Archive

150 Years Of U.S. Fiat Currency

-

5 days ago saw the 150th year anniversary of an event so historic that a very select few even noticed: the birth of US fiat. Bloomberg was one of the few who commemorated the birth of modern US currency: “On April 2, 1862, the first greenback left the U.S. Treasury, marking the start of a new era in the American monetary system…. The greenbacks were originally intended to be a temporary emergency-financing measure. Almost bankrupt, the Treasury needed money to pay suppliers and troops. The plan was to print a limited supply of United States notes to meet the crisis and then have people convert the currency into Treasury bonds. But United States notes grew in popularity and continued to circulate.” The rest, as they say is history.

In the intervening 150 years, the greenback saw major transformations: from being issued by the Treasury and backed by gold, it is now printed, mostly in electronic form, by an entity that in its own words, is “set up similarly to private corporations, but operated in the public interest.” Of course, when said public interest is not the primary driver of operation, the entity, also known as the Federal Reserve is accountable to precisely nobody. Oh, and the fiat money, which is now just a balance sheet liability of a private corporation, and thus just a plug to the Fed’s deficit monetization efforts, is no longer backed by anything besides the “full faith and credit” of a country that is forced to fund more than half of its spending through debt issuance than tax revenues.

More on the history of American fiat from Bloomberg:

At the start of the Civil War, the U.S. didn’t have a national paper currency. Instead, the money supply consisted of U.S. coins and a collection of paper notes issued by private banks. Technically, the federal government began issuing its own paper currency in 1861. That year, the Lincoln administration issued $60 million in demand notes, a variant of a Treasury note that was redeemable “on demand” for gold coins at the Treasury or any sub-Treasury.These notes were overshadowed in 1862 by the issue of $150 million in a new fiat currency officially known as United States notes and popularly known as greenbacks or legal tenders. By the end of the war, close to $450 million worth of greenbacks were in circulation.

The name greenbacks referred to the reverse of the notes, which were printed in green. The name legal-tender notes referred to the text that originally appeared on the back, which began, “This note is legal tender for all debts, public and private.” This provision made the currency a valid form of payment on par with gold and silver, which was a very controversial action at the time. It made the United States note a fiat currency — meaning its value was established by law alone and wasn’t based on some other unit of value, such as gold, silver or land.

Many Americans during and after the Civil War believed the creation of a fiat currency was unconstitutional. The Constitution explicitly stated that only gold and silver could be considered legal tender. In 1871, in the case of Knox v. Lee, the Supreme Court settled the matter by declaring that making United States notes legal tender was indeed constitutional.

By this time, the greenback was at the center of a countrywide debate on monetary policy. When the post-Civil War economic boom ended in the panic and depression of 1873, many people, especially farmers, blamed the Treasury’s policy of contracting the currency — that is, removing United States notes from circulation in an attempt to go back to the gold standard, which would require that a $1 note could be redeemed for $1 in gold.

As a consequence, there was a call for the expansion of United States note circulation or an inflation of the currency. This belief became joined with a political ideology that opposed big business and banking interests, resulting in the birth of the Greenback Party in 1874.

Opposing the Greenbackers were more conservative interests, sometimes known as “gold bugs,” who found support in the Republican Party and in elements of the Democratic Party. Gold interests proved the stronger contestant in the debate and in 1878, the total circulation of United States notes was fixed at a little over $346 million and the notes eventually became redeemable in gold (at least until 1933, when this provision was removed).

During the 20th century, United States notes became ever less important in the nation’s money supply, though Congress supported their continued circulation. They were increasingly replaced by currency issued by the Federal Reserve System, which came to look almost identical to the United States note. The Federal Reserve note thus became the new greenback.

In 1966, Congress allowed the Treasury to start removing United States notes from circulation. The last delivery of the notes by the Bureau of Engraving and Printing to the Treasury was made in 1971. In 1994, the Riegle Community Development and Regulatory Improvement Act eliminated the issuance of the notes altogether.

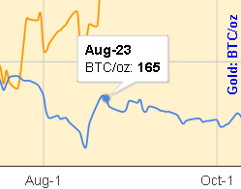

So instead of real money, America has an impostor “which came to look almost identical to the United States note” with the full complicity of everyone in charge, just so that when needed, any and all untenable debt burdens can be inflated away. And while the latter is a topic of a whole different discussion, we present another chart which, unlike the 150th anniversary of fiat, should be something discussed far more broadly… Because in a fiat world superpower status is always relative.

-

Source: ZeroHedge

Related Articles:

Why hasn’t gold kept up with inflation?

-

Towards the end of Chris Powell’s speech at the 18th CLSA Investors’ Forum in Hong Kong, he addressed the all important question Why hasn’t gold kept up with inflation?

It’s because Western governments found ways of vastly increasing the supply of gold without having to go through the trouble of mining it — to dishoard and lease it from central bank reserves and to issue certificates of deposit against gold that never existed in the first place.

“Why” is supposed to be a basic question of journalism. But it has fallen out of financial journalism when it comes to gold, he lamented.

In recent years, and especially in recent months, I have spent much time explaining the gold price suppression scheme to leading financial journalists in the West. I have given them the documentation. Some of these journalists seemed interested. But none has ever reported anything about the issue. One writer who works for a major news agency in the United States was intrigued enough to call the Federal Reserve and ask about its gold swaps. She got a very telling “no comment.” But unfortunately she could not get her editor’s permission to write a gold story.

Frustrating as all this is, it is not too surprising. After all, who are the major advertisers in the Western financial news media and the major sources of financial news? The market manipulators and governments themselves. And journalists seem to take for granted that central banks operate in secret, particularly in regard to gold, so there’s no point in questioning them — even though central banking now determines the value of all capital, labor, goods, and services in the world, and does so in secret.

So here I am in Asia, which is a major victim of the gold price suppression scheme. Maybe there will be more curiosity and indignation about it here.

But Asia is not the only victim of this scheme. My own country may be the biggest victim. For this scheme has helped to corrupt the United States, destroying our once-free markets and the accountability of our government.

We in GATA do what we can, even though, from our beginning, we have wondered whether we could really presume to speak for gold. And not just for gold, of course — we are not idolaters — but for the economic and political liberty of individuals and the national sovereignty that gold serves and stands for. With gold always under attack precisely for what it represents, and with no others coming forward to defend it for what it represents, with even the gold mining industry’s main trade association refusing to acknowledge the attack, we have hoped that any presumption on our part might be forgiven.

We remain largely amateurs. At the outset we did not half understand what was going on and what we were setting about to do. Our name preserves that imperfect understanding. We thought we had discovered just another anti-trust violation. It was a while before we perceived that we were up against government policy and that most of what we were discovering had been discovered long ago, at least in principle, just not well taught, publicized, preserved, and made timely again.

Because it can work only through surreptitiousness and deceit, this government policy will be defeated when it is more widely understood — and every day it is being better understood, because it is getting so brazen. It was more brazen than ever the other day when Switzerland devalued its franc, the world’s leading “safe haven” currency, apparently leaving the “safe haven” field exclusively to gold. But just a few minutes before the Swiss franc’s devaluation was announced, unidentified sellers dumped thousands of gold futures contracts on markets around the world, causing the gold price to plunge along with the Swiss franc. These sellers plainly did not aim to make a profit from their gold holdings; if they had intended to make a profit, they would have sold gradually into the market. No, they meant to knock the price down hard, and they did.

These sellers almost surely were central banks. But as far as I could tell, no Western journalist has yet put a question to any central banker about that strange and counterintuitive action in the gold market.

I ask for your help in forcing an end to the gold price suppression scheme. I ask in the cause of giving individuals, nations, and all humanity a chance at democracy, liberty, and limited government with a neutral, fair, and impartial international currency that serves not just one government or another or one class or another but rather the whole brotherhood of man.

-

Chris Powell, is the treasurer/secretary of Gold Anti Trust Committee and a newspaper editor in Connecticut.

Government admission of price suppression: Report by South Carolina State Treasurer’s Office

-

[Active updates: Developing stories] The South Carolina Treasurer’s Office, acting upon a directive from the state legislature, has recently published a report on the advisability of investing in gold and silver. Basically, the state legislature wanted to know if it’s wise to invest public funds under it’s custody in gold & silver.

Here’s what the Treasurer’s Office has to say about itself:

This is a tall order, hence we can assume that the report must be well researched and credible. It concluded that it is not advisable to invest public funds in gold & silver because:-

While the timestamp of the document was 27 Feb 2012, it can be assumed that the report was prepared soon after the end of September 23, 2011 due to this inclusion. From the perspective of a short term investment, that was a pretty good call, considering the fact that gold and silver have been taken down to $1624 and $31.40 respectively as I write.

However, this piece is not about how good the Treasurer’s Office was at making an investment call based on price. Neither is it about whether gold & silver is in a bubble. These conclusions (2) & (3) are opinions of the Treasurer’s Office, which are subjective. Of greater interest are the facts revealed in the body of the report.

Regular readers of this blog would have noticed that there are several key issues that are repeatedly discussed or highlighted here (through news feeds or third party contributions). They include:-

Items (1) to (4) are often disputed by the mainstream media and investors, sometimes referring to them as conspiracy theories. Hence, it is most interesting to see what this government published report has to say about these 6 issues.

Price Suppression is Real

In one short paragraph, this report confirms in no uncertain terms the truth behind the so called “conspiracy theories”. Not only does it confirm the existence of price suppression, it discloses the WHOs and the HOWs!

Risks of holding gold through ETFs, Certificates, Bank Accounts & other Derivatives

It has been repeatedly emphasized here that the only secure means of owning gold & silver is by holding physical coins and bars in your own possession or stored in a private vault outside the banking system. Anything else is a derivative - a paper or electronic representation of the real thing.

This report explains the nature of these derivatives and lists the risks associated with each, together with reasons why the Treasury’s Office advised against investing in them.

The full report in pdf is available for download at the South Carolina Treasurer’s website. Text from relevant sections is reproduced below with comments related to the 6 items above highlighted. Most of the remarks are self explanatory. There are, however, two groups of comments that warrant some discussion.

1. Allocated & Unallocated Accounts

The above describes two products offered by banks to clients who want to invest in gold (or silver) without having to deal with the physical metals. For example, when a bank accepts $2,000 from a customer and issues a gold certificate or credits the customer’s gold account under the unallocated system, the bank is not obliged to buy and store 1.2 oz (at current price) of gold on behalf of the customer. It holds only a tiny portion of that amount in gold. Hence when many of its the customers decide to redeem their certificates at the same time, the bank will not have sufficient gold to deliver. This is what’s referred to as a “run on the bank’s gold on deposit”. The same applies when depositing cash in your bank. The practice of keeping only a tiny fraction of what’s rightfully belonging to the customers (gold or cash) is referred to as fractional reserve banking.

When selling allocated gold products, the bank is legally required to hold 100% of the customers deposit in physical metal. For example, if a customer deposits sufficient cash to own a 400 oz gold bar and is assigned a bar bearing serial No: AGR Matthey 156571, how can one be sure that the same bar or a portion thereof is not assigned to another customer at the same time? That’s the issue raised by the report - and the risk is real.

This brings us back to “the only secure means of owning gold & silver is by holding physical coins and bars in your own possession or stored in a private vault outside the banking system”. If you have to use a third party to store your metals, use specialized private vaults instead, because banks operate on a fractional reserve banking system.

There are many companies outside the banking system that offer secure vaulting services. Generally, they have very high transparency, including publishing audited client holdings on the web for public scrutiny (without any login required). Of course clients’ ID are anonymous, and known only to the operator and the client.

Try these links:

GoldMoney bar list and BullionVault client holdings. Their reviews can be found here.

Learn more about private vaulting services, including issues like ownership, custody, bailment, counter-party risks, and performance risks.

