Gold All Time High in Euro, Franc, Peso, Rupee, Rupiah, Real & Rand

News of physical gold priced in Euro and Swiss Franc hitting all-time highs was all over the media after Friday’s trading. What’s not making it into the news is that gold priced in several other major currencies has already surpassed their all-time highs over the past few weeks. The chart below shows this critical event for the Argentine Peso, Brazilian Real, Euro, Indian Rupee, Indonesian Rupiah, South African Rand and the Swiss Franc.

With the coordinated quantitative easing by central banks, investors and savers alike are flocking to gold as a preferred store of value over fiat currencies.

As the race to debase picks up steam, other major currencies are not far behind their all-time nominal highs. The chart below shows this critical event is near for the US Dollar, Australian Dollar, New Zealand Dollar, Singapore Dollar, Malaysian Ringgit, British Pound, Chinese Yuan, Russian Ruble and Japanese Yen.

Governments of the world are trying to solve a debt crisis by adding more debt. Escalating fiscal deficits only increase the burden on central banks to print more money. As long as the world is caught in this circular loop of debt and easy money, all fiat currencies will continue to depreciate against gold, the ultimate store of value.

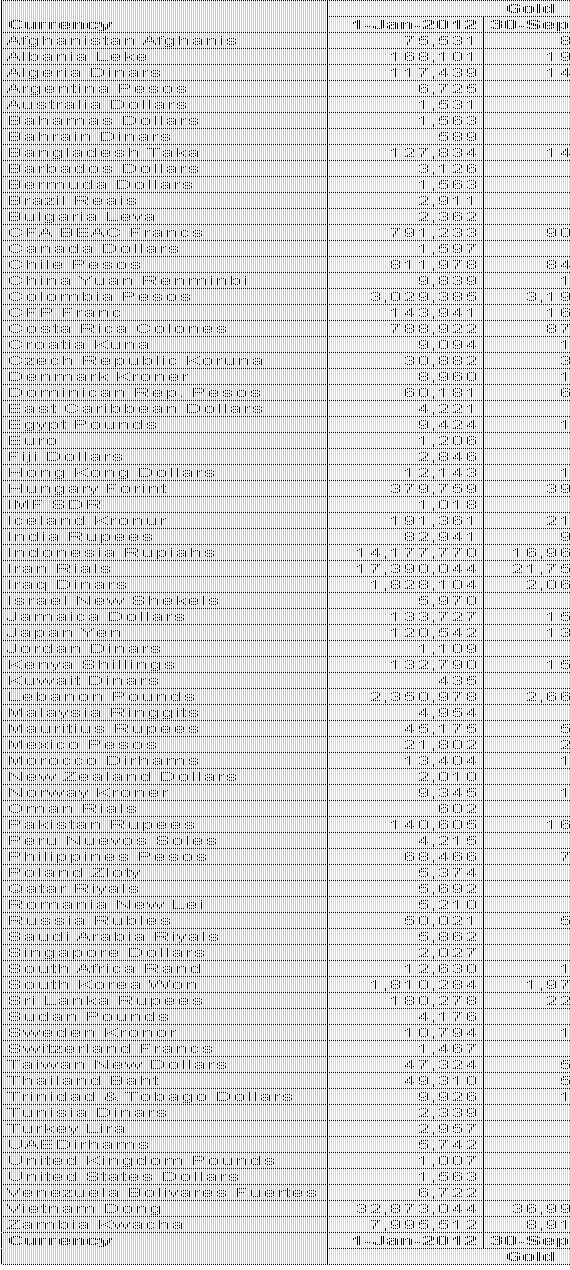

Take a look at how fiat currencies globally performed against gold & silver in the first three quarters of 2012. The chart below shows how many units of your national currency was required to purchase one ounce of gold & silver on January 1, 2012 compared to September 30, 2012.

Compiled from data at GoldSilver.ocm

Compiled from data at GoldSilver.ocm

-

And this is how fiat currencies globally performed against gold & silver over the past 12 years (since the bull market in PMs). The chart below shows how many units of your national currency was required to purchase one ounce of gold & silver in January 1, 2000 compared to September 30, 2012.

Leave a Reply Cancel reply

Most Popular

Most Recent

- Potential sharp moves in gold & silver prices. Which direction?

- Malaysian Central Bank Raided “Gold Investment” Company

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

- Gold All Time High in Euro, Franc, Peso, Rupee, Rupiah, Real & Rand

- Fed’s $40 billion/month is matched by China’s record $46 billion in one day!

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

High Frequency Trading: You can get in easily. "Getting out is the problem" David Greenberg, former NYMEX board and executive committee member. Paper gold & silver markets are dominated by HFTs. |

|

Chris Martenson with Capital account's Lauren Lyster on what Job Numbers, the Fed, and a Drop in Oil Prices are Hiding! |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- Rule: We Have Tight Gold Supplies & Future Supply Constraints October 9, 2012

- Gold, Silver & The Smart Move By The Chinese In Commodities October 9, 2012

- No Currencies Will Survive What Lies Ahead, But That’s OK October 9, 2012

- Richard Russell - Gold & China’s Plan To Take Over The World October 8, 2012

- Greyerz: Global Debt Over $200 Trillion, Gold Demand Surges October 8, 2012

- More Stunning Developments In The Gold & Silver Markets October 7, 2012

- Phony Government Release Used To Attack Gold Market October 6, 2012

- Celente - Exclusive Sneak Peek Of New Trends Journal & Gold October 5, 2012

Finance & Economics

Finance & Economics

- Uncle Sam Prepares To Unleash Up To 30,000 Drones Over America For "Public Safety" October 10, 2012 Tyler Durden

- The ECB-Driven Toxic Debt Loop At The Heart Of Europe's Misery October 10, 2012 Tyler Durden

- 70 Second Market Outlook – Metals, Dollar, Bonds, Stocks, Energy October 10, 2012 ilene

- Guest Post: The Unstimulus October 10, 2012 Tyler Durden

- Merkel Hides Behind The Troika Report, The Greeks Seethe, And The Drachma Advances October 10, 2012 testosteronepit

- European Banks Need To Sell Up $4.5 Trillion In Assets In Next 14 Months, IMF Warns October 10, 2012 Tyler Durden

- Guest Post: Are Businesses Quietly Preparing For A Financial Apocalypse? October 10, 2012 Tyler Durden

- Everything You Need To Know About Resolving The Fiscal Cliff But Were Afraid To Ask October 9, 2012 Tyler Durden

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)