Archive

For illegally withholding gold information, Fed pays GATA

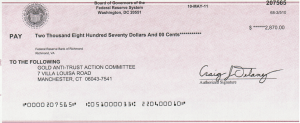

Fed's Check to GATA for illegally withholding a gold-related document GATA sought in its FOI lawsuit against the Fed in U.S. District Court

Today, GATA announced that they’ve received a check from the Fed for $2,870 in attorney’s fees and costs for illegally withholding a gold-related document GATA sought in its FOI lawsuit. Nice piece of souvenir for GATA’s more than a decade long effort in exposing the gold price suppression scheme of the Fed.

For a brief history to this, see my earlier post G-10 Committee Meeting Minutes released to GATA by the Fed, as ordered by U.S. District Court judge Ellen Segal Huvelle, where I highlighted how the US Fed continues to operate in secrecy just as it was conceived way back in 1910 on Jekyll Island.

I decided to swap my savings in paper currencies for gold (& silver) years ago after studying GATA’s work. Had not for their very well documented exposé of how governments had been manipulating the gold price for decades, I would still be counted among the many who consider gold as a barbaric relic being dug out of one hole only to be buried in another. Thanks Bill Murphy, Chris Powell & others at GATA.

If you do not own a single ounce of gold or silver yet, I hope this check may trigger your interest to start your investigation. A good place to start would be the links in GATA’s news release below and some information compiled from various sources in this website: Why hold gold, Why hold silver, Gold manipulation & Silver manipulation.

For illegally withholding gold information, Fed pays GATA

Friday, May 13, 2011 Chris Powell | GATA

Dear Friend of GATA and Gold (and Silver):

The Federal Reserve System this week paid GATA $2,870 in attorney’s fees and costs for illegally withholding a gold-related document GATA sought in its federal freedom-of-information request and lawsuit against the Fed in U.S. District Court for the District of Columbia.

While the judge in the case, Ellen Segal Huvelle, allowed the Fed to withhold most of the gold-related documents GATA sought (http://www.gata.org/node/9560), the document she ordered disclosed, the minutes of a secret meeting of the G-10 Gold and Foreign Exchange Committee in April 1997, showed Western central bankers conspiring to coordinate their gold market policies:

GATA’s freedom-of-information request also elicited an admission from a member of the Fed’s Board of Governors, Kevin M. Warsh, that the Fed has gold swap arrangements with foreign banks and insists on keeping those arrangements secret:

http://www.gata.org/files/GATAFedResponse-09-17-2009.pdf

From what GATA’s case extracted from the Fed and from what the case showed the Fed was determined to keep secret, it now has been established on the official record that the Fed and likely the U.S. Treasury Department too are heavily involved in surreptitious action to suppress the gold price. Thanks to GATA, financial journalists now have plenty of documentation to pursue the story of gold price suppression:

http://www.gata.org/taxonomy/term/21

All they need now is the courage to pursue it.

GATA continues to approach many news organizations to urge them to pursue this story.

A letter from the Fed’s associate general counsel, Katherine H. Wheatley, to GATA’s lawyers, William J. Olson and John S. Miles of William J. Olson, P.C., of Vienna, Virginia (http://www.lawandfreedom.com/), conveying the check for the attorneys’ fees and costs, has been posted here:

http://www.gata.org/files/FedLetterLegalCosts.jpg

A copy of the Fed’s check payable to GATA has been posted here:

http://www.gata.org/files/FedCheckLegalCosts.jpg

Of course the attorneys’ fees and costs paid to GATA by the Fed are just a small fraction of the total costs incurred by GATA in the case. To cover those costs, to explore more legal action against the Fed and other government agencies, and to continue its work generally, GATA is always grateful for financial contributions, which are federally tax-deductible in the United States:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Like this:

GATA: Having called plunge, Grandich and Davies jump back in; Sinclair says: Relax!

By Chris Powell | GATA | 8:29a ET Thursday, May 5, 2011

At 11:33a ET today Peter Grandich of the Grandich Letter, who had called the plunge in the precious metals exactly, announced that he had returned to being fully invested in them:

http://www.grandich.com/2011/05/time-to-go-back-in-gold-1481-silver-35-7…

Tonight in an interview with King World News, Hinde Capital CEO Ben Davies, who had also called the plunge exactly, reported that his firm had covered its hedges and was getting back into silver too. “This is the start of a great opportunity to accumulate silver,” Davies said. “All the key fundamental issues in the world have not gone away, nor those specific to silver, such as the fact that it is under-owned and short of supply in the medium-term.” An excerpt from that interview can be found at the King World News blog here:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/5_Ben…

And at 2:22p ET today the dean of gold traders, mining entrepreneur Jim Sinclair of JSMineSet.com, wrote that the plunge is only proof that gold will make a major move upward in June. Sinclair’s advice to the friends of gold and silver was simply, “Relax”:

http://jsmineset.com/2011/05/05/the-foundation-for-gold-at-5000/

KWN Interview: Hathaway - Gold & Silver to Explode Again After Consolidation-

-

-

-

Like this:

Another Unprecedented Court Order for the Federal Reserve

Fed Must Release Data on Emergency Bank Loans as High Court Rejects Appeal

Hardly 2 months after judge Ellen Segal Huvelle ordered the Federal Reserve to release some tightly held records related to its gold price suppression scheme sought by GATA, it is now ordered to release details of emergency loans made to banks in 2008. The records were originally requested by Bloomberg under the Freedom of Information Act. A federal trial judge ruled in 2009 that the Fed had to disclose the records, and a New York-based appeals court upheld that ruling.

The Federal Reserve will disclose details of emergency loans it made to banks in 2008, after the U.S. Supreme Court rejected an industry appeal that aimed to shield the records from public view.

The justices today left intact a court order that gives the Fed five days to release the records, sought by Bloomberg News’s parent company, Bloomberg LP. The Clearing House Association LLC, a group of the nation’s largest commercial banks, had asked the Supreme Court to intervene.

“The board will fully comply with the court’s decision and is preparing to make the information available,” said David Skidmore, a spokesman for the Fed.

The order marks the first time a court has forced the Fed to reveal the names of banks that borrowed from its oldest lending program, the 98-year-old discount window. The disclosures, together with details of six bailout programs released by the central bank in December under a congressional mandate, would give taxpayers insight into the Fed’s unprecedented $3.5 trillion effort to stem the 2008 financial panic.

“I can’t recall that the Fed was ever sued and forced to release information” in its 98-year history, said Allan H. Meltzer, the author of three books on the U.S central bank and a professor at Carnegie Mellon University in Pittsburgh.

Source [Bloomberg]

Obviously the reporter, Greg Stohr, was not aware of the GATA suit. G-10 Committee Meeting Minutes released to GATA by the Fed, as ordered by U.S. District Court judge Ellen Segal Huvelle.

-

Like this:

G-10 Committee Meeting Minutes released to GATA by the Fed, as ordered by U.S. District Court judge Ellen Segal Huvelle.

Judge Ellen Segal Huvelle - US District Court, District of Columbia

True to its form, the US federal Reserve (Fed) continues to operate in secrecy just as it was conceived way back in 1910 on Jekyll Island.

The Gold Anti-Trust Action Committee (GATA) sent two letters, one on December 2007 and another on April 2009, to the Fed board requesting the central bank’s records of its market intervention to suppress the price of gold (specifically “gold swaps” related documents). Both requests were denied, despite appeals.

After the unsuccessful attempts to obtain such records under the Freedom-of-Information Act (FOIA), GATA filed a lawsuit against the Fed Board seeking a court order for disclosure of some specific documents on 30th December 2009.

On 3rd February 2011, judge Ellen Segal Huvelle of U.S. District Court for the District of Columbia ruled that most of the Fed’s documents were exempt from disclosure under the FOIA for being “pre-decisional or deliberative”. However, she ordered the disclosure of one document - “a staff member’s notes on the discussion by the Gold and Foreign Exchange Committee of the Group of Ten (or “G-10″), as well as a transmission memorandum from Mr. [Ted] Truman to the board” , and that it be handed over to the plaintiff by February 18.

The very fact that there existed a Gold and Foreign Exchange Committee at the G-10 level suggests that gold is high up the agenda of central banks, rather than being a “barbaric relic” as some would have us believe. Reproduced below is Chris Powell, GATA’s secretary/treasurer’s comments on the minutes of this meeting held on 7th April 1997 that the Fed has been refusing to release until now.

They quote a British delegate as saying that while the gold price seemed “sluggish,” the gold market itself was actually showing “resilience” and “physical demand is high.” The British delegate described the gold market as “traditionally secretive.”

The minutes show committee members acknowledging the heavy involvement of central banks in gold leasing, with the British delegate estimating that a year’s worth of gold production already had been sold forward. That was 14 years ago and of course much central bank gold leasing followed until the last year or so.

According to the minutes, the U.S. delegate cited above, identified only as “Fisher” — apparently Peter R. Fisher, head of open market operations and foreign exchange trading for the Federal Reserve Bank of New York — also warned that central bank gold sales and leasing might be construed as positive for gold. The minutes say: “First, he noted that some market cynics viewed central bank activity as a contrary indicator and therefore one had to be conscious of possible feedback effects. Second, he noted that the price of gold, unlike other commodities, had historically not trended toward the cost of production. This seemed to suggest an ongoing supply/demand imbalance. Third, he had the sense that the gold leasing market was an important component in this puzzle, though he did not understand enough about that market, particularly the credit risk aspects of gold lending.”

A Canadian delegate, the minutes say, wondered whether data about the gold market could be trusted — a point much pressed by GATA and others lately.

U.S. delegate Fisher, the minutes say, “explained that U.S. gold belongs to the Treasury. However, the Treasury had issued gold certificates to the Reserve Banks, and so gold (by these means) also appears on the Federal Reserve balance sheet. If there were to be a revaluation of gold, the certificates would also be revalued upwards; however [to prevent the Fed's balance sheet from expanding] this would lead to sales of government securities. So the net benefit to Treasury would need to be carefully calculated, since sales of government securities would expand the public portfolio of government securities and hence also expand the Treasury’s debt-servicing burden.”

This seems to be as candid an acknowledgement as any of the U.S. government’s profound interest in suppressing the price of gold.

Two years after the G-10′s Gold and Foreign Exchange Committee discussed coordinating Western central bank policies toward gold, most of those central banks announced just such a formal mechanism of cooperation, the Washington Agreement on Gold:

http://www.ecb.int/press/pr/date/1999/html/pr990926.en.html

The minutes of the April 1997 meeting of the G-10 Gold and Foreign Exchange Committee, which the Fed sought to conceal, along with the secrecy on which the Fed successfully has insisted for its other gold records, are powerful confirmations of Western central bank interest in controlling the gold market surreptitiously. The minutes have been posted at GATA’s Internet site here:

http://www.gata.org/files/FedMemoG-10Gold&FXCommittee-4-29-1997.pdf

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Here is ZeroHedge’s take on Fisher’s comments:

Fisher’s comment relates to what would happen to the Fed’s securities portfolio should there be a sudden or gradual revaluation in the price of gold. His conclusion is that in order to keep the Fed’s balance sheet stable, an (acknowledged) surge in the price of gold would lead to a forced selling in Treasurys. Of course, that would mean that the Fed would have to actually value gold at its actual market price, instead of that relic price of $42.22 per ounce. Which means that valuing gold at fair market value would result in dumping over $300 billion in Treasurys, something the Fed can not afford to do at a time when it is engaged in purchasing $100+ billion each month.

To an extent we agree with GATA’s summary of the implication of this statement: “This seems to be as candid an acknowledgement as any of the U.S. government’s profound interest in suppressing the price of gold.” Yes and no. While this is in fact indicative of the Fed’s desire to keep gold price low, it is the case in a world in which the Fed were to see gold as priced at $1,390/ounce. Not at the fake price of $42.22/ounce (perhaps the Fed can sell us some gold at that price?)

Now keep in mind that the Fed discloses the value of its gold stock as $11.041 billion in each weekly H.4.1. If the Fed were to value gold at FMV, the asset side of the Fed’s balance sheet would suddenly balloon by just over $350 billion, as the fair value of the 8,133.5 tonnes of gold allegedly in possession by the US is valued at $361.8 billion. Which of course also means that to account for the surge in paper assets by $350 billion, the Fed would either have to sell a like amount of Treasurys or increase the liabilities side of its balance sheet, by either increasing the Currency in circulation or the Excess bank reserves by a like amount, a result which would increase inflationary expectations by a massive percentage. Both are obviously outcomes that the Fed will fight to the death to avoid.

As for the question of how much of this unauditable gold tonnage is actually there, that’s a different matter entirely.

So yes, thank you JP Morgan for continuing your sworn duty of doing all you have to do, to maintain the Fed’s 4th mandate of suppressing the price of gold, and preserving the myth that there is no inflation in the US. The people of this truly great and democratic nation applaud your efforts.

Finally, this is what I consider a must watch video interview between James Turk of GoldMoney and Chris Powell of GATA, especially if you are new to the political nature of gold & silver and GATA’s work. Listen to what Chris had to say about the FOIA lawsuit, what else is pending besides the disclosure discussed above, the secretive Gold Stabilization Fund (GSF), Gold Reserve Act 1934, what Deutsche Bundesbank (German central bank) had to say about their gold swap operations, central banking secrecy and gold price suppression scheme in general.

For more information on GATA’s work in exposing the central banks’ role in price suppression of PMs, visit www.gata.org

-

Like this:

The Race to Debase

Monitoring the Currency Wars

Most Recent: Australia Interest Rate Cut

|

Currency Wars Simulation |

Most Popular

Most Recent

Archives

Featured Reviews

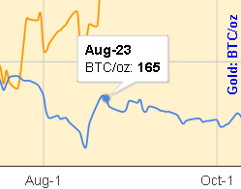

16Oct: Jeff Clark (Casey Research)

$2,300 gold by January 2014

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

>> More forecasts & forecast accuracy

Featured Videos

|

German Central Bank pledged to the Fed never to buy gold again |

|

George Soros: His role in major world events as agent of the British Empire, as told by LarouchYouth |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- Here Is What Will Fuel The Move Higher In Hard Assets October 27, 2012

- Greyerz - Two Absolutely Incredible & Key Gold Charts October 26, 2012

- Celente - It’s Not Just Germany’s Gold That’s Missing October 26, 2012

- What To Expect With Gold Assaulting $1,700 & Silver At $32 October 26, 2012

- James Turk - The Entire German Gold Hoard Is Gone October 25, 2012

- KWN Update - Here Is A Huge Key To The Markets October 25, 2012

- Currency Wars Continue To Rage & This Is Positive For Gold October 25, 2012

- Central Planners Greatest Fear, Possible Surprises & Gold October 24, 2012

Finance & Economics

Finance & Economics

- Guest Post: GDP - The Warning Signs From Exports October 28, 2012 Tyler Durden

- On Europe And The Future Of International Relations October 28, 2012 Tyler Durden

- Meanwhile In Japan... October 27, 2012 Tyler Durden

- Bundesbank's Official Statment On Where It's Gold Is (And Isn't) October 27, 2012 Tyler Durden

- A CRuSTY CRiTTER AND aN INTeRPLaNeTaRY BuLL SHiTTeR... October 27, 2012 williambanzai7

- As Thousands Of Italians March Against Austerity On "No Monti Day", Berlusconi Threatens To Scuttle Monti Government October 27, 2012 Tyler Durden

- "Go South, Young Man": The Africa Scramble October 27, 2012 Tyler Durden

- Too Much Rain Will Kill Ya October 27, 2012 Bruce Krasting

Gold at all time high $1,487.50 | Silver at new 31-year high $42.85

Related reading: GATA’s testimony before the CFTC hearing in March 2010Share this:

Like this: