Why Borrow When You Can Print?

-

Positive Money is a movement in the UK and NZ campaigning to remove the power of money creation from the hands of private banks. Their solution to the global debt crisis is to empower governments to create debt free (hence interest free) money out of nothing and spend it directly into the economy. It boils down to this idea - Why borrow when you can print?1

Over in the U.S., key proponents of government issued debt-free fiat money are Bill Still, the producer of The Money Masters & 2012 Libertarian Presidential Candidate and Lyndon LaRouche, an 8-time presidential candidate. Still considers the current debt-based money a form of slavery and gold-backed money as the ultimate centralization of the money power - in the hands of “those few best able to buy up the commodity serving as the monetary base”.

No Gold

Given the choice between the current system where governments borrow money from private banks (who created it out of nothing and charging interest which has to be paid from tax payers’ hard earned money) and the Positive Money system where governments create the debt-free money outright, it seems a no-brainer that it should be the latter.

For a nation like New Zealand, where its central bank (RBNZ) owns zero ounces of gold, any form of gold-backed money is not even an option. Hence, empowering the government to create debt-free money backed by nothing seems to be the only way out of the public debt spiral. But will it work?

One of the main objections to such a system is the fear of monetary inflation, leading inevitably to price inflation. While we can’t trust the bankers, what makes us think we can trust the politicians and the government of the day not to print the currency into oblivion? To overcome this fear, proponents of the Positive Money system in NZ have suggested that

decisions on changes in the money supply will be made not by elected politicians but by an independent body (the Monetary Policy Committee). Politicians will have no influence whatsoever on the amount of money that will be created.

So far so good, but unlike the money whose quantity the committee is tasked to control, members of this “independent body” cannot be created out of thin air! They have to be either:-

- appointed by an authority or

- elected into office directly.

Therein lies the problem. If we adopt the model of judicial appointments in NZ, the Executive branch of government would be the authority. While NZ has been fortunate that its judicial appointments have so far been relatively free of party political considerations, the same cannot be said of many countries, including Malaysia and the US. Appointees report to and are often beholden to the appointing authority. If, on the other hand, members were appointed by parliament or were elected directly, we’re back to square one - campaigns, funding, media. Who controls these influences the outcome.

Assuming the appointment or election process were totally free of “political considerations” or vested interests, what is there to prevent such a high profile Monetary Policy Committee from being subject to and influenced by intense lobbying, considering the fact that the fate of the nation’s economy & politics hinges on its decisions.

I see a mirror image of the 12 FOMC members meeting behind closed doors controlling the money supply in the US. Are they not appointed directly and indirectly by the President and confirmed by the Senate, and are supposed to be independent? In fighting against Ron Paul’s Audit the Fed bill, did Bernanke not emphasized that he prefers to keep it the way it is to protect the Fed’s independence? It doesn’t take a brain surgeon to figure out the Fed’s independence or its lack thereof.

Notwithstanding the above-mentioned challenges, being the first to implement such a system under the current environment where all national currencies are debt-based may make NZ stand tall among other indebted nations. I can see the PIIGS nations salivating! As the first nation issuing debt-free money in modern times, the government’s interest-bearing debt at just over 20% of GDP could be rapidly brought down to zero. Tax payers’ money can be channeled to the rebuilding of Christchurch instead of ending up in the coffers of private banks, most of them Australian owned anyway. Debt-laden local councils can be funded directly from federally created new money, thereby lowering rates and improving services.2

The list of merits goes on and on….. until gold is brought into the equation.

Central Banks’ Gold

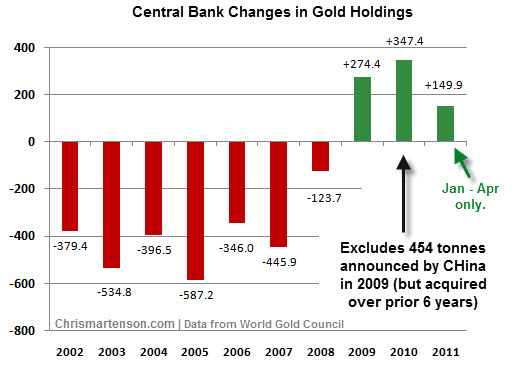

For reasons best known to the RBNZ, the nation’s reserves in gold remains at zero after the last of its 22,505 oz of gold was sold in 1989, while the rest of the world’s central banks have turned net buyers of gold since the financial crisis. Many have been aggressively pilling up on their gold reserves.

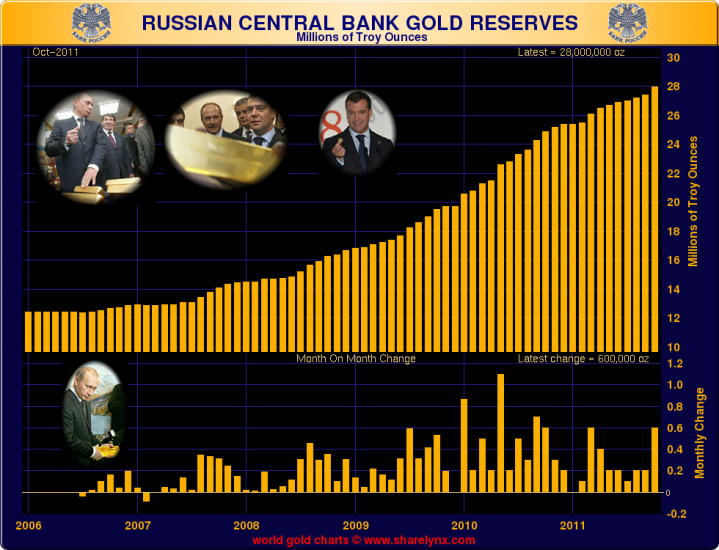

A case in point is Russia. They had the foresight to be steadily accumulating gold as reserves years before the 2008 financial crisis struck.

While China does not report its gold reserves as transparently, it’s widely known that it is silently converting part of its US$3 trillion reserve into hard money in the form of the yellow metal. As the world’s largest gold producer, none of the locally mined gold is allowed to be exported while reports pop up every now and then about massive gold imports through Hong Kong. They’ve even started scrapping the golden barrel of cash-strapped North Korea with a total import of 2 tons over the past year. The Voice of Russia recently reported that “China wants to increase gold reserves six-fold“.

India’s central bank was one of the first to reverse the trend with its massive 200 tons purchase from the IMF way back in 2009, creating a sharp spike and and a sustained rise in the price of gold.

And it’s not just the giants. According to the World Gold Council, central banks of other countries that have been stacking gold include Argentina, Bolivia, Mexico, Sri Lanka, Bangladesh, Thailand, Philippines, South Korea, Kazakhstan, Turkey and Ukraine, Estonia, Malta, just to name a few, not forgetting the repatriation of Venezuela’s 211 tonnes of gold last year. Paraguay became the latest central bank buyer, sharply boosting their gold reserves from a few thousand ounces to over 8 tonnes.

And it’s not just the giants. According to the World Gold Council, central banks of other countries that have been stacking gold include Argentina, Bolivia, Mexico, Sri Lanka, Bangladesh, Thailand, Philippines, South Korea, Kazakhstan, Turkey and Ukraine, Estonia, Malta, just to name a few, not forgetting the repatriation of Venezuela’s 211 tonnes of gold last year. Paraguay became the latest central bank buyer, sharply boosting their gold reserves from a few thousand ounces to over 8 tonnes.

Across the ditch, Australia has been sitting tight on their 80 tons watching their reserves in gold rise steadily.

It is evident that central bankers are placing increasing importance on the role of gold as part of a nation’s reserve. Why? They are not telling. Why is RBNZ not hoarding any gold? They are not telling either.

All we need is one, just one major player to announce that they are pegging their national currency to gold for existing debt-based fiat currencies and the proposed debt-free fiat currencies to be dropped like hot potatoes in favor of the new gold-backed currency. This is especially so after the world has witnessed the disastrous failure of a 40-year global experiment with debt-based fiat currencies.

Bear in mind that the once almighty US$, the global reserve currency following the Bretton Woods agreement after WW2, is currently under threat. Its petro-dollar status is also under threat, and significantly so by the same nations stock pilling gold at a frantic pace. The competition (by China, according to WikiLeaks cable) for the next global reserve currency is underway among the economic powerhouses, and a gold backing may just tip the balance.

All other smaller countries have not much choice other than to be prepared to go with the flow.

Conclusion

While the debt-free money concept is the way to go, perhaps it should be just the first step towards sound money whose quantity is regulated directly or indirectly by something tangible rather than press statements from a small group of people meeting behind closed doors.

