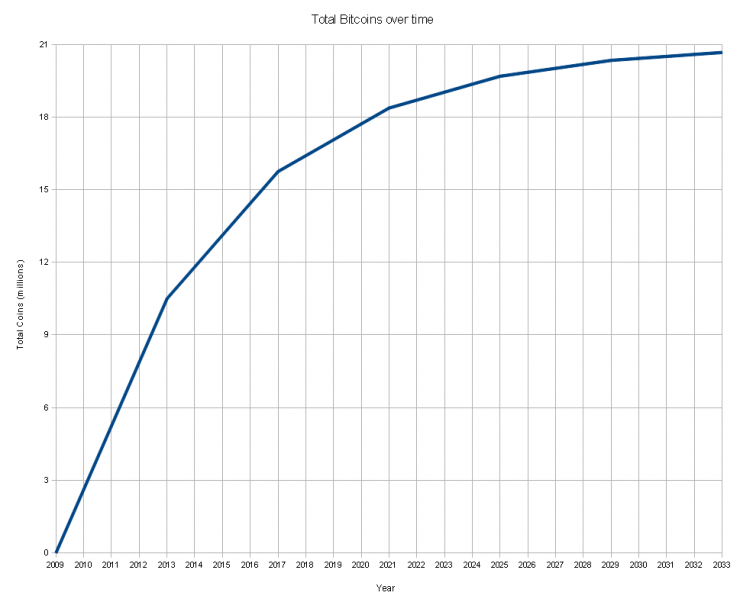

Monetary inflation is the increase in money supply resulting in price inflation (rising prices of goods & services), with a time lag between the former and the latter. The reverse applies to monetary deflation and price deflation. Studying the trend in money supply or the total amount of currency in circulation (CinC) over a period of time gives us an idea of where we are and where we’re heading in terms of inflation and deflation.

Money is created in two stages. The initial Base Money is created by the Fed (or other central banks). More new money is then created (up to 9 times the initial Base Money) within the private banking system through credit. It is loaned into existence. Watch the video to learn more about the money creation process.

The chart above represents the amount of CinC that’s exclusively created by the private banking system. The highlighted area indicates that this component of the overall money supply has dropped by $1.7T since the 2008 crisis. This is the Debt Collapse or Credit Contraction. Less lending by banks results in less money chasing goods and services, leading to price & asset deflation. It is evident from the chart that a contraction of this magnitude has never happened since 1960. The last time it happened was just before the Great Depression of the 1930s.

This rapid increase in Base Money (red chart) was an attempt to offset the decrease in the credit money (blue chart). When we add these two components of money supply together, we obtain the total CinC (Base Money plus Credit Money) as shown in the chart below.

Notice the contraction at the top of the chart, albeit a smaller one. It is evident that despite the frantic pace of money printing by the Fed, it has not succeeded in offsetting the reduction in money supply due to credit contraction.

The Fed has little choice but to continue creating money. With such a large perturbation in total currency supply and due to the complexity and size of the monetary system, it is not possible for the Fed or anyone else to create just sufficient money at just the right rate such that the total CinC won’t overshoot its long term trend. The principle that the larger the deviation from the mean, the larger will be the overshoot during the correction applies here as in the stock market above. The fact that there’s an undetermined time lag, between monetary inflation and price inflation further adds to the likelihood that the next round of money printing will result in a massive overshoot. Coupled with other factors, hyperinflation could be just round the corner.

In his book, Rich Dad’s Advisors: Guide to Investing In Gold and Silver: Protect Your Financial Future, and again in his presentation, Mike predicted the following sequence of events:-

How does gold perform under inflation and deflation environment? Check out the study by Oxford Economics: “Impact of inflation and deflation on the case for gold”.

Related Resources:

Share this:

Like this: