Gross US Debt Surges By $240 Billion Overnight, US Debt To GDP Hits Post World War II High 97.2%, Official Debt Ceiling Increase Only $400 Billion

By ZeroHedge | Aug 3, 2011

-

Two things happened when the Senate voted in the “Bipartisan” plan into law yesterday:

i) deferred debt on the Treasury’s balance sheet finally caught up with reality, and

ii) as a result of i) America’s Debt/GDP just hit a post World War 2 High of 97.2%.

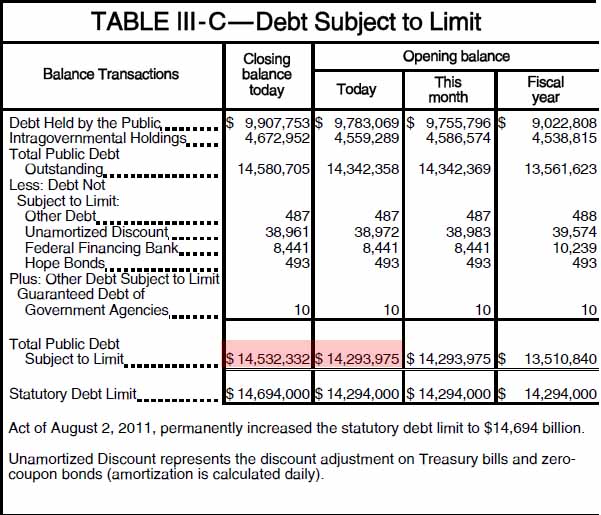

As the Daily Treasury Statement as of last night indicates, total US marketable debt surged by $124.6 billion, while debt in intragovernmental holdings (Social Security, Government Retirement Accounts, etc), soared by $113.6 billion, for a combined one day change of $238.2 billion, the single biggest one day increase of US debt in history.

Obviously this is a result of massive underfunding and disinvestment in the various government retirement accounts as well as due to deferred debt which was to be booked since the debt was breached on May 16. However, how marketable debt could increase by a whopping $125 billion without any actual auction settlement is slightly confusing. Just as confusing is that according to the endnote in the debt subject to limit calculation, the new ceiling is not the $900 billion increase as requested, but only $400 billion more than the $14.294 billion previous, or at $14.694 billion.

We hope this is some Treasury type or misunderstanding as this new ceiling will be breached in a month. And the last thing we need is this whole debt ceiling drama back again in September. One thing there is no confusion about, however, is that based on the latest gross debt number of $14.581 trillion, and the just reported Q2 GDP of $15.003 billion, total US debt to GDP is now a post World War II high of 97.2% (and that excludes the GSE off balance sheet debt).

-

-

August 5, 2011 at 1:38 AM | #1The Near Debt Experience « The Trough

-

August 5, 2011 at 7:36 AM | #2Here We Go Again… | Don't Tread On Me