-

Notes:

1 Don Richards of Positive Money NZ wrote to Bill English, Minister of Finance seeking a meeting to present the proposal. Here’s the Minister’s reply and Don’s response.

2 Sue Hamill of Positive Money NZ’s submission before the select committee on the Local Government Act 2002 Amendment Bill 27-1.

Additional Resources

- From Canada to NZ, and everywhere in between, people are waking up!

- Watch The Money Masters, a full length historical documentary at the Calm Before the Storm page.

- This short clip by Positive Money UK explains the process of money creation out of thin air using mortgages & housing as an example.

- If your curiosity over the subject of money creation was piqued by this video, consider reading “Modern Money Mechanics” – by The Federal Reserve Bank of Chicago. It may change your thinking about what to do with your money.

Leave a Reply Cancel reply

Most Popular

Most Recent

- BullionVault Gold Investor Index: A tool to to track how private investors react to the price actions in gold

- Why Borrow When You Can Print?

- Gold All Time High in Euro, Franc, Peso, Rupee, Rupiah, Real & Rand

- Fed’s $40 billion/month is matched by China’s record $46 billion in one day!

- QE3 To Infinity–The Final End Game

- From Operation Twist to Operation Screw

Archives

Featured Reviews

05Sep: Bill Murphy (GATA)

$50 silver by year end

13Aug: James Turk (GoldMoney)

We won’t see $1580 gold & $27 silver again

12Aug: Bill Murphy's source

We could see a 100% increase in 90 days.

03Aug: HSBC Analysts

Gold to rally above $1,900 by end 2012

05June: David Bond (SilverMiners)

Gold & Silver may bottom at $1,200 & $18

02June: Don Coxe (Coxe Advisors)

Europe to issue Gold-backed Euro Bonds within the next 3 months

21May: Gene Arensberg (GotGoldReport)

Gold and Silver are very close to a bottom, if one has not already been put in last week

9May: Eric Sprott (Sprott Asset)

Gold over $2000, Silver over $50 by year end

>> More forecasts & forecast accuracy

Featured Videos

|

Rob Gray of The American Open Currency Standard talks about competing currencies as the solution to the Fed's money printing. |

|

G. Edward Griffin: The Fed Is a Cartel |

Gold & Silver Interviews (KWN)

Gold & Silver Interviews (KWN)

- Rick Rule - The Availability Of Physical Gold Will Disappear October 4, 2012

- Massive Fear In Gold Means We May Not See A Correction October 3, 2012

- Richard Russell - October Stock Plunge, Gold & The Fear Index October 3, 2012

- Yamada - Here Are The Key Levels To Watch On Gold & Silver October 3, 2012

- Here Are Two Incredibly Frightening Charts October 2, 2012

- The Tremendous War In Gold Continues Near The $1,800 Level October 2, 2012

- KWN Exclusive - Today The Fed Unofficially Announced QE4 October 2, 2012

- Turk - No Profit Taking In Gold & Silver, Even After Huge Run October 1, 2012

Finance, Economics, Geopolitics

Finance, Economics, Geopolitics

- Wake Up America, We Are Being Distracted From the Real Issues by MSM Lackeys October 3, 2012 Phoenix Capital Research

- Guest Post: Hyperinflation Has Arrived In Iran October 3, 2012 Tyler Durden

- NATO Issues Statement On Syrian-Turkish Hostilities October 3, 2012 Tyler Durden

- Complete Fed Failure: Retail Investors Pull Out Most From Domestic Equity Funds In Two Months October 3, 2012 Tyler Durden

- Stocks Up, Bonds Up, USD Up, Gold Up; Oil Plungapalooza October 3, 2012 Tyler Durden

- NY Mass Transit Fares Will Rise 35% From 2007 To 2015, And Surge From There October 3, 2012 Tyler Durden

- THe GReaT PReSiDeNTiaL DeBaTe 2012... October 3, 2012 williambanzai7

- Point Out The Auto Sales Recovery In These Charts October 3, 2012 Tyler Durden

Search by Tags

References

LaRouchePAC: Lyndon LaRouche

Paul Craig Roberts IPE

G. Edward Griffin's Unfiltered News

Trends Research Institute (Gerald Celente)

Global Europe Anticipation Bulletin (GEAB)

Gold Anti-Trust Action Committee (GATA)

Butler Research LLC (Ted Butler)

The International Forecaster (Bob Chapman)