2. Reason for not investing in physical gold & silver

The report listed 5 ways to invest in gold & silver - ETPs, Certificates, Accounts, Derivatives and physical coins & bars. Notice how it highlights & explains all the risks associated with ETPs, Certificates, Accounts and Derivatives and the reasons why it is not advisable for the Treasury to invest in these.

Notice also that there are NO risk associated with physical metals. The only reason given for not investing in coins and bars is “South Carolina does not have the capacity to store or funding to secure gold and silver bullion”.

What a lame excuse! Do they not know that in April last year, “The University of Texas Investment Management Co., the second-largest U.S. academic endowment, took delivery of almost $1 billion in gold bullion“?

-

Proviso 89.145 GP:

Gold & Silver Investments

Office of State Treasurer

-

GOLD AND SILVER AS AN INVESTMENT:

Historically, investors have purchased gold as a hedge against an economic, a political, or a currency crisis. A decline in investment markets, a growing national debt, a weak currency, increasing inflation, military conflicts and social unrest are the most common reasons for investment in gold. Currently, gold and silver are at historic highs leading many expert investors to conclude that a bubble has been created in the precious metals market. Since the US recession began, the value of gold and silver has increased as investment markets perform poorly, troublesome economic news is announced, and when uncertainty in international markets intensifies.

Similar to other commodities, the value of gold and silver is determined by supply and demand, as well as speculation. The Federal Reserve, The London Bullion Market Association, JP Morgan Chase, and HSBC Holdings have practiced fractional-reserve banking and engaged in naked short selling causing artiñcial price suppression.

There are several ways to invest in gold and silver: bars, coins, ETP’s, certificates, accounts, and derivatives. If a state were to choose to invest in gold (and silver), it would likely choose to invest by:

1. ETP’s-Exchange Traded Products. This allows the stakeholder to invest in bullion without having to store bars and coins. The ñrst gold ETF (Exchange Traded Fund) was created in 2003 and has been viewed largely as a success, but has also been compared to investing in mortgagebacked securities. The annual expenses of the fund (storage, insurance, and management fees) are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time. ETF’s are investment companies that are legally classified as open-end companies or Unit Investment Trusts (UIT), but differ from traditional open-end companies and U]T’s. The main differences are that ETF’s do not sell directly to investors and they issue their shares in what are called Creation Units. Also, the Creation Units may not be purchased with cash but a basket of securities that mirrors the ETF‘s portfolio. The Usually, the Creation Units are split up and re-sold on a secondary market.

2. Certificates- allow investors to avoid the risks and costs associated with the transfer and storage of bullion by taking on a set of risks and costs associated with the certificate itself. Banks may issue gold certificates for gold which is allocated (non-fungible) or unallocated (fungible). Unallocated gold certiñcates are a form of fractional reserve banking and do not guarantee an equal exchange for metal in the event of a run on the bank’s gold on deposit. Allocated gold certificates should be correlated with speciñc numbered bars, however it is difficult to prove whether a bank is improperly allocating a single bar to more than one investor. The US ñrst authorized the use of gold certificates in 1863. By the early l930’s the US placed restrictions on private gold ownership and therefore, the gold certificates stopped circulating as money, but certificates are still issued by gold pool programs for investment purposes.

3. Accounts- Many banks offer gold accounts where gold can be instantly bought or sold just like any foreign currency on a fractional reserve (non-allocated, fungible) basis. Pool accounts, facilitate highly liquid, but unallocated claims on gold owned by the company. Digital gold currency systems operate like pool accounts and additionally allow the direct transfer of fungible gold between members of the service. Different accounts impose varying types of intermediation between the client and their gold. One of the most important differences between accounts is whether the gold is held on an allocated or unallocated basis. Another major difference is the strength of the account holder’s claim on the gold, in the event that the account administrator faces gold-denominated liabilities, asset forfeiture, or bankruptcy.

4. Derivatives- The product symbol for gold futures is GC, and it is traded in a standard contract

size of 100 troy ounces. In the US, gold futures are primarily traded on the New York Commodities Exchange (COMEX). As of 2009 holders of COMEX gold futures have experienced problems taking delivery of their metal. Along with chronic delivery delays, some investors have received delivery of bars not matching their contract in serial number and weight. Because of these problems, there are concerns that COMEX may not have the gold inventory to back its existing warehouse receipts.

ADVISABILITY:

There is no statute preventing the State from investing in gold and silver. The various methods of investment in gold and silver each carry different and often significant risks, the foremost being speculation. As the US has experienced the recent bursts in the housing and tech bubbles, it is important to take caution when contemplating an unconventional investment. Taxpayer money (state funds and state pension) across the US has not typically been used to invest in gold or silver bullion.

Recently, with the uncertainty in global markets, the devaluation of the dollar, rising inflation, and a flat US economy, there has been a renewed interest in either moving back to a gold standard, investing in gold or both. The value of gold and silver has significantly increased in the last decade, meaning it would cost a great deal to invest at this time.

Risks:

1. Bars and coins- South Carolina does not have the capacity to store or funding to secure gold and silver bullion. For these reasons the State Treasurer’s Office does not advise investing in gold and silver bars and coins.

2. ETP’s- The armual expenses and costs associated with this type of investment are high. In recent years there have been issues surrounding gold ETP’s. The purchase price provides the investor with a fluctuating amount (in weight) of the metal. Over time, as value increases and more investors participate in the fund, the amount of metal owner by the investor decreases. ETP’s can also be split and sold on the secondary market. For these reasons the State Treasurer’s Ofñce does not advise investing in ETP’s for gold and silver.

3. Certificates- Certificates for allocated gold present an accountability problem. Allocated gold certificates are supposed to be correlated with speciñc numbered bars; however, it is difficult to verify whether a bank is improperly allocating a single bar to more than one investor. Also, unallocated gold certificates are a form of fractional reserve banking and do not guarantee an equal exchange for metal in the event of a run on the bank’s gold on deposit. This is in conflict with S.C. Code of Laws 1976 SECTION 11-9-660. For these reasons, the State Treasurer’s Office cannot advise investing in gold and silver certificates.

4. Accounts- Similar to the risks associated with gold and silver certificates, allocated and unallocated metals held in accounts produce similar accountability problems. The strength of the account holder’s claim on metals is subject to the account administrators liabilities, assets, and/or solvency. Per S.C. Code of Laws 1976 SECTION 11-9-660, the State Treasurer’s Office cannot advise investing in gold and silver accounts.

5. Derivatives- Over the last three years, gold futures traded on the New York Commodities Exchange (COMEX) have encountered significant accountability problems. Holders of COMEX gold ñltures have frequently experienced delivery delays of their metals. Once delivered, there have been many reports of inaccurate weights and serial numbers on bars that do not match the holder’s contract. For these reasons the State Treasurer’s Office does not advise investing in gold and silver derivatives.

-

Gold: April 2012

-

Having read the above, it may now be easier to make sense of the sharp price decline for both gold & silver over the past 2 days. Lets now ask some questions. Was the price action due to:

The mainstream media attributed this week’s sharp price decline to improving economy, low inflation and no imminent QE announcements following the release of the latest FOMC meeting minutes. Given that the above statement was published just 5 weeks before the FOMC minutes, who is lying?

-

Developing Stories

12 Apr:

Jason Hommel explains what Blythe Masters actually meant by “the underlying client position that we’re hedging”.

11 Apr:

Ted Butler, the pioneer of silver manipulation investigation finally broke his silence over the Blythe Masters denial video clip. By far, this is THE best, most level-headed, objective rebuttal to Masters’ famous words that they are “not running a large directional position”. Read “JPM’s TV appearance” posted at Silverseek.com.

10 Apr:

-

7 Apr:

Mike Maloney on RT discussing gold & silver manipulation, Blythe Masters denial of JPM’s role in price manipulation, “First government admission of price suppression” & High Frequency Sheering. Must Watch!

-

6 Apr:

Further Reading:

-

Share this:

Like